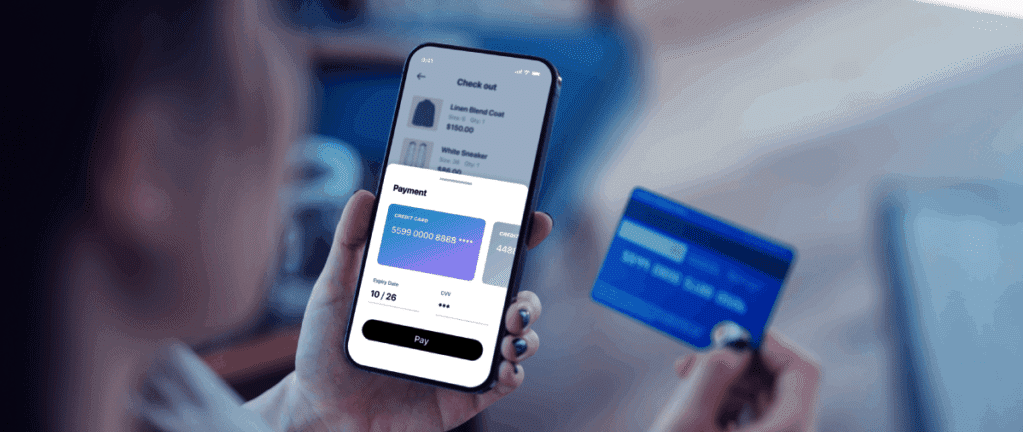

Modernize your payments experience

Point-to-point encryption

Point-to-Point Encryption (P2PE) protects payments data during the transaction process by instantly encrypting the sensitive card and customer information at the terminal — and keeping it encrypted until it reaches the payments switch.

Ensure customers’ payments information is not exposed, even in the event of a data breach

Reduce the scope of your PCI compliance

Minimize the amount of sensitive payments data in your environment

Validated P2PE with asset management

Meet the gold standard for secure encryption. Building on our standard P2PE offering, ACI’s validated P2PE (VP2PE), combined with asset management capabilities, puts additional discipline around P2PE operations and devices, gives you greater confidence, visibility and control of in-store payments.

- Cover the entire lifecycle of your POI devices and any connected software and processes,

- Ensure sensitive payments data is protected throughout the chain of transmission.

- Eliminate the risk of usable cardholder data being stolen

- Reduce or even de-scope store POS systems from PCI audit and compliance

- Achieve complete control over device compliance through our hardware estate management facility

- Gain additional PCI compliance burden relief and cost savings, beyond P2PE alone

Protection along the entire payments journey

End-to-End Protection

ACI Worldwide delivers payment and fraud management capabilities that allow merchants to manage and protect the full lifecycle of payments.