To stay competitive, merchants must offer customers an easy, fast and secure way to pay. This is where the right payments gateway can be critical.

What is a payments gateway?

A payments gateway is a platform that enables merchants to accept and process cards and other customer payment methods across sales channels, including eCommerce, mobile commerce and in-store.

Why do you need a payments gateway?

A payments gateway allows merchants to offer different payment methods and channels to their customers. It provides the ability to reach overseas shoppers by connecting to local payment methods and acquirers, which is increasingly important for merchants looking to expand their businesses across borders.

However, it’s not as simple as just selecting any payments gateway — the platform needs to be robust, secure and flexible enough to be configured to deliver the best payments experience at checkout.

Why is this important? Recent market research has shown that:

- Offering three payment methods can improve conversion by 30 percent+

- 59 percent of shoppers will abandon a transaction if their preferred payment method is not available

- Improvements in checkout design can boost the conversion rate by 35 percent*

We explore in detail how merchants can optimize payments to create more conversion uplift in our on-demand webinar, “How to Convert More Transactions.”

→ The Payment Gateway market was valued at USD 17.2 billion in 2019 and is expected to reach USD 42.9 billion by 2025, at a CAGR of 16.43% over the forecast period (2020-2025).

– Source

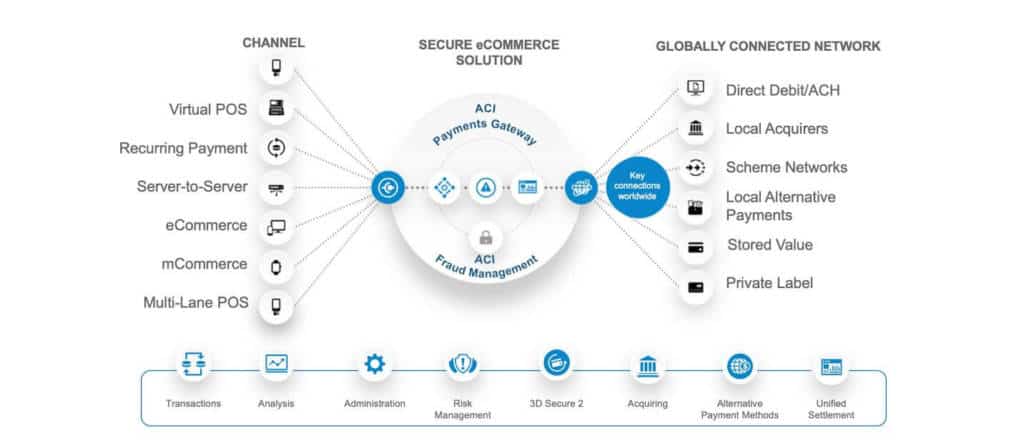

Integrated secure payment gateway infrastructure example

What to consider when selecting a payments gateway

To remain competitive and cost-effective, there are a number of key requirements that must be taken into account for a merchant payments gateway:

Onboarding and integration

Connecting your systems to the payments gateway needs to be simple and smooth. Cloud-based APIs that use standardized interfaces are the best option, especially if they support all channels and payment types through a single integration. This allows the setup and onboarding process to be faster and more cost-effective, and supports a more cohesive payments strategy.

Channel coverage

A payments gateway must support secure eCommerce payments, as well as mobile and in-store transactions. There is growing value in having a single payments platform to process payments across all channels.

Consumers are increasingly using multiple channels when making a purchase. The popularity of omni-channel options such as Buy Online, Pickup In-Store (BOPIS) means that having consistency and transaction visibility across channels is an important capability for merchants in all sectors.

Scalability and geographic reach

Shoppers buying goods from overseas are driving many merchants to explore cross-border eCommerce and international expansion opportunities. A payments gateway with strong global coverage and the ability to scale up easily is a valuable asset for merchants looking to grow their business.

Flexible payments architecture

Using a payments gateway built with an open architecture can offer real value and flexibility for merchants. It enables merchants to configure the solution according to their individual needs and to quickly innovate, add new payment methods, reach new markets, and design and control the customer experience.

