ACI Payments Orchestration Platform

Built to be your competitive advantage

Optimize and grow your business with everything you need in one place, on a centralized merchant payments platform.

Trusted by clients in 94 countries… and counting

Exponential growth, effortless control

Payments built for you: ACI Payments Orchestration Platform

-

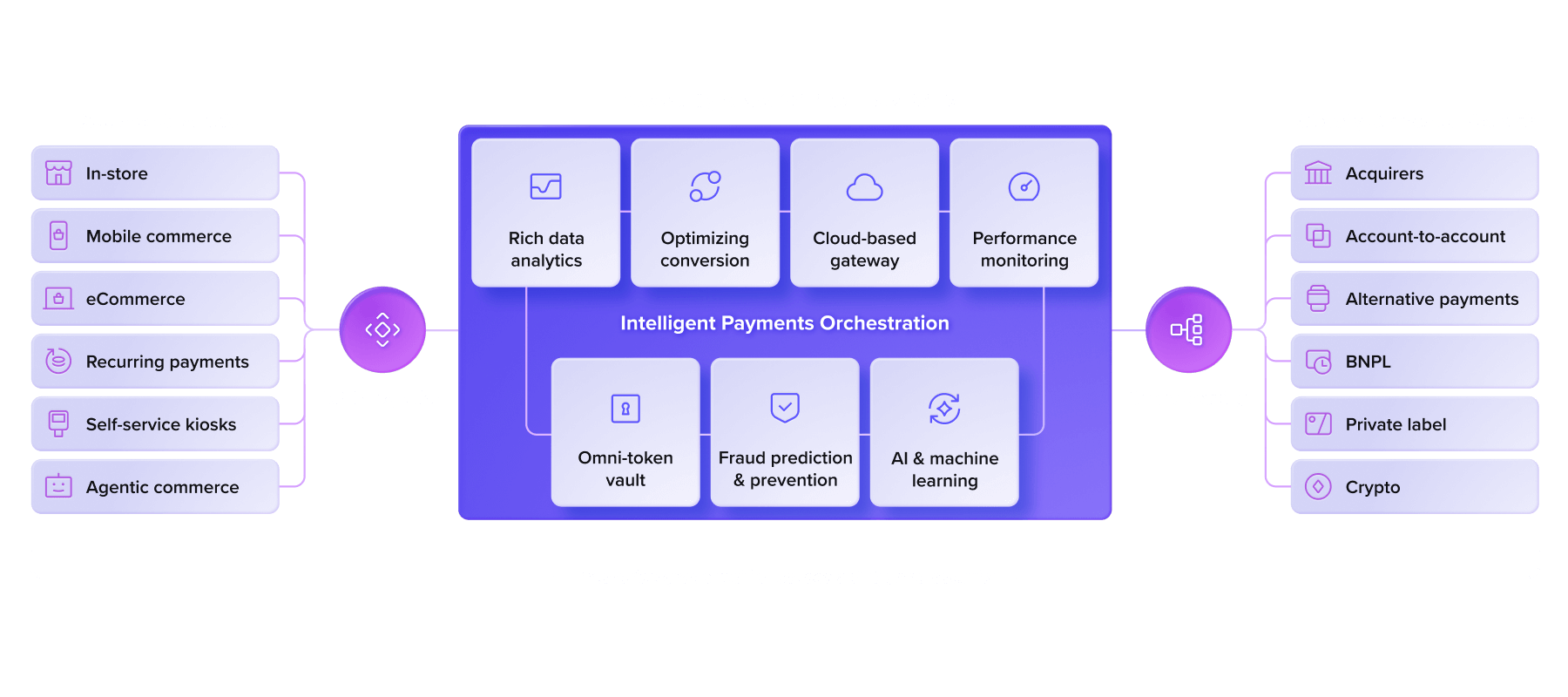

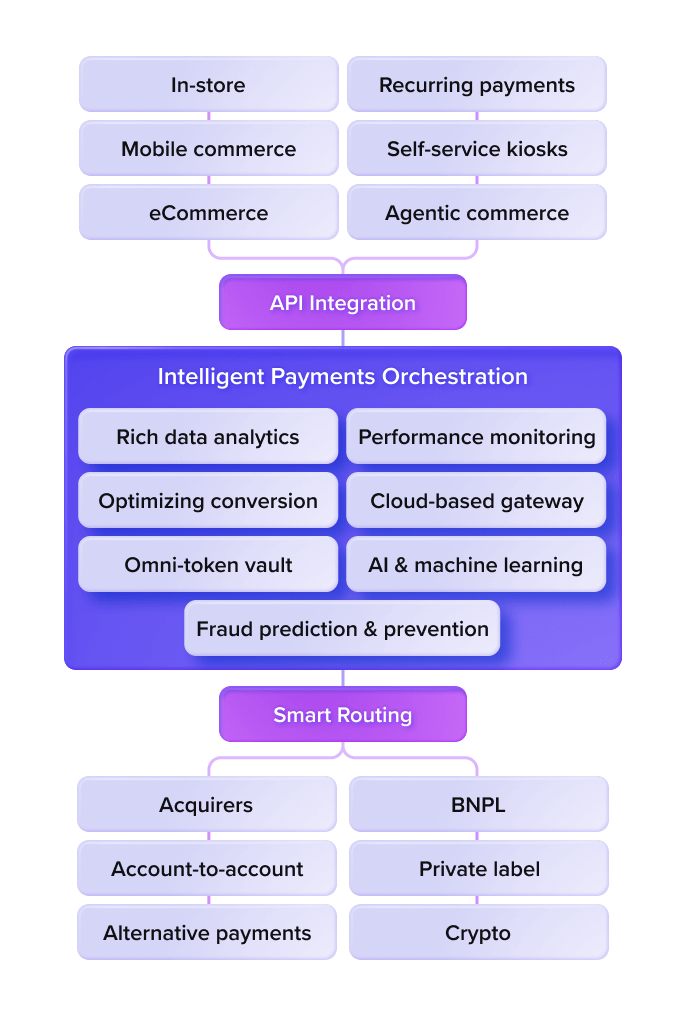

From agentic to in-store

Deliver seamless cross-channel payment experiences.

-

Intelligence at every step

1 trillion data points powered by AI, optimizing payments and preventing fraud.

-

Acquirer agnostic

Rapidly expand across 160+ countries while adding alternative payments and partners.

Optimize payments

Profit from precision-tuned payments

Increase acceptance rates and grow revenue.

-

Acquirer-agnostic processing and smart routing.

-

Drive conversions with seamless payment flows.

-

Orchestrate payments seamlessly across in-store, online, mobile, and emerging channels, while delivering cross-channel experiences.

-

Bolstered by rich data analytics and real-time AI.

Predict fraud

Get ahead with AI-powered fraud prediction

Protect your customers and your bottom line with real-time AI and deep fraud expertise.

-

Adaptive intelligence, derived from real-world data.

-

Outstanding fraud protection, delivered through 1 trillion+ transaction data pool.

-

Manage sensitive customer data securely and reduce your compliance burden with omnichannel tokens.

Maximize revenue

Scale to support exponential growth

Grow your payments ecosystem by expanding into new markets and innovating quickly.

-

Rapidly enter new international markets with local acquirers and payment methods.

-

Quickly add alternative payment methods and partners.

-

Deliver customer-centric innovation while reducing errors and outages.

Enterprise-Grade service

Built and designed for your business

ACI Payments Orchestration Platform is secure, scalable, and resilient—built to address the needs of enterprise and growth businesses.

-

Support PCI compliance through a highly secure token vault across card and alternative payment methods.

-

Our payments orchestration platform is modular, flexible, and adaptable, giving you only what you need and faster time to market.

-

Designed to deliver exceptional uptime for the largest businesses even during peak seasons.

-

Securely encrypt payment card data at point of interaction and reduce PCI compliance scope.

Do more with one mighty platform

-

Multi-acquiring

Gain flexibility and control over acquiring, lower your costs, and increase conversions.

-

Payments intelligence

Stay ahead of financial crime and fraud with AI.

-

Cross-border eCommerce

Get all the payment partners you need in a single integration.

