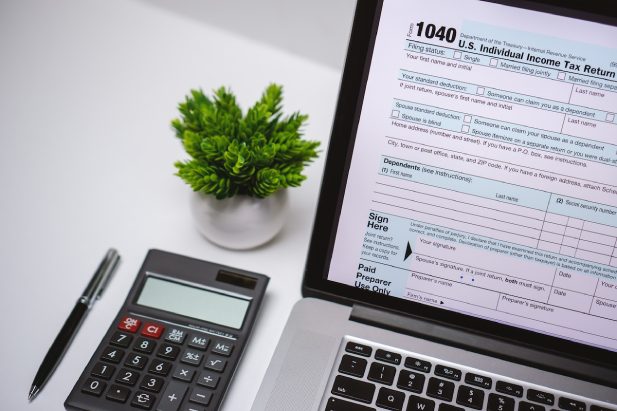

Network Intelligence for Banks, Processors and Acquirers

Network collaboration for improved fraud prevention

Increasing digital payment volumes and types creates increasing fraud volumes and attack vectors. Financial institutions need to collaborate to develop macro insights and beat the fraudsters with valid models that are weighted appropriately across all parties.

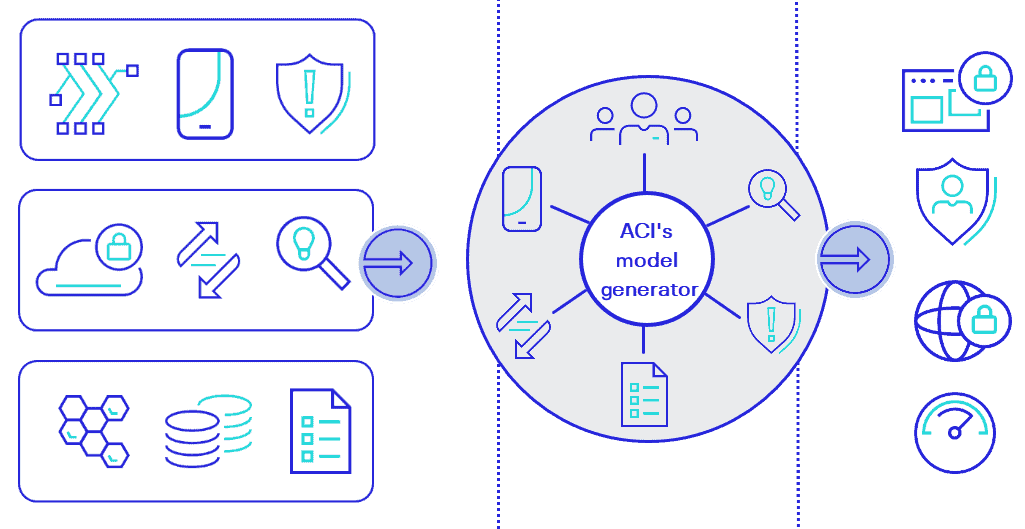

Consume, distribute and exchange secure fraud signals without exposing raw data with ACI’s best-in-class fraud management

Maintain the strength of custom, proprietary signals and complement with community exchanged signals

Choose your adopted model insights and which contribute to community findings

Leverage transparent, individual signals rather than a single opaque model

Understand localized threats before they become endemic

Incorporate signals from third-party fraud intelligence sources

Create informative and meaningful data features, focused on individual requirements

Leverage machine learning insights effectively

Machine learning insight is only as strong as the data it receives. Systems must be supplied with the widest possible view of risk in real time. This necessitates access to internal and external data.

Incorporate community data into machine learning model training and risk analysis

Consume community fraud signals in real time to instantly improve models

Integrate proven model features into adaptive machine learning strategies

Leverage a hybrid approach with model creation and risk scoring

Leverage an intuitive UI for validation, and automatically apply community contributions for accelerated time to value

Democratize Machine Learning

Take machine learning to a tactical level in a faster and unlimited manner. ACI’s model generator puts the power back into the hands of the business.

- Create models as needed and focus on multiple channels and typologies

- Define coverage metrics and select candidate features with automated analytics and results in publishing

- Leverage your existing data and resources to convert raw data into adaptive, relevant features

- Form scoring model foundations easily with a fully integrated and intuitive dashboard interface

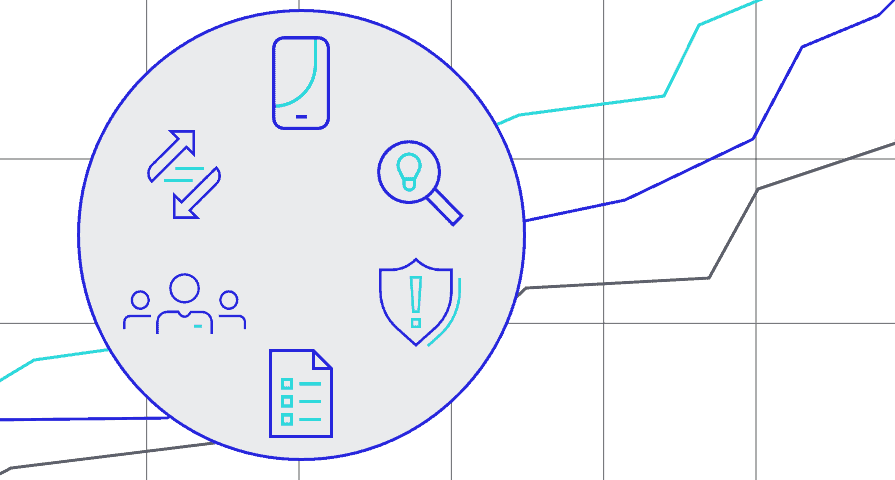

Turn Complexity Into Simplicity

- Adjust models in real time to pinpoint assertive and strong fraud signals

- Control models based on incoming financial and non-financial events

- Individually configure static and adaptive features to maintain relevance

- Build further models from a self-maintainable features library

- Manipulate live data without risking performance

Quality Features Create High Performance

- Benchmark findings over an outside window and publish results with automated model training

- Reduce fraud losses through improved detection and preparation for future fraud threats

- Enhance operational efficiency with improved false positive rates and detection rates

- Reduce the ongoing burden and regulatory risk of exporting and submitting data externally

- Improve customer experience ensuring fraud is declined and genuine transactions are approved

RISK AND FRAUD MANAGEMENT

Safe and secure

Learn about ACI’s wide-ranging fraud prevention and detection capabilities.

ACI Fraud Management for Banking

Real-time, machine-learning-driven fraud management solution for banks, processors, acquirers and payment networks

ACI Fraud Management for Merchants

Reduce chargebacks, fraud, and false positives while increasing conversion with ACI’s machine-learning driven merchant fraud management

Robotic process automation

Advanced solution that allows businesses to improve operational efficiency and automatically respond to data, events and interactions

Anti-money laundering

Strong, advanced AML compliance framework to maintain compliance with international and domestic regulations