Security

eCommerce fraud is growing and merchants have a responsibility to protect customer data and prevent fraud. Payments gateways should be fully integrated with fraud detection and prevention solutions to ensure businesses are protected. Data security tools such as tokenization and point-to-point encryption (P2PE) also shield sensitive customer data and reduce the compliance burden.

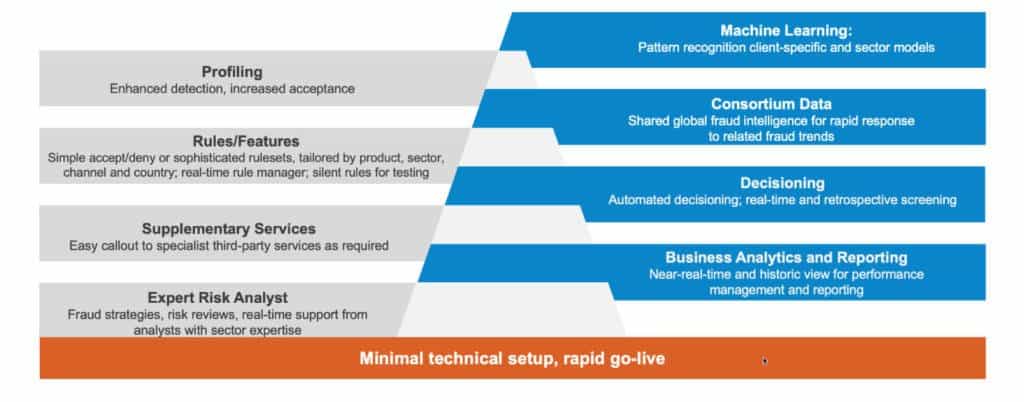

Components of a multi-layered fraud management for merchants

How a payments gateway can help with key merchant challenges

Fraud detection and prevention

Fraud is a growing problem, causing significant damage to customers and often costing merchants far more than just the lost goods. In fact, LexisNexis research shows that, for every dollar of fraud, merchants are hit with approximately three times as much in associated costs.

The ability to commit fraud is reliant on data, stolen credentials, faked accounts or an account takeover. In every case, the fraudster uses certain data points or identity markers to successfully make a fraudulent purchase. This data leaves a trail, and merchants have the chance to block fraud by identifying those data trails.

Machine learning and AI help fight merchant fraud

Machine learning and artificial intelligence (AI) can turn the tide in the battle against fraudsters. Modern machine learning models can quickly and efficiently analyze vast amounts of data, identifying patterns and trends that are too complex to spot through other means.

Machine learning models can analyze millions of historical transactions, remember behaviors and learn the difference between genuine and fraudulent transactions. Machine learning turns data into intelligence that can augment customer profiles, spot fraud signals and combat emerging fraud threats.

Yet, machine learning by itself is not a silver bullet for effective fraud detection and prevention. Because models learn from experience, there are sometimes nuances or exceptional circumstances that cannot be taken into account by a machine learning model.

For instance, models do not offer the same flexibility as a sophisticated rules engine in adapting to unusual periods of trading, such as sales peaks or new product launches. In cases where customer and fraudulent behavior changes rapidly, rules can be updated to ensure that genuine customers are not mistakenly blocked, or fraudsters inadvertently let through.

It’s not just about combining rules and machine learning either. Fraudsters work to predict the industry’s next move and to circumvent the controls or predictive measures we use to combat them. A single tool or layer of fraud prevention is not enough to stop fraud. Good fraud prevention requires a solution with multiple dimensions — and it should be fully integrated with the payments gateway to make sure that all transactions are appropriately screened.

Conversion and personalization

According to IMRG, 34.5 percent of eCommerce customers and 42.8 percent of mCommerce shoppers abandon their purchases at the checkout stage.

There are many reasons why a shopper does not convert into a paying customer after filling their basket. Maintaining high conversion rates is one of the biggest challenges for merchants — and one of the key measures that merchants use to gauge business performance. Understanding conversion rates and checkout performance is invaluable, particularly for eCommerce merchants. Competing is more than just a factor of product and price, it’s about making the purchasing experience so simple and convenient that the customer is put at ease and completes the transaction.

Merchants need to ensure their shoppers are focused on purchase conversion and this requires a slick checkout process, with simple design, few steps and no redirects or distractions. Payment gateways need to include the ability to customize checkout screens, offer the payment options that customers want and enable seamless checkout options such as one-click payments for returning customers.

