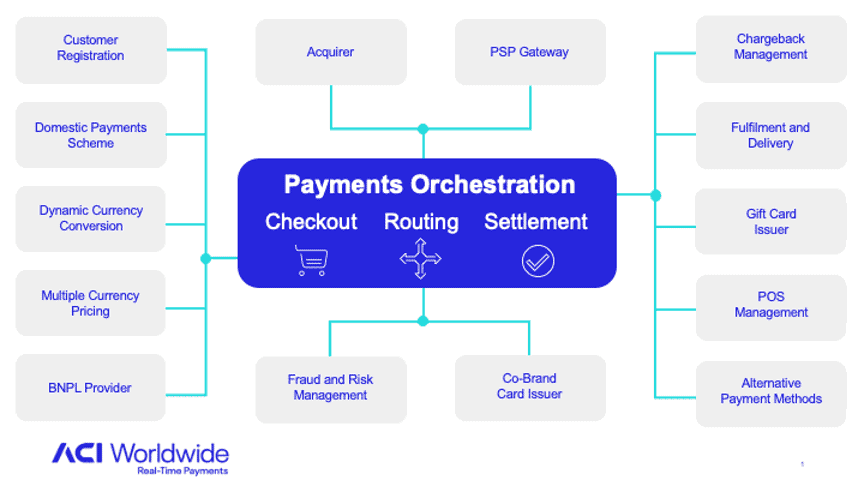

Payments orchestration is about maximizing payment conversion in the most cost effective way. It involves working with multiple payment providers, acquirers and banks to optimize the customer experience, increase conversions, ensure regulatory compliance, enhance fraud prevention and enable global payments coverage.

It’s a concept that’s rapidly gaining popularity, particularly in the eCommerce space. 451 Research Business Impact Brief reports:

- Over 60% of merchants prefer working with multiple vendors

- Over a quarter merchants surveyed said enhancing payment orchestration platforms is a top priority

Orchestration platforms (POPs), also known as payment orchestration layers (POLs) simplify front-and back-end integration. But do merchants need them and is there more to payment orchestration than these platforms are built to offer? We’ll answer those and other questions in this article.

Understanding front-end and back-end orchestration

Front-end orchestration starts with the payment source and enables it to easily integrate into payment gateways. Examples of integration include multiple shopping websites, mobile shopping apps, call centers and kiosks.

The goal of front-end orchestration is to

- Minimize integration effort and complexity for the merchant

- Enable easy submission of payments authorization request during checkout

A unified interface can ensure a simplified integration with those storefronts while gaining access to multiple payments, fraud management and additional services offered by payment gateways and other service providers.

Back-end integration offers the greatest value to online merchants. It focuses on encouraging customers throughout the shopping funnel, which is important because 70% of eCommerce customers abandon their cart. Enabling shoppers to use their preferred payments method — be it card; wallet; direct-to-account; cash-on delivery; buy now, pay later or others — is a critical factor in maximizing conversions.

Orchestration is essential to conversation rate optimization

Payment orchestration layers can help customers clear that final hurdle. They provide connectivity to a variety of payment methods and bank card acquirers to manipulate the payments flow, creating a frictionless checkout process.

Manipulating the payments flow involves selecting the best acquirer to route your payments authorization request. An orchestration layer can automatically select the best acquirer based on their conversion rate for a particular card, transaction type, merchant category code, shopper location, transaction value and so on. It can also locate an alternative acquirer in real time if the first authorization request is denied.

The orchestration layer can also adapt the payment flow to call out to tokenization services, fraud management services and strong customer authentication (SCA) exemption management solutions, all in the interest of minimizing the risk of disrupting the customer journey.

Being able to orchestrate the payments flow in this way is vitally important as part of a strategy to maximize customer conversion. For high-volume merchants, marginal gains can lead to dramatic impacts to their bottom line. But it’s not enough for merchants to simply offer a selection of payment methods; they need to profile their customers to make sure they are offering the right payment methods for their customer base.

There is undoubtedly a market for independent orchestration layers to add value to the payment gateways some merchants use, but the best gateways already cater to this. Although utilizing the orchestration layer embedded in a highly flexible payments gateway does not allow for independence, it does offer the benefit of fewer service partners to manage and reduced complexity.

Frequently asked payments orchestration questions

Why is payments orchestration needed?

Until recently, payments orchestration was the sole province of the largest merchants, which typically had contracts with multiple processors and could afford to build and maintain complex back-end payment systems.

However, as a result of developments over the last decade — including the emergence of strong automation tools, the growth of cloud infrastructure, and the proliferation and growing sophistication of payment service providers (PSPs) — POPs that bundle essential payment functionalities in an efficient, streamlined way are now available to merchants of all sizes. These POPs serve as the entry point and core of a merchant’s payments system — eCommerce platforms and online service providers no longer need to integrate every PSP or acquirer separately.

