Chargeback Protection and Management

Improve profitability with advanced chargeback protection

Solve the issues of increased costs and refunded transaction fees caused by chargebacks with ACI’s advanced chargeback management solution for merchants

The challenge with chargebacks

Chargebacks are the bane of every merchant’s existence, requiring them to pay extensive fees and cover administrative and management costs — all on top of the direct cost of a refunded transaction. Fraud further increases the risk and consequences of chargebacks.

These exorbitant rates pose a direct threat to profit margins; merchants can raise the price of goods and services in an attempt to recoup costs, but this comes at the risk of alienating consumers. Part of ACI Fraud Management, ACI’s chargeback management solution solves these challenges for merchants.

The Cost of Fraud Loss

every $1 of fraud loss now costs U.S. retail and ecommerce merchants $3.75, compared to $3.60 in 2021 and $3.36 in 2020*

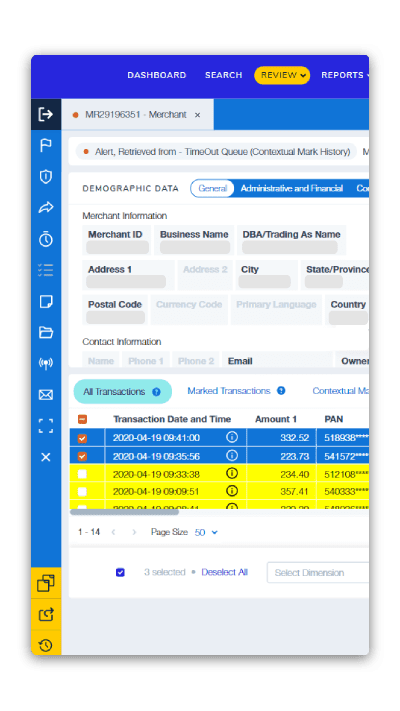

Eliminate the complexity of chargeback management

Our chargeback indemnification service utilizes a trusted team of specialists to provide comprehensive chargeback protection and fraud strategies to offer merchants peace of mind.

Eliminate Expenses

Zero fraud chargeback expenses, volume transactional fees or manual review expenses

Control Costs

Reduced fraud operational costs and fraud chargeback losses

Ensure Performance

Consistent performance during peak sales without the need for additional resources

Simplify Vendor Management

Manage a single contract as opposed to contracts for multiple vendors

Scale and Support

Agility and scalability to support multiple geographic regions and quickly deploy to new territories

Convert More Customers

Fewer false positives and increased conversions and revenue

Satisfy Customers

Increased customer satisfaction and longer-term customer loyalty

Protection along the entire payments journey

End-to-End Protection

ACI Worldwide delivers fraud management capabilities that allow merchants to manage and protect the full lifecycle of payments.