Fraud by the numbers

$10 billion

Total fraud losses in the United States in 20231

1 million

Reports of identify theft in the United States in 20231

30.7%

Population who reported being a victim of fraud in the last four years2

Stop fraud in real time using AI and network intelligence

Billers need to outpace fraudsters to safeguard customers and cut down costs. Empower your fraud team with the latest payment fraud prevention technology.

- Share and receive fraud risk signals with a community of fraud fighters via network intelligence

- Utilize profiling capabilities and data, from billions of transactions to identify known fraud patterns

- Gain an end-to-end view of the transaction data including rejections and chargebacks to improve model performance

- Automatically adjust and adapt patented models to new fraud behaviors with incremental machine learning, increasing fraud detection by up to 20%3

Reduce costs and mitigate risk

Sophisticated scams target payments with scale, putting you and your customers at risk. Leverage an AI-powered fraud management solution tailored to your industry.

- Spot and stop payment aggregators before they increase expenses and upset customers, with the ability to whitelist good accounts

- Identify and block card testing schemes that drive up costs and enable further fraud

- Drive down operational costs with comprehensive end-to-end chargeback and dispute management

- Confirm identity before accounts are opened using another layer of verification using customer behavior enhanced with thousands of data points with ACI’s digital identity solutions

Protect payments with one fraud solution

Implementing and managing multiple fraud solutions increases expense and slows performance. Plug into the power of an award-winning holistic solution proven to reduce fraud, simplify implementation, and improve performance.

Fraud comes in many forms

Fraudsters continue to expand with sophisticated scams targeting you and your customers, including:

Payment aggregators

Imposters collect and consolidate transactions into high-cost credit card payments

Account testing

Scammers use your payment channels to test and confirm stolen acccounts

Return and chargeback fraud

Impersonators steal customer data and make fraudulent payments that are disputed later

Identity theft

Personal information is collected and curated to create synthetic identities to open fraudulent accounts to commit crimes