Payments experts agree that payments orchestration will continue to increase as we see changes in payment method offerings, customer expectations and increased security regulations such as Payment Card Industry Data Security Standard (PCI DSS) and Payment Services Directive 2 (PSD2) in Europe.

How can payments orchestration benefit the business?

Payments orchestration helps manage multiple payment providers while putting in place a framework for optimization, enabling payment managers to shift their focus from operational to strategic tasks.

Key benefits include:

· Streamlined connectivity into multiple payment partners

· Optimized routing rules/decisioning to lower transaction costs

· Reduced risk by implementing improved fraud prevention processes

· Boosted acceptance and checkout conversions

· Enhanced cost savings through reduced authorization and chargeback costs

Payments orchestration can help businesses be more agile and scale faster, simplifying the process of moving into new markets. It also enables them to integrate region-specific payment providers and currencies while ensuring regulatory compliance. Finally, payments orchestration prevents vendor lock-in, making it easier to collect and analyze payments data.

Is it too difficult for customers to authenticate, or not difficult enough?

If the authentication process is too easy, fraudulent buyers may slip through. Conversely, if the process is too strict, it may turn away good customers. The challenge for payments orchestration is finding the perfect balance between the two.

With that in mind, the world is moving toward SCA, which authenticates buyers based on three criteria:

· Something they possess, such as a mobile device SMS

· Something they know, such as a password

· Something that they inherently are, such as biometric data, which can be verified using Touch ID

SCA should not be confused with two-factor authentication.

3D Secure 2 (3DS) is the latest version of SCA, developed in Europe as a part of PSD2, where its use is mandatory for online transactions. However, the PSD2 standards allow for two important exemptions that merchants can dynamically apply to individual transactions through payments orchestration.

The first is for low value transactions — for example, purchases less than €50. The second exemption allows the merchant to exclude “white list” buyers who are otherwise able to be identified by their profile information. For example, airlines frequently apply this exemption to purchasers of first-class tickets — not surprisingly, higher value “white-listed” customers tend to get better treatment.

There is a considerable incentive for merchants to adopt 3DS. Once applied, the liability for the transaction shifts from the merchant to the acquiring bank. The bad news, however, is that 3DS results in additional “friction,” such as further requirements placed on the buyer, which could potentially result in a lost sale. The solution is to use customer profile data to identify and white list the buyer, eliminating friction.

ACI Worldwide has seen merchants achieve a 25% improvement in authentication on average when using SCA. Unfortunately, many merchants without robust payments orchestration lack the technology or expertise to identify legitimate buyers through profiling. Others aren’t able to, or don’t take advantage of the ability to dynamically apply exemptions.

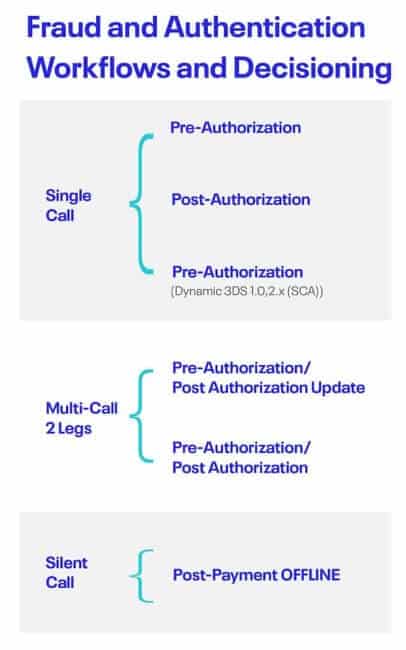

Is fraud screening required when using SCA?

Though the issuer bears liability for the transaction any time a merchant uses 3DS, that doesn’t let the merchant off the hook for fraud screening. Similar to authentication, merchants need to strike the right balance between being too strict, which adds transactional friction, and too weak.

Merchants can conduct fraud screening using several different data points — specifically, the device ID, the IP location where the transaction takes place and any deviation from the customer’s normal buying patterns as part of payments orchestration. However, the issuer is not privy to this data. Instead, they see limited bank data and some new fields under PSD2 including merchant identification number (MID), amount and time. Issuers don’t employ dedicated customer profiling solutions to define risk for individual merchants.

Merchants are required to control fraud metrics and perform screening under 3DS. If a merchant neglects to conduct proper fraud screening, the issuer could take a hit on merchant fraud, and consequently, place that merchant on their hot list. The issuer could request 3DS for all future transactions from the merchant, which could result in 3DS conversion loss.

In addition, both the issuer and the acquirer could also introduce strict fraud rules on the merchant that could increase bank declines. The merchant’s customers could see chargebacks irrespective of liability, resulting in merchant losses.

