On this page

Intense competition and soaring costs are squeezing profits for enterprise retailers, leaving them under increasing pressure from stakeholders to do more with less. When it comes to checkout, this means optimizing every transaction while still meeting evolving consumer expectations and reducing fraud in real time without blocking legitimate sales.

Today’s payment decisions have lasting impacts on profitability, scalability, and customer experience

With all eyes focused on better managing sales journeys and operational costs, US-based retail payment leaders no longer view transaction management as a back-office function but as a powerful game-changer with the potential to impact business success.

According to the National Retail Federation (NRF), 62% of surveyed merchants say their CFO now leads the payments function. The same survey flags some important challenges for merchants as they try to balance customer and operational needs to achieve the best ROI for their business.

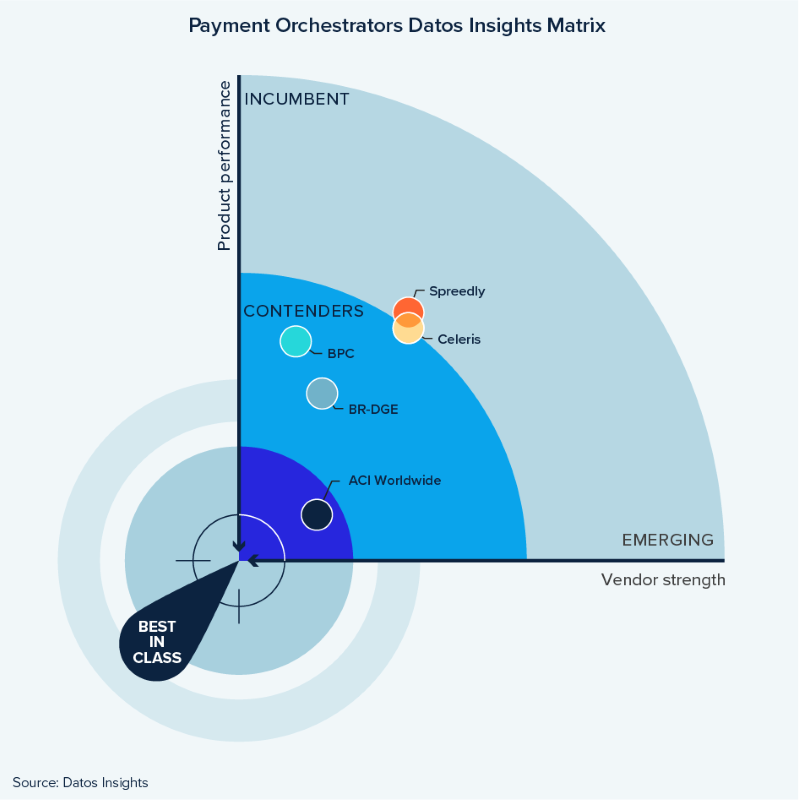

Datos Matrix: Payment Orchestration

Vendor Evaluation

ACI Payments Orchestration Platform named best-in-class.

✔ Payment provider connections

✔ Out-of-the-box integrations

✔ Product stability

✔ Strategic product initiatives

What should enterprise merchants be prioritizing as we move through 2025?

What is certain is that the right payment infrastructure and strategy are crucial to achieving success. But now, as we reach the halfway point of the year and look ahead to the critical Golden Quarter, how can merchants be sure they’re on track?

Based on the NRF survey results, we’ve pulled out six key areas that enterprise merchants need to address right now, and the role of advanced payment orchestration in helping to achieve their game plan:

- Prioritize fee reduction with smarter payment routing

Reducing network and processor fees is a #1 concern

Fee fatigue is real, and it’s not just related to card networks and interchange fees. Most retailers said processor and gateway fees lack transparency. This makes it harder than ever to understand the true cost of acceptance and how to optimize it.

Payment orchestration platforms with multi-acquiring features enable merchants to route transactions in real-time to the most cost-effective acquirer by geography, card type, or risk level. This can significantly reduce processing fees while improving acceptance rates. - Combat fraud and chargebacks without adding friction

Fraud mitigation and chargeback reduction are among merchants’ top three priorities

From returns fraud to friendly fraud, retailers are under siege, but layering on legacy fraud tools often creates false declines and poor user experiences.

Modern orchestration engines, on the other hand, can integrate AI-driven fraud detection and logic directly into the payment flow. This means merchants can dynamically adapt rules and acceptance parameters based on intelligent, real-time risk signals without slowing down the checkout process. - Demand flexibility and clarity from providers

57% of merchants use more than one payment provider, and nearly 1 in 5 use more than four

Today’s merchants want more control, better cost performance, and less lock-in from their providers. But adopting multi-acquiring strategies can create new layers of complexity that can be hard to manage and maintain.

Payments orchestration empowers merchants to optimize provider use based on region, cost, or performance by unifying multiple providers behind a single layer, simplifying operations while increasing flexibility. - Future-proof the payment mixes for emerging channels

Retailers are rapidly adopting digital options: 72% accept Apple Pay, 39% use BNPL, and 33% support live chat payments

A flexible orchestration platform enables merchants to efficiently implement and evaluate alternative payment methods, such as Buy Now, Pay Later (BNPL), the FedNow Service®, digital wallets, and conversational commerce. Additionally, it facilitates rules-based decision-making regarding the timing, placement, and presentation of various payment options, allowing for a more customized experience tailored to each shopper. - Continue to invest in seamless, omnichannel experiences

Mobile POS, kiosks, and self-checkout are on the rise

Customer journeys are no longer linear. Shoppers expect payment continuity across mobile, online, and in-store experiences to be fast and secure. Orchestration enables merchants to offer consistent payments across all channels. Smart routing, tokenization, and integrated fraud protection ensure that whether the transaction starts online or in-store, it’s seamless and secure. - Use real-time data to make smarter decisions

Retailers use algorithms to determine token use, personalize checkout, and optimize approvals

Yet many merchants still lack real-time visibility across providers and geographies. Advanced orchestration platforms offer real-time analytics and dashboards that track performance, approval rates, and fraud across payment providers. This data empowers merchants to act quickly, optimize routing, and improve ROI.

The future belongs to merchants who orchestrate

As enterprise retailers navigate rising complexity, changing consumer habits, and ongoing cost pressures, the right payment strategy can be a growth engine, not just a cost center.

Whether you’re an established enterprise merchant or an emerging brand with big growth ambitions, payment orchestration platforms like ACI offer the flexibility, control, and intelligence you need to stay ahead.

With our fast integration, pre-built commerce connectors, multi-acquiring, and intelligent fraud management, you can tackle today’s challenges and seize tomorrow’s opportunities. From cutting fees and minimizing risk to scaling with agility, payments orchestration is the quickest and smartest way to make your payment goals a reality in 2025.

The New Payments Era

Embracing change at full speed and future–proofing payments for tomorrow’s needs

✔ Urgent case for modernization

✔ Strategies to combat fraud

✔ Faster, cheaper, more inclusive cross-border payments

✔Navigating complex regulations