Accessing mobile eCommerce opportunities

Mobile eCommerce is currently a priority for many merchants, since mobile now accounts for more than 60 percent of eCommerce in the U.K. and major Western European markets and 31 percent in the U.S. This trend is likely to continue, outgrowing desktop-based eCommerce.

Although many principles from traditional eCommerce extend to mobile commerce, merchants must adapt the customer experience and operating model to thrive. And that includes adapting the payments setup.

There are similarities to desktop-based eCommerce, especially when conducted via a mobile web browser, but mobile’s unique form factor enables many other possibilities:

- Enhanced mobile wallet payments security by authenticating all transactions with a PIN or by leveraging biometric and other sensors

- More convenience with contactless in-store payments or one-click online payments

- Loyalty programs can be layered into transactions

- Receipts can be digitized for customer convenience

In the future, mobile wallets will automatically select the most appropriate card for a given transaction.

Retailer mobile apps can enhance the shopping experience and improve conversion rates. And, while these apps are usually not strictly payment tools, their viability often relies on embedded payments. Examples include mobile self-checkout so shoppers can avoid lines, or product reviews and price check services, which act as advertising tools.

Merchants with young, tech-savvy customers have higher mobile service demand, as those individuals tend to be early adopters and find mobile shopping more convenient than desktop- or laptop-based eCommerce.

Whether a mobile-optimized online shop or an app, strong design and a smooth checkout process are key to effective commerce. This importance is illustrated by the fact that merchants often focus on payment methods that do not require external validation factors such as 3-D Secure. For example, many retailers enable PayPal for their mobile sites, but exclude it on bigger screens for cost reasons.

Pages displayed incorrectly on mobile, complicated payment forms, 3-D Secure redirects and pop-ups all increase checkout abandonment. Mobile requires responsive payment pages and one-tap payment capabilities via saved payment profiles or digital wallets. Merchants should therefore extend smart checkout tools, such as card vaults, from the online environment into mobile devices, as well as extend their suite of payment methods to include relevant mobile wallets.

The payments gateway should enable merchants to customize their mobile checkout experience to ensure it creates a smooth and consistent brand experience. It is also vital that merchants can quickly and easily build new mobile experiences, accept new payment or authentication methods, and seamlessly integrate mobile into omni-channel journeys. This requires that the payments gateway is flexible and delivers easy access to an array of payment methods, so that offering the right mobile experience and adapting to customer needs doesn’t involve significant technical development. Similarly, the payments gateway should support self-service tools, such as front-end widgets and mobile software development kits (mSDKs) that enable merchants to build new applications and services simply and in line with their needs.

→ Read: Three Merchant Payment Trends to Watch in 2020

Supporting cross-border eCommerce

For merchants considering international expansion, enabling locally-preferred alternative payment methods and connecting to local acquirers can be a critical determinant of success. To succeed in cross-border eCommerce, merchants must also tailor their customer experience to each market. This means offering international currencies, local language web pages and an expanded range of payment methods.

Alternative payment methods are growing in popularity, with unique local payment methods establishing a customer stronghold in many countries. ACI’s own research shows that offering the top three payment methods in any market, rather than only the top one, can increase merchants’ conversion rates up to 30 percent. The combination of preferred payment options with local language and currency offers a convenient, familiar and more trusted payments experience that can help boost cross-border sales.

It is therefore critical for cross-border merchants to understand local market preferences and use a payments gateway that can connect with the relevant domestic acquirers in each locale. Local acquirers are often better attuned to domestic regulations and local market conditions, having access to more complete information, often with higher authorization rates and frequently more competitive rates.

Of course, successful international expansion requires not only offering shoppers the right payment methods and acquiring options, but also the ability to configure them quickly and efficiently. This is perhaps the biggest hurdle for merchants to clear without the right support.

ACI Secure eCommerce connects more ways to pay with more payment capabilities than any other provider with its payments gateway that utilizes open API architecture to ensure technology stays responsive to changing market needs. Online fraud detection and prevention capabilities combine machine learning models, predictive and behavioral analytics, customer profiling techniques, unlimited rules and powerful consortium data to detect and prevent fraud.