Lower fraud rates permit more exemptions for the merchant under Transactional Risk Analysis (TRA), a critical new part of SCA. Achieving strong key performance indicators (KPIs) generally results in less authentication friction and the highest possible acceptance rates for the merchant.

What is a healthy acceptance rate on transactions, and how does payments performance compare to industry averages?

The challenge for payments orchestration is sending the right transaction to the right bank using “smart routing,” which is based on several criteria:

· Location (local, domestic, cross border)

· Value

· What customers are buying (note that changing the purchase type code can sometimes increase acceptance)

The bank then makes the call on acceptance.

The goal for the merchant is to maximize acceptance and minimize the cost per transaction using a multi-acquirer strategy and dynamic routing. For example, if one bank declines a transaction, the payments processing system automatically routes it to another bank.

How do your acceptance rates stack up? Here is data comparing ACI payments orchestration performance data with industry benchmarks from the merchant risk council (MRC).*

*Note that Market Average International refers to cross-border. Ultimately, the MRC findings show that merchants going cross-border are achieving lower KPIs than those domestic. However, ACI maintains high KPIs on domestic as well as international levels.

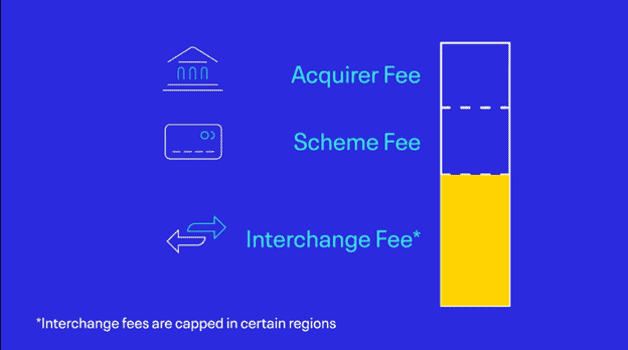

Could using multiple acquirers minimize costs and maximize acceptance?

Merchants can reduce transaction fees by working with multiple acquirers as part of payments orchestration. The merchant service charge is the amount charged to merchants or PSPs.

It is made up of three parts:

· Acquirer fee

· Scheme fee

· Interchange fee (capped in certain regions)

Acquirer fees are negotiable, and the scheme and interchange fees are set by the credit card companies. The scheme fee is typically minor, but the interchange fee, which can vary from 1.4%–2.5% on credit cards and be as low as 0.3% for debit cards, is usually the largest portion of the merchant service charge.

The interchange fee is influenced by many factors, but the main driver of cost is the location of the shopper and the merchant. Typically, the cost is lowest when the merchant or issuer and shopper are in the same country. The costs are more when the transaction is regional or cross border — for example, a U.S. customer making a purchase from a European merchant.

If you work with multi-acquirers in multiple countries corresponding to your customer base, robust payments orchestration ensures seamless technical integration for your payments no matter how many you work with. Individual acquirers may also offer specific advantages in a given country, which could be coded into an orchestration system.

Does payments orchestration support alternative payment methods or multiple currency pricing?

Alternative payment methods such as buy now, pay later (BNPL) and digital wallets can increase customer conversion, as well as ticket size. Shoppers are more likely to abandon their cart if merchants do not have their preferred payment method available.

BNPL payments are particularly attractive to millennials and Gen Z consumers, many of whom eschew credit cards. With these schemes, the third-party provider connected through the payments orchestration process provides specific credit terms to the shopper, and the merchant receives payment (minus a fee, typically around 3%).

Offering international customers multiple currency pricing and dynamic currency conversion, which can be integrated into payments orchestration, are also important to shoppers and can boost merchant conversion rates.

What’s the best way to keep conversation rates healthy?

Conversion is all about getting the shopper to complete the payment. They need to click and pay, and then the payment has to be processed successfully. This is the job of payments orchestration. To increase conversion rates, merchants must offer the right payment methods, improve their user experience, offer one-click purchasing, work with multiple banks and acquirers and ensure dynamic routing is turned on.

What role can ACI play in payments orchestration?

ACI delivers access to a vast network of card acquirers and alternative payment methods with integrated fraud management, tokenization and SCA exemption management through ACI Secure eCommerce.

It also comes complete with built-in orchestration services to optimize customer conversion: routing to the best acquirer, auto-retrying on soft declines, minimizing the impact of SCA and optimizing the payments experience with mobile-enabled payments and one-click experiences. Acceptance rates are also improved with a multilayered approach to fraud prevention, taking advantage of machine learning, positive profiling, risk analysts, business intelligence, complex rules, silent mode and consortium data.

Ultimately, a strong orchestration strategy can deliver robustness and resilience to the payments chain, reduce customer friction and increase conversion rates — selling more and losing less — which is music to the ears of merchants.

To find how the ACI payments orchestration solution can quantifiably improve your business, contact an ACI payments expert about conducting an orchestration assessment using the ROI calculator.