REAL-TIME PAYMENT TRENDS

Prime time for real-time global payments report

Get unparalleled real-time payment insights and end-to-end use cases

- Analysis of 51 Markets

- Top Real-Time Use Cases

- Forecasting and More

Real-time potential has become real-world proof

A momentous shift is happening in real-time payments as countries begin to connect and expand payment options, creating end-to-end customer journeys that are finally delivering on the bigger promise of moving value fast, at scale and at lower costs.

For the first time, the 2024 Prime Time for Real-Time report includes a deep dive into five real-time payment markets that are leading the way in instant payments adoption, giving you key insights into their global economic impact.

Access the report to explore:

- Real-time, account-to-account payment volumes and forecasts across 51 markets

- How real-time payments benefit the entire transaction ecosystem from banks and providers to merchants and consumers

- The impact of the pan-European SCT Inst scheme; new central-bank-driven initiatives in the Middle East, Africa and Asia Pacific; the FedNow® Service and RTP from The Clearing House in the U.S.; Brazilian PIX and more

- How real-time payments deliver real-life advantages that go beyond greater convenience and choice to act as a catalyst for economic growth and financial inclusion

The prime time for real-time is now. What are you waiting for?

42.2%

growth in global real-time transaction volumes

$575.1 Billion

estimated real-time transaction volume by 2028

19.1%

of all electronic transactions in 2023 were real-time

Prime time for real-time snapshot — Global summary

Markets moving to maturity as 2023 reaches a record-breaking high

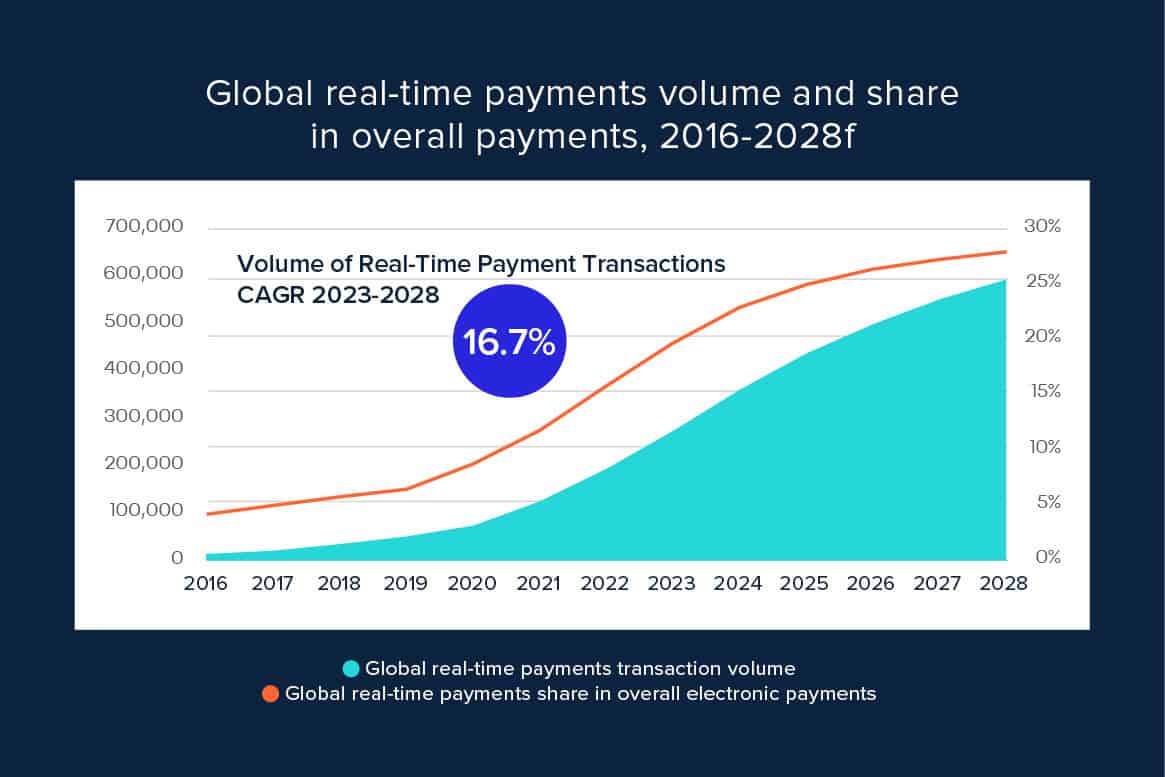

Real-time payments accounted for 266.2 billion transactions globally in 2023, a year-over-year (YoY) growth of 42.2%. This shift toward more sustainable growth levels is as expected as countries move beyond early adoption to maturity.

