On This Page

Related but not the same, payment gateways and payments orchestration both help merchants to process payments, but they operate differently and offer their own distinct advantages. Here, we explore their unique selling propositions, key benefits and considerations to help you choose the right solution for your business.

Before making any decisions about which approach fits your requirements, it pays to understand how both options work, exactly what they do and the pros and cons of each. Only then can you gauge which will provide the most suitable platform to optimize your sales performance and give you the competitive edge and reach vital in today’s fast-moving digital markets.

Getting to know the options

- Payment gateways

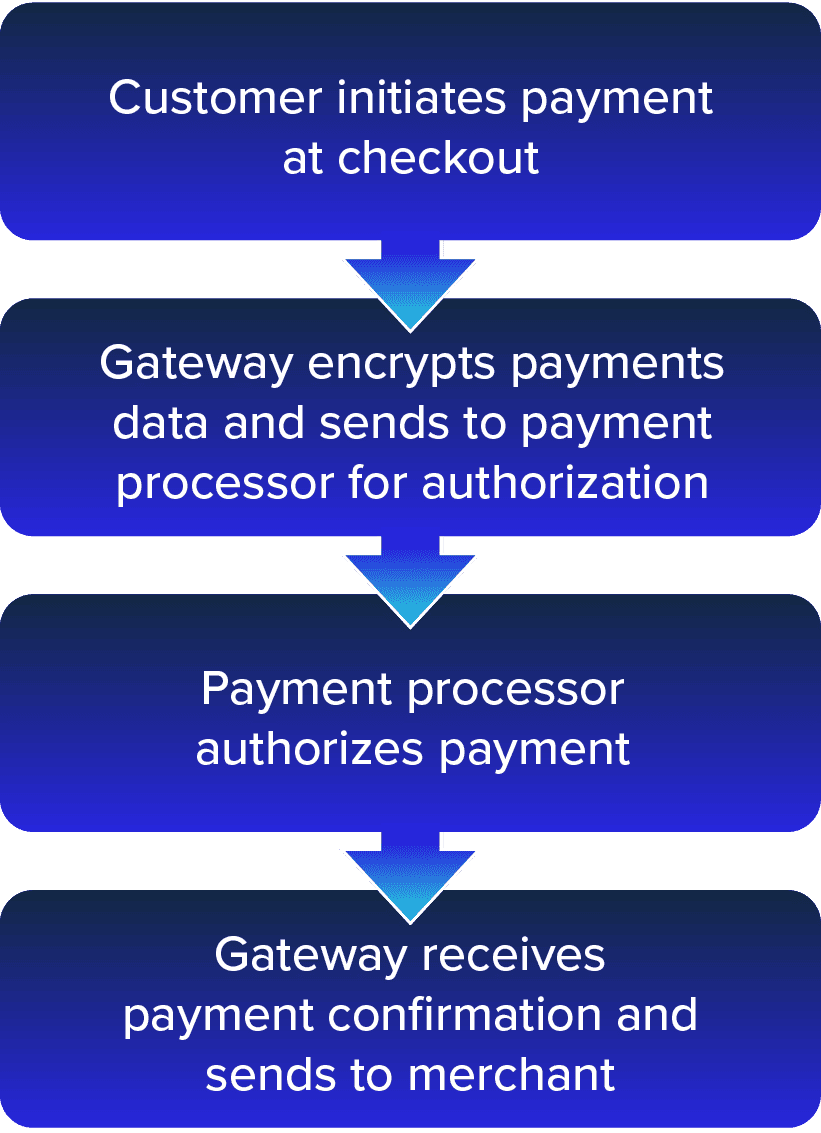

A payments gateway acts as a bridge between an eCommerce website and a payment processor, transferring funds between the customer’s and the merchant’s account. It authorizes and processes online payments by transmitting payments information securely between all parties — the customer, the merchant and the payment processor. When a customer initiates a transaction, the payments gateway securely collects the customer’s payment information and forwards it to the payment processor for verification and processing. Once the payment is approved, the payments gateway sends a confirmation message back to the merchant, and the transaction is complete. - Payments orchestration

