Combat fraud more effectively

Fraudsters are continuously developing new fraud schemes to bypass risk controls. Mitigate these potential fraud risks by enhancing ACI Fraud Management with Robotic Process Automation (RPA) and improve operational efficiency and productivity.

Automate current processes to identify and respond to vulnerabilities and emerging fraudulent activities

Reduce human error by limiting human interaction when dealing with critical response processes

Increase the speed of searching for anomalies in the current high-volume transaction scenario

Strengthen your internal programs while complying with the regulators

Automate around third-party intelligence

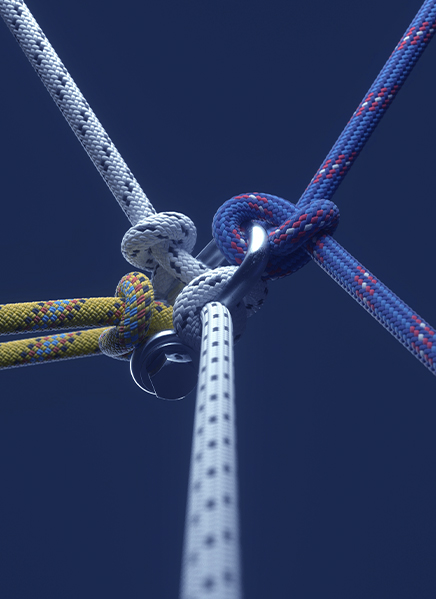

As part of ACI Fraud Management, RPA can be combined and connected with your existing partners or ACI Worldwide’s verified solution partners.

Integrate with leading partners that automate their real-time behavioral assessments to identify a wide range of cyber threats without disrupting the user experience

Combine RPA with third-party intelligence to protect customers from online and mobile banking fraud such as account takeover

Improve relationships with customers by actively protecting their assets

Improve customer centricity

By establishing the proper criteria for the customer base and business needs, RPA can reduce temporary blocks and deliver more accurate responses.

Deliver fast, accurate responses to ensure genuine transactions are approved

Respond in real time to keep customers safe even while using new and alternative payment methods

Reduce temporary blocks to avoid poor customer experience

Make SCA exemptions a business differentiator

RPA empowers the highest efficiency when delivering 3DS 2.0 and SCA in Europe enabling a consumer-centric approach through automation. Reach minimum risk while delivering the best customer experience.

React immediately to emerging fraud trends

Adapt fraud management strategies by learned behaviors and preferences

Reduce processing strain on internal resources

Minimize maintenance and system downtime

RELATED SOLUTIONS

Explore more solutions

Learn about our additional solution capabilities.

ACI Fraud Management for Banking

Real-time, machine-learning-driven fraud management solution for banks, processors, acquirers and payment networks

Network intelligence

Proprietary technology that enables banks, processors, acquirers and networks to securely share and consume industry-wide fraud signals to feed their machine learning models

Anti-money laundering

Strong, advanced AML compliance framework to maintain compliance with international and domestic regulations

Real-time payments fraud prevention

End-to-end, real-time enterprise fraud management featuring multilayered fraud prevention