Protect sensitive customer and payments data

Complying with PCI DSS helps avoid severe financial penalties, risk of data breaches, reputational damage and potentially losing your right to accept payments from major card schemes.

- Protect against malicious software and viruses

- Track and monitor access to cardholder data and network resources

- Safeguard data in transit by encrypting transmissions across open, public networks

- Maintain a security management policy for employees and contractors

Reduce compliance scope and reporting

Protect data in a fast-moving environment by instilling a discipline around the process of protecting payments data during the transaction process.

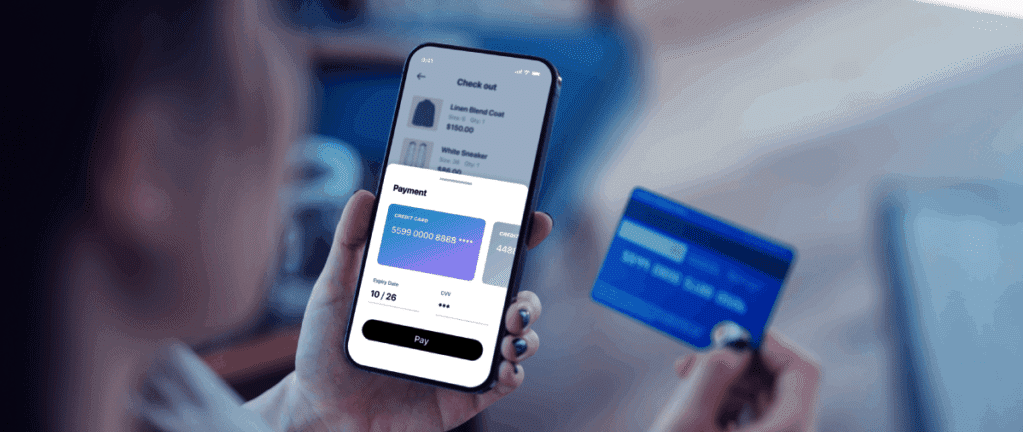

Secure payments data during the transaction process

Merchant omni-tokens give you the ability to replace sensitive card data without

impacting the performance of other processes that depend on the primary account number (PAN) as a reference point

- Gain complete ownership of tokens for greater flexibility, control and reporting

- Remove sensitive data from the merchant environment

- Create improved omnichannel customer experiences

- Simplify and speed up the returns process