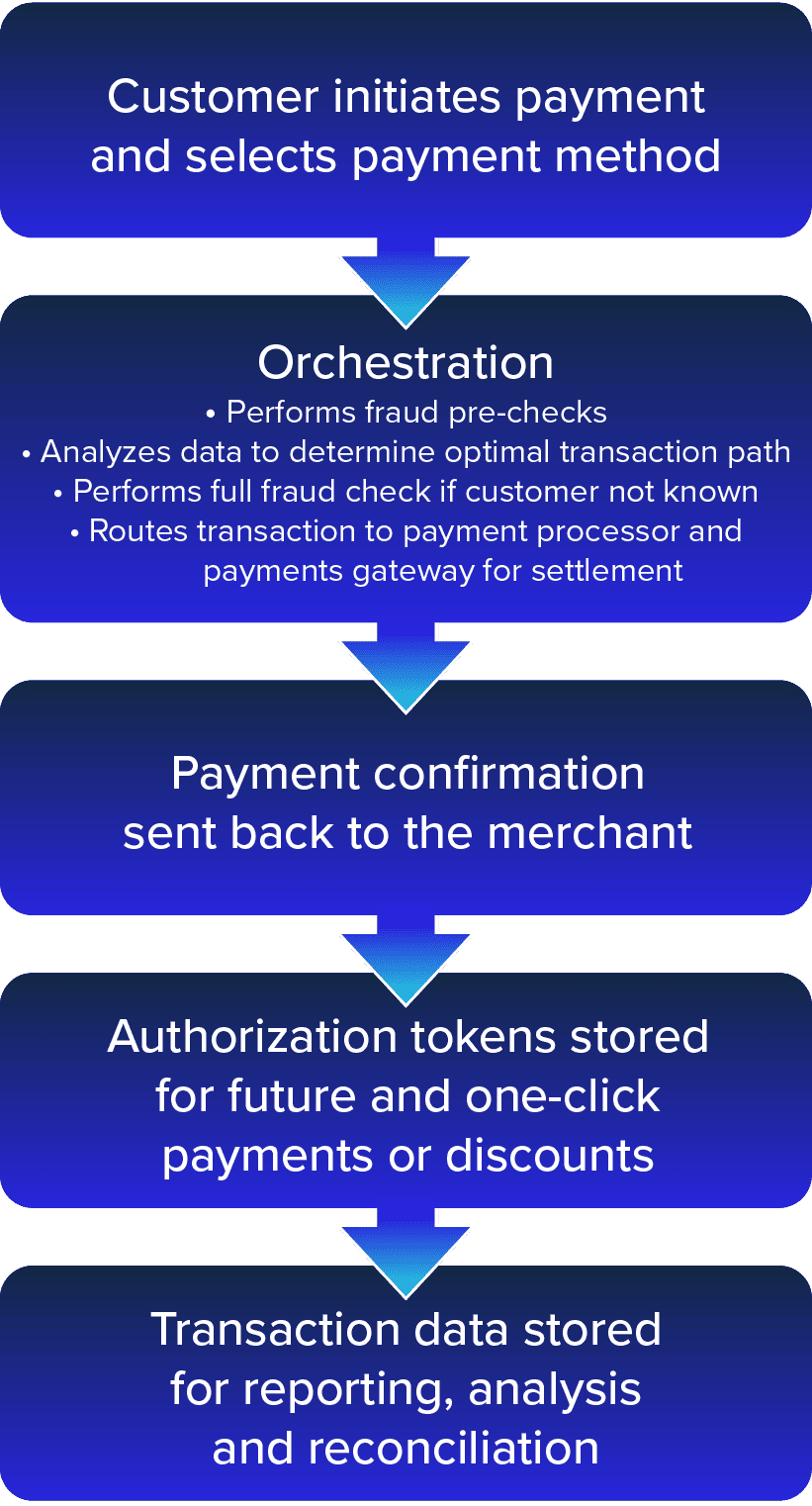

Payments orchestration includes one or more gateways but is packed with much more functionality, including payment method selection, smart routing, fraud detection, currency conversion, reconciliation and even analysis. Orchestration helps merchants manage and optimize complex payments and incorporate best-of-breed solutions. Able to route payments to the best provider based on transaction value, currency, cost, reliability, location and customer preference, it can manage the entire payments flow from a single API and interface.

Looking under the hood: How they compare in terms of functionality and performance

| Payments gateway | Payments orchestration | |

| What it does | Acts as a bridge between eCommerce website and a payment processor to transfer funds from the customer to the merchant account | Acts as a payments management platform, enabling businesses to manage their entire payments infrastructure from one place |

| Who is most likely to use it | Businesses with low to moderate transaction volumes and who require a simple and easy-to-use eCommerce payments solution | Businesses with high transaction volumes or complex requirements (e.g., cross-border) who want to manage multiple gateways, payment methods and regulatory requirements from a single dashboard in a streamlined, efficient and cost-effective way |

| Role in transaction flow |  |  |

| Key functions | Authorizes payments by verifying the customer’s payment information and confirming whether they have sufficient funds to complete the transaction Performs settlement by transferring authorized funds from the customer’s account to the merchant’s account Creates reports by providing information about the processed transactions to the merchant | Streamlines payment operations by providing a single point of integration for multiple payment gateways, processors and payment types, including credit and debit cards, gift cards, wallets, APMs and real-time payments Reduces payment errors by automatically rerouting transactions if a payment authorization fails Enhances security by offering fraud detection and prevention features that protect businesses and customers from online payments fraud |

