Payment Service Providers in Europe should start looking at the significant possibilities offered by the newest EPC rulebook on One-Leg Out SCT Inst, to develop new business propositions by providing effective international transaction processing to their retail and corporate customer base.

Within the SEPA area, One-Leg Out (OLO) transactions have been discussed for a while. With PSPs providing SEPA cross-border services, too, this has been — and still is of course — a relevant topic, especially for correspondent banks and non-European PSPs with a branch in the Euro area.

Regulators, especially due to the historically “flawed” approach to sanction screening of those OLO transactions, had originally started to work on a global answer to the market requirements, covering both SCT and SCT Inst; then, eventually, an OLO SCT Inst-specific rulebook was released in March 2023 (v1.0) and updated later in June 2023 (v1.1).

In a One-Leg Out Instant Credit Transfer transaction, at least one part of the international instant credit transfer is processed in euro (the Euro Leg), while the other part is processed in any possible currency (the non-Euro Leg).

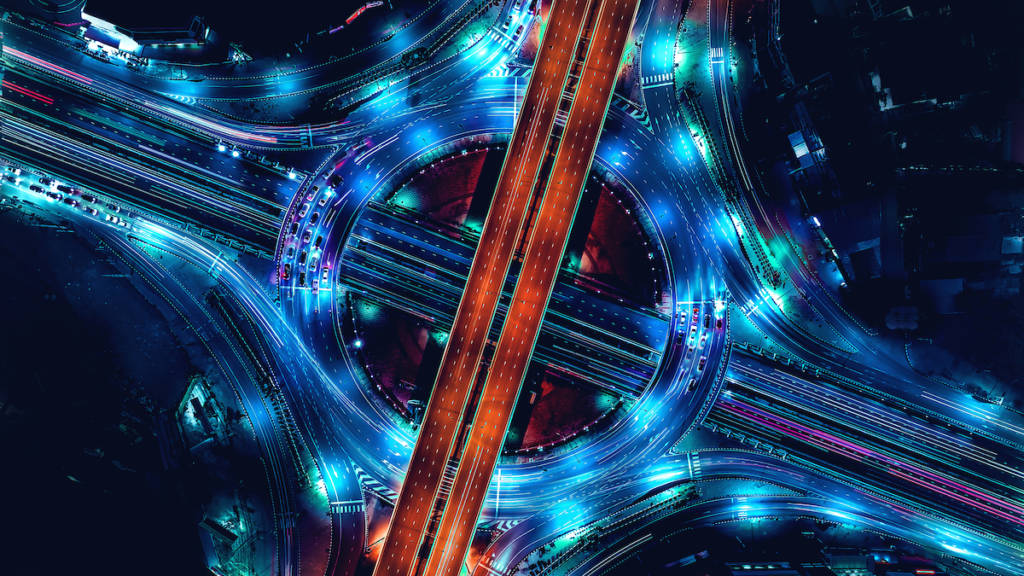

The demand for international instant payment services using an instant credit transfer is indeed very clear in the market. As globalization and trade continues to flow across borders, and with international travel re-established post-pandemic, payers wish to transfer funds instantly anywhere in the world. Today, this possibility is not easily available to everybody. This requirement for new, real-time, cross-border payments is today more “inclusive” and global than ever, impacting any PSP, as it originates from any customer segment, both retail and SME/corporate

The issuance of the OLO SCT Inst rulebook by EPC should also be seen in conjunction with the upcoming SCT Inst mandate; it is clear that regulators are focusing on what is likely going to be the most relevant account-to-account payments instrument in the SEPA area going ahead, in order to maximize the possibilities for PSPs of leveraging the full reachability that it will also provide for the cross-border business.

Considering the possible “OLO SCT Inst” roles — including the new Euro-Entry PSP and Euro-Exit PSP — European PSPs now have lots of new possibilities to create innovative payment services with faster and cheaper cross-border transaction processing. New clearing and settlement mechanisms, too, may allow financial institutions to develop competitive services, leveraging their wide connections to incorporate OLO SCT Inst “processor” service capabilities for their customers. While service levels and innovative propositions are key to brand adoption in retail and business banking, this new service offering may provide PSPs with the ability of charging a premium for instant convenience for its customers.

The world is smaller than ever and market adoption of this new service will evolve. As an industry, we will be looking into additional related topics such as the possible creation of new cross-regional payment corridors and evaluation of fraud implications, balancing risk with opportunity.