ACI Connetic

Built to help you stay ahead, today and tomorrow

Innovate while you operate with a unified, future-proof, cloud-native platform for all payment types, plus fraud protection.

ACI is trusted by the world’s top banks

Meet the future standard for payments

ACI Connetic fundamentally redefines the payments hub

-

The only truly unified platform

Seamlessly and securely move money—no matter the network.

-

Ready for new possibilities and opportunities

Increase revenue and efficiency with a unified, resilient, and comprehensive payments platform.

-

Modern by design

Scale and innovate quickly with cloud-native, multi-tenant architecture with microservices, APIs, and embedded AI.

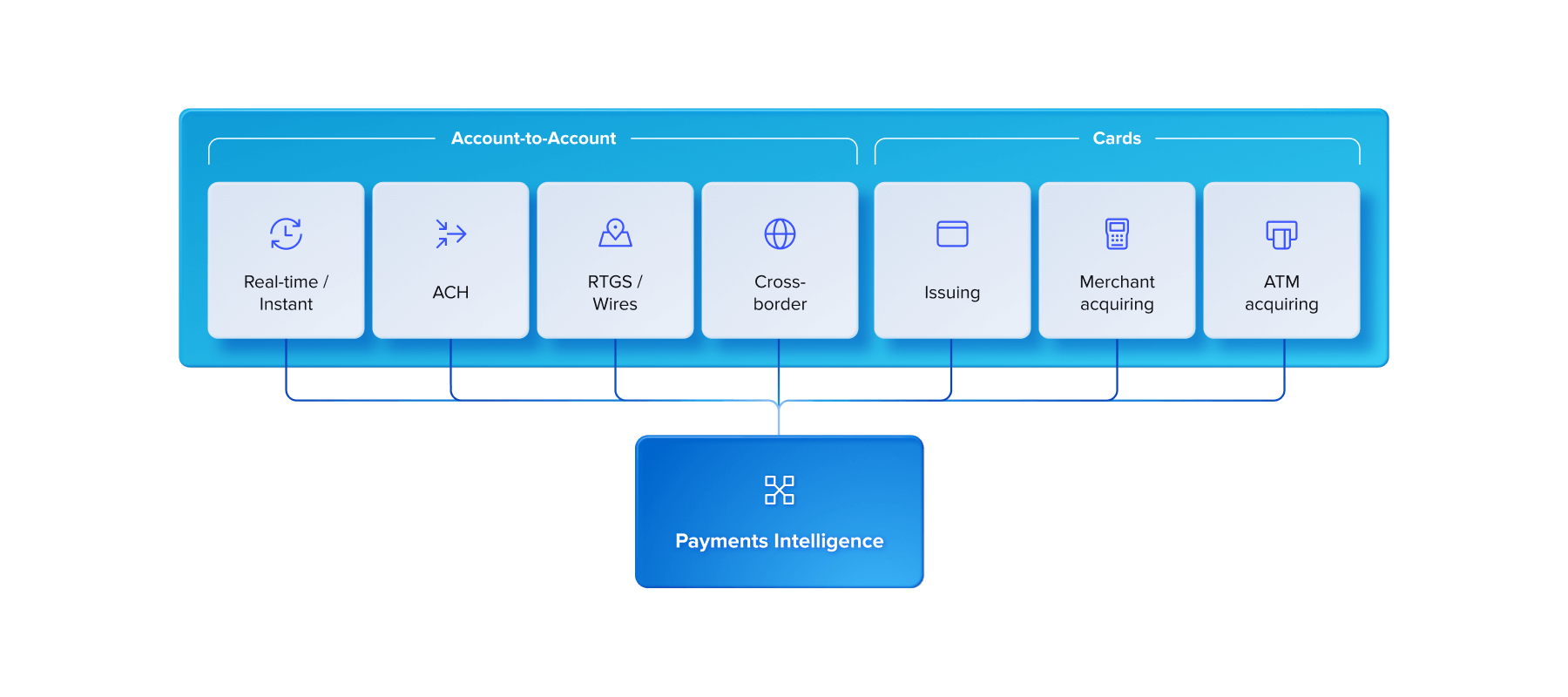

Built for account-to-account

Unify payments in one place

Simplify account-to-account (A2A) payments with a single, compliant solution for all of your channels.

-

Immediate A2A payments with instant clearing and settlement.

Learn more -

Low-cost electronic payments processed efficiently in bulk batches.

-

High-value, irrevocable payments settled securely in real time.

Learn more -

Secure international transfers with currency conversion and regulatory compliance.

Learn more

Built for Cards

Profit more, risk less, operate smarter

Increase revenue, manage risk, and reduce operating costs with a single, secure solution.

-

Comprehensive card issuance, management, and transaction authorization for banks.

Learn more -

Merchant payments acceptance with authorization, clearing, settlement, and reconciliation.

Learn more -

Full transaction support including cash, deposits, transfers, payments, and inquiries.

Learn more

Built for Fraud

Get peace of mind with the best fraud protection

Seamlessly add comprehensive fraud protection to ACI Connetic and take care of all your payment needs in one place.

-

Predictive modeling gives you the power of continuous, data-driven decision making to act quickly on financial crimes.

Learn more

Deploy on your own terms

-

Customer managed

Run ACI’s software on premise or in your cloud.

-

Managed service

Outsource expertise for operational efficiency.

-

SaaS

ACI software delivered as a cloud offering.

Innovating with industry leaders

ACI sparks innovation through collaboration, building alongside the most important institutions in our field.

Let’s get to work

Dig into the details

Talk to the experts at ACI about how a payments hub can help you enhance operations and propel innovation.

-

A payments hub is a centralized platform that consolidates multiple payment types and channels into one system. It allows financial institutions and businesses to manage ACH, wire transfers, card payments, and real-time transactions through a single interface. This approach improves efficiency and reduces operational complexity.

-

By centralizing payment flows, a payments hub delivers meaningful insights—insights you can use to determine which new products to launch, detect fraud threats, reduce operational costs, and increase efficiency. You can build the business case for a payments hub from many angles—and we’d be happy to help you build yours.

-

The technologies and standards used to build a secure, scalable payments hub have matured significantly in the last few years. These recent advancements have made the scale, security, and resilience of a centralized payments capability possible, ushering in a new era in payments.

-

Yes, ACI Connetic offers flexible integration options that allow financial institutions to connect with existing core banking and payment systems. This reduces the need for costly infrastructure changes while enabling modernization. The platform supports APIs and modular components for smooth implementation.

-

ACI’s payments hub is built to process any payment type originating from any endpoint and leverages capabilities from across our ecosystem, including BASE24-eps, Postilion, and ACI Enterprise Payments Platform. This ensures that any existing ACI customer will have the same processing power they currently have in the payments hub, as well.