The power of collaboration between governments, regulators, banks and fintechs is finally bearing fruit, resulting in wider domestic reach and exciting new use cases. Merchants and consumers are now embracing real-time payments through apps, QR codes and mobile wallets.

Markets where real-time is mainstream have knowledge to share

With regulatory frameworks being established, and the demand for real-time payments increasing, collaborative ecosystems have emerged to drive powerful use cases that revolutionize businesses and enhance daily lives.

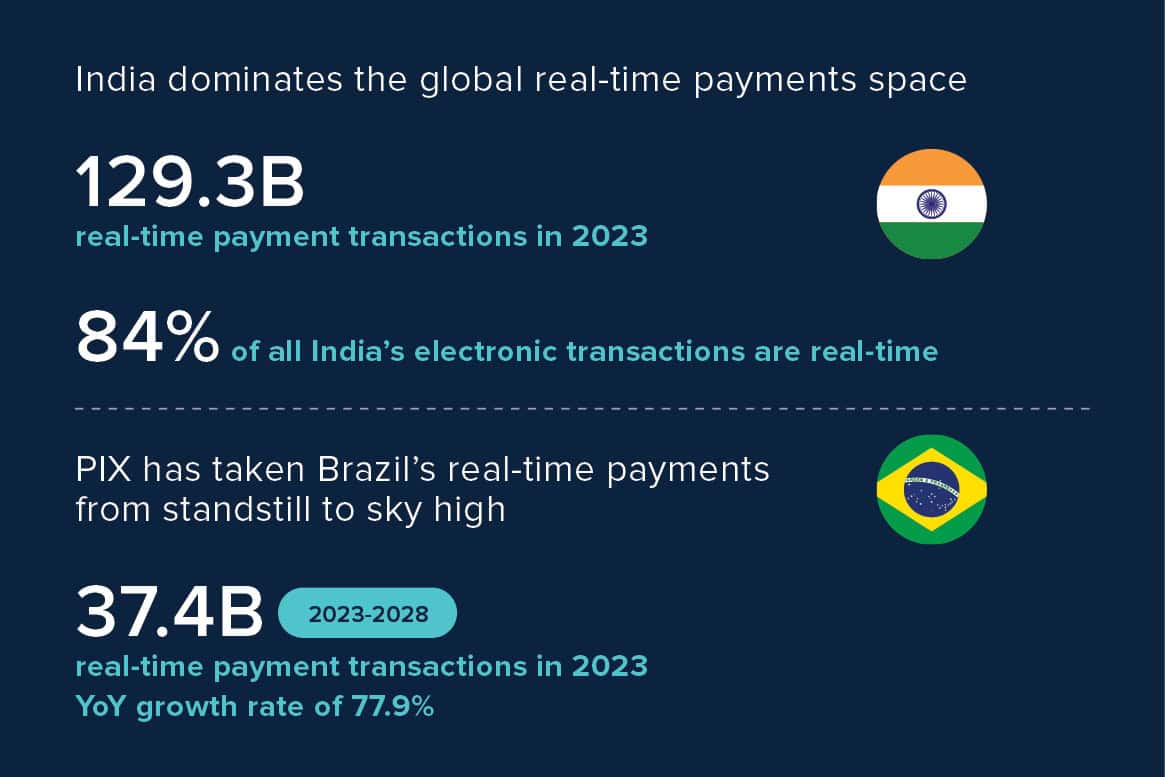

The success of real-time systems like India’s UPI and Brazil’s PIX shows that consumers and merchants are ready to take advantage of real-time benefits — faster settlement, lower risk than cash and better liquidity than cards.

Closing the gap to real-time ubiquity

In every corner of the world, real-time payments are now in regular use — moving value at scale and at low cost. In 2023, just under one-fifth of all electronic payments globally were real-time, and by 2028, it will be more than one-quarter.

This year’s report confirms that real-time payments are now an integral part of the global payments mix, and as more markets go mainstream, they should now be acknowledged as a cornerstone for all strategies targeting financial inclusion and economic gain.

Get the report

Real-time potential has become real-world proof

Learn how banks, payment service providers, merchants and consumers benefit from real-time payments across 51 markets.