Modernize your payments experience

eCommerce payments tailored to grow your business

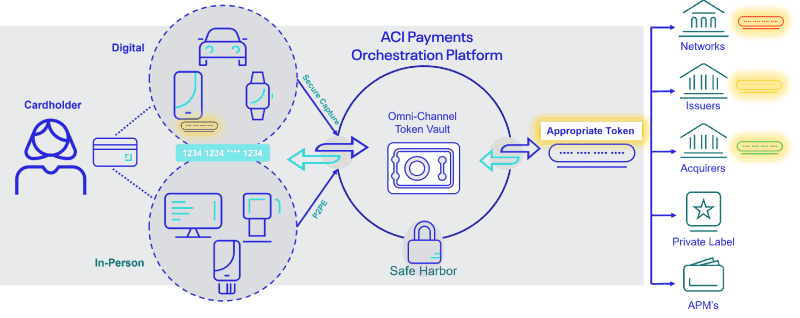

- Safeguard transactions on any device via any browser

- Integrate payment methods into mobile checkout quickly with the mSDK

- Store payments information across devices and channels — eCommerce, mobile app, and in-store transactions

- Generate and distribute secure payment links via email, SMS, social, WhatsApp, or web chat

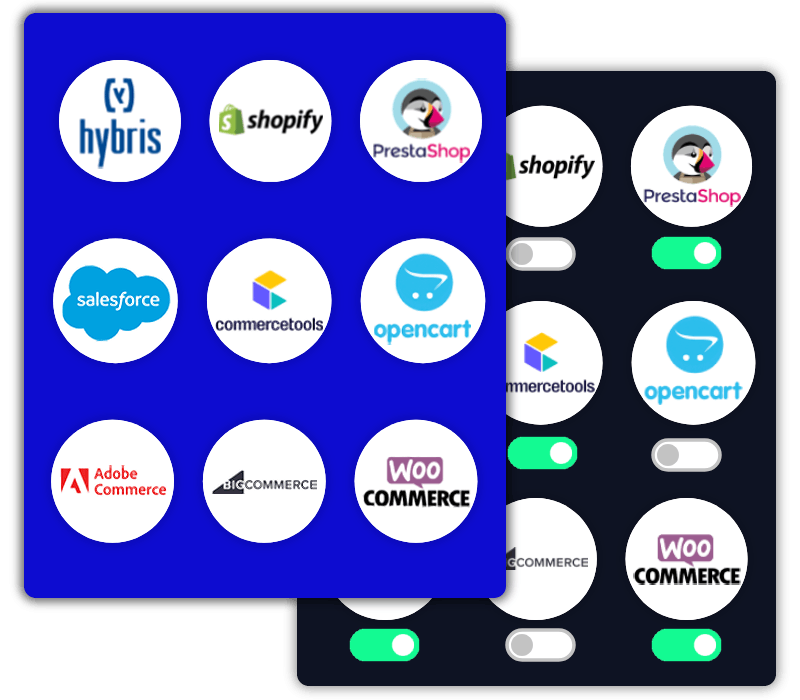

- Accept and process digital cryptocurrencies and other alternative payments

Innovations to drive conversions and growth

Increase sales and reduce the cost of ownership by enabling better payment experiences and connecting with global partners.

Accelerate uplifts in conversion

+42%

Transaction dispatching

+13%

Smart retry

+22%

Fraud declines

+35%

3DS declines

Take control of your payments strategy

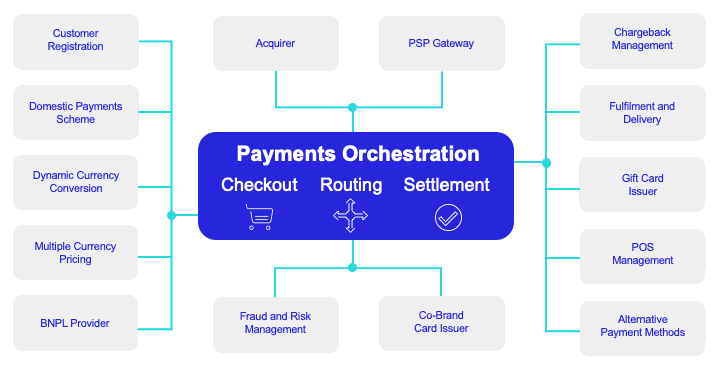

Payments orchestration for the customer journey

Optimize every element of the payments journey, from the checkout experience to offering the right payment methods, to receiving funds in your bank account.

- Improve conversion and fraud-prevention processes

- Streamline connectivity to multiple payment partners

- Optimize routing rules and decisioning to enhance cost savings

Continuously innovating

The world of payments is changing day by day and to remain in line with best practices and evolving technology – ACI invests heavily in roadmap and development.

ACI’s payment software is a white-labeled technology layer for digital evolving payments supporting global, market-leading brands that ensure ACI continues to evolve for all users.

Fraud management reimagined

Our dedicated, multilayered fraud prevention capabilities provide a robust framework to minimize the impact of fraud. Deep sector expertise, advanced machine learning capabilities, a global team of fraud experts, and fraud strategies tailored to individual merchant needs result in reduced chargeback rates, lower operational costs and optimized acceptance rates.

Complete payments functionality

Apply a full set of emerging payment tools to exceed customer expectations. One-click, scheduled payments, account updater and transparent transaction descriptions offer your shoppers a frictionless experience. With dynamic 3DS, and a world of payment methods at your fingertips, you can be sure to offer the right mix to manage and grow customer loyalty.

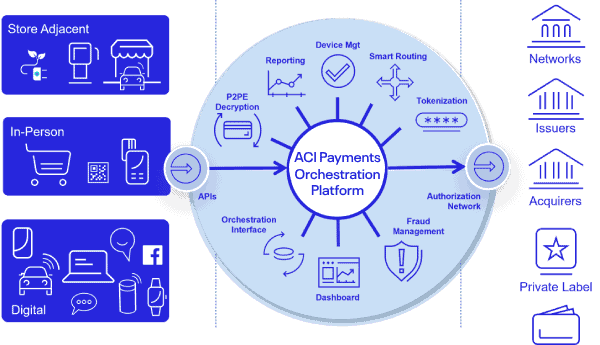

Achieve acquirer and payment provider independence

With a global network of acquirers and partners, you control your payments strategy to leverage local acquiring at a global scale

- Maximize conversion at minimum cost with local smart routing options

- Build payment experiences your customers love

- Tailor your fraud solution for the best results at the lowest cost

Evolve your payments strategy

Explore related ACI Worldwide solutions to ensure your ongoing business success.

*According to the 2021 MRC Global Fraud Survey

**ACI internal customer data