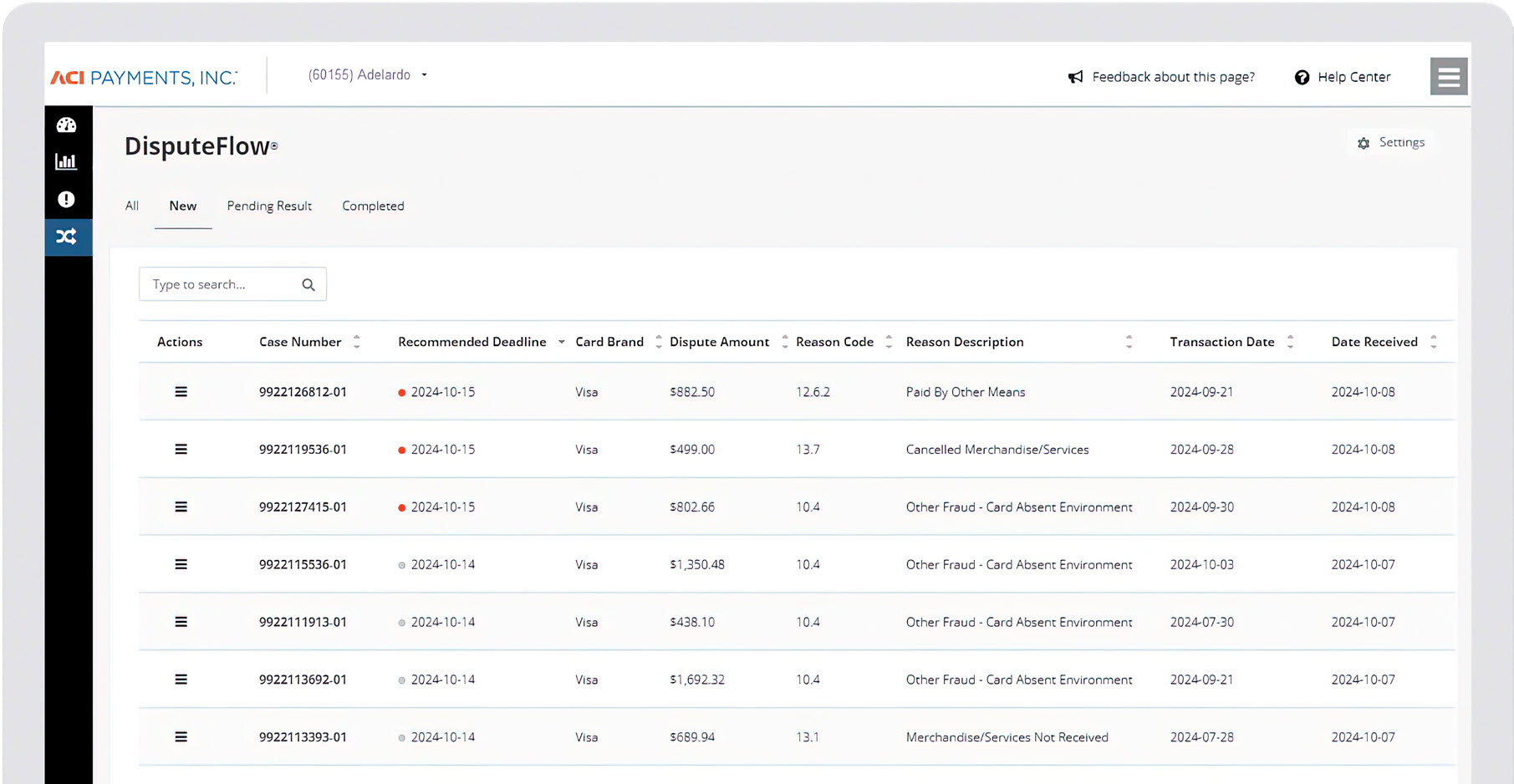

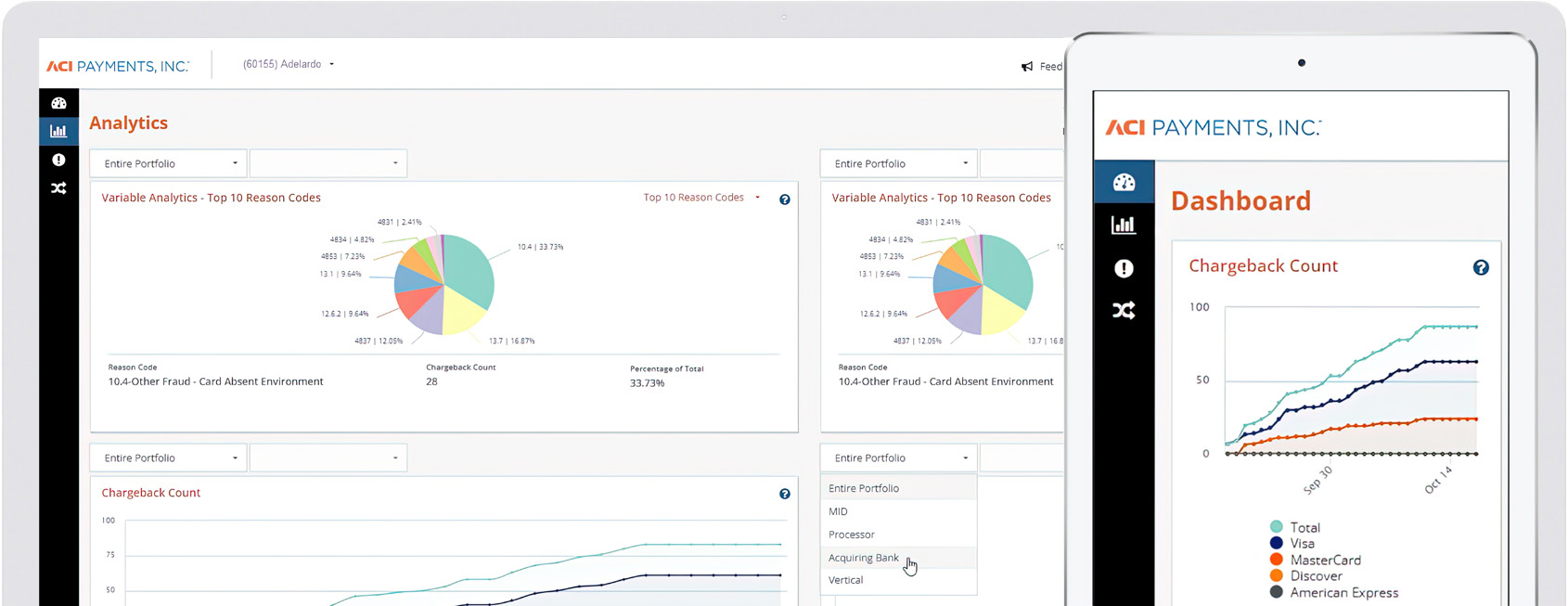

Simplify your chargebacks

Effortlessly consolidate and review your chargeback data with ACI’s dispute portal. Our intuitive dashboard, workflow, and reporting simplify dispute response to ensure smooth, confident navigation.