-

Alternative payment methods

Give customers the payment options they trust.

-

Omni-tokens

Keep customer data safe across all channels and stay compliant.

-

Connectors and plug-ins

Connect to leading eCommerce software platforms, AI-powered fraud capabilities, and more.

See how ACI Payments Orchestration Platform provides intelligent payments orchestration

Enabling seamless, secure flows with streamlined connectivity into your payments and fraud ecosystems.

-

Tesco Mobile dials up digital growth

During high-volume events, the system maintained uninterrupted performance, supporting critical sales periods with

zero downtime

-

Auchan retail keeps its payments fresh and future-ready

Supports smooth, seamless payments across multiple locations and securely manages eCommerce transactions totaling

9 million annually

-

Unlocking new revenue and longstanding successes in Africa

In less than one year, Peach Payments increased its monthly transaction volume by

400%

-

Planet payment offers additional services and wins over new customers

Now providing convenient access to local acquirers and alternative payment methods in

160+ countries

-

Hy-vee gains in-house command of transaction processing

Hy-Vee now processes payments in-house across

220 supermarkets

Built for Merchants & PSPs

Grow safely and securely with PSPs for commerce

Provide a seamless customer experience while reducing risk and complexity.

-

Quickly connect to the most extensive network of local and cross-border acquirers and alternative payment methods.

-

Our PSP solutions are flexible and adaptable, giving you control, choice, and faster time to market.

-

Deploy tailored payment and fraud strategies for each channel and market as you expand.

Find solutions that scale for every industry

The world’s most impressive companies have one thing in common—they all rely on ACI to power their payments.

-

Airlines

Process the most popular payment methods in each market in a safe, secure and efficient environment with ACI Secure eCommerce.

-

Fueling and Convenience

Process the most popular payment methods in each market in a safe, secure and efficient environment with ACI Secure eCommerce.

-

Grocery

Deliver speed and convenience with safe, frictionless omnichannel payments.

-

Payment service providers

Enable merchant growth and a seamless omnichannel consumer experience, while mitigating risk and reducing the burden of compliance.

-

Restaurants

ACI’s highly adaptable technology delivers a seamless, secure payments experience—whether customers order at the table, counter, curbside, drive-thru, QR code, or their mobile phone.

-

Retailer

Win more shoppers with fast, frictionless multichannel payments.

-

Telecommunications

Solutions and strategies to drive revenue for MNOs, MVNOs, cable, and telco.

-

Travel and transportation

No matter how far from home, power your customers’ journeys with payments that are built for today’s jet-setters.

-

Utilities

Transform your utility payment processing.

Let’s get to work

Dig into the details

Start maximizing the benefits of payments orchestration by requesting an expert assessment today.

-

A payments orchestration platform is a centralized solution that helps businesses manage multiple payment providers, methods, and workflows through a single interface. It streamlines payment processing, routing, and reconciliation, reducing complexity and improving efficiency. This approach ensures flexibility and scalability for businesses operating in diverse markets.

-

Businesses need payments orchestration to simplify the management of multiple payment gateways and providers while optimizing transaction success rates. It reduces operational overhead, improves customer experience, and enables faster integration of new payment methods. By using orchestration, companies can adapt quickly to changing market demands and regulatory requirements.

-

ACI’s platform uses intelligent routing and real-time decisioning to ensure transactions are processed through the most optimal payment path. This minimizes declines caused by network issues or provider limitations. Additionally, advanced fraud prevention and tokenization features help maintain security while maximizing approval rates.

-

Yes, ACI’s payments orchestration platform is designed for seamless integration with existing payment systems, gateways, and acquirers. It supports a wide range of payment methods, including cards, digital wallets, and alternative payments. This flexibility allows businesses to maintain their current infrastructure while expanding capabilities globally.

-

Industries with high transaction volumes and global customer bases — such as eCommerce, travel, subscription services, and marketplaces — benefit significantly from payments orchestration. These sectors require multiple payment options, cross-border capabilities, and strong fraud protection. ACI’s solution helps these businesses optimize costs, improve conversion rates, and deliver a frictionless payments experience.