| Pros | Secure transactions Uses encryption and tokenization to protect sensitive customer data from cyber threats; complies with security standards (e.g., PCI DSS) Payments choice Supports a variety of payment methods (e.g., credit cards, debit cards and e-wallets) Customizable user experience Payment pages can be customized to reflect merchant branding Easy integration Simple to integrate with most eCommerce platforms, so merchants can start accepting payments quickly and easily | Increased conversion rates Offers a much wider range of payment methods, helping to increase conversion Cost optimization Routes payments to the most cost-effective payments provider to reduce payment processing costs Improved payment success rates Monitors payment success rates in real time, allowing merchants to quickly identify and resolve payment issues Scalability Easily scalable with the necessary infrastructure to handle large transaction volumes either variably, seasonally or consistently, as merchants grow Flexibility Robust APIs to integrate best-in-breed solutions as part of their payments stack |

| Cons | Cumbersome PCI compliance Merchants must comply with PCI DSS regulations, which can be cumbersome and expensive Limited payment methods May not support all payment methods, such as bank transfers or cryptocurrency Cost at high volume A fee is charged for each transaction processed, adding up to significant amounts for high-volume merchants Technical complexity Non-standard platform integration or adding unsupported payment methods require programming skills and knowledge of APIs and web development Limited scope May not be able to handle complex payment scenarios or merchant customization Lack of features The emphasis is on payment processing and unlikely to include reporting or analytics | Initial integration May require a more significant initial integration effort than payment gateways Complexity Are more complex than payment gateways and require more technical expertise to manage the full process that goes beyond facilitating an eCommerce transaction Dependency on third-party providers Can rely too heavily on third-party payment providers, creating a potential point of failure |

Which is best for your business?

Choosing between a payments gateway and payments orchestration depends on your business needs, operational requirements and priorities. Here are eight key questions you should ask before to deciding on your approach to payment processing:

- Do you want to keep integration simple?

Payment gateways typically involve coding and API integration. On the other hand, payment orchestration platforms offer a simpler integration process that allows businesses to connect multiple payment gateways and processors through a single API. - What are the current transaction volumes and what growth is anticipated?

Payment gateways are suitable for small- and medium-sized businesses with low to medium transaction volumes. However, if you want to scale your payment operations, you may have to integrate multiple payment gateways. This lends itself to payments orchestration, which is ideal for high transaction volumes and can scale rapidly as your business grows. - What payment options are important to reach target audiences and markets?

Payment gateways typically support a limited number of payment options, such as credit card payments. Meanwhile payment orchestration platforms offer a range of payment options, such as mobile payments, e-wallets and bank transfers. - How healthy is your profit margin, and how will transaction costs impact it?

Payment gateways usually charge a transaction fee for every payment processed. Some may also charge a setup fee. Payment orchestration platforms also charge a transaction fee, but the cost is usually lower than that of payment gateways. Payment orchestration platforms may be more expensive to set up, but their real-time reporting and analytic functions provide you with more visibility and control over payment costs. - Does your business operate in a high-risk environment or suffer from issues with declines?

Payment gateways offer basic security features, such as SSL encryption and fraud detection. Payment orchestration platforms also offer advanced security features, such as multifactor authentication, tokenization and real-time fraud monitoring to help prevent false declines. - Do you have complex payment requirements and the technological resources to manage them?

Payment gateways are relatively simple solutions that facilitate online payments between you and your customers. They are designed to be easy to use and require minimal technical expertise. Payments orchestration is designed for businesses that have more complex payment requirements, so it may require more in-house technical expertise. - Is flexibility and the ability to customize the payments platform important?

Payment gateways offer limited front-end customization and are designed to work with a specific set of payment providers. They give limited control over the payment process, and their features are defined by the gateway. Payments orchestration enables you to choose from multiple payment providers and customize the payments flow to meet your business’s specific requirements. You can also create your own rules for routing transactions based on factors such as cost, availability and reliability. - Is your business data-dependent, subject to fluctuations, change and seasonal spikes? Payment gateways have limited reporting and seldom offer analytics. Payments orchestration delivers advanced reporting and analytics capabilities, which can help you optimize your payment processes and improve your business’s financial performance.

Already have a payments gateway and thinking of upgrading to payments orchestration?

If you’re a high-volume or high-growth organization that is currently using single or multiple payment gateways, you may be considering migrating to payments orchestration. Given the considerations above, this is a wise move and one that can deliver competitive advantages, including the ability to:

- Access multiple payment providers through a single integration, reducing the complexity and cost of managing multiple integrations

- Optimize payment processing by routing transactions to the most cost-effective or fastest payment method, which can result in significant cost savings and improved customer experience

- Deliver valuable insights into payments performance and customer behavior, enabling businesses to make data-driven decisions to improve their payment processes

Overall, payments orchestration offers businesses greater flexibility, efficiency and control over their payment processes. In many cases, this makes it a more advantageous solution than a traditional payments gateway, and is a good option to future-proof your business for long-term success.