- Improve the speed, accuracy, and ease of each response with templated information

- Gain in-depth information about each chargeback

- Send dispute responses according to your processor’s preferences with one click

- Customize and review dispute data for the highest possible win rates

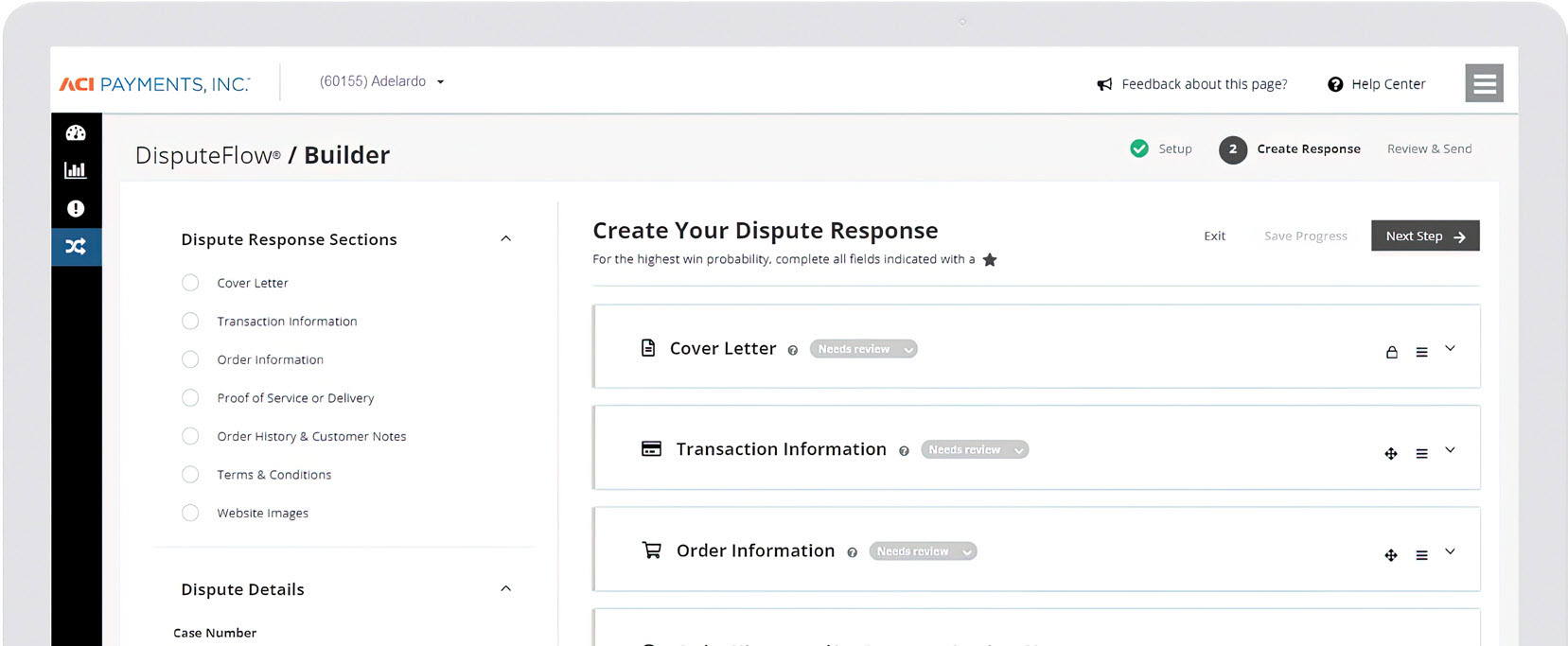

Customize your dispute responses using the recommended response sections. Drag and drop compelling evidence to provide proof of cardholder transaction participation:

- Company and product description

- Transaction information

- Order history and information

- Proof of usage and more

Stay informed on the progress and outcomes of disputes with real-time updates in a centralized dashboard. Recover revenue and optimize future dispute processing by identifying chargeback causes and patterns.

- Analyze your entire portfolio or leverage case-specific chargeback data

- Investigate success rates against a range of variables

- Compare response strategies for the highest probability of winning

RELATED SOLUTIONS

Stay secure

ACI’s industry-leading fraud prevention is delivered via a powerful combination of machine learning, predictive and behavioral analytics, positive profiling, customized fraud strategies, and expert support.

1Consumer Sentinel Network Data Book 2023, Federal Trade Commission

22023 Prime Time for Real Time Report

3ACI Internal Customer Data