On this page

The “heart” of the issue

Merchant acquirers are to merchants what financial institutions are to consumer critical infrastructures, powering global commerce. They are half of the whole heart and the engine that keeps the world’s payments ecosystem running. Without them, payments stall, economies slow, and trust in the financial system erodes. As the fraud and financial crime landscape accelerates, acquirers must move beyond incremental improvements and harness AI to stay ahead of increasingly adapting threats. Whether it be POS and physical store payments, eCommerce, faster payments, or new alternative forms of payment, they are one half of a whole that are quintessential to how payments live and breathe daily.

A perfect storm for acquirers

Whether it’s new payment options, real-time payment processing, fraud protection, or improved services, merchant acquirers need to create value for their customers and merchants. They currently face a convergence of challenges:

- Increased regulatory and compliance scrutiny

- Margin compression and rising operational costs

- Proliferation of sophisticated fraud attack vectors

- Pressure for high approval rates without increasing risk

Yet, large-scale data science projects aimed at minimizing fraud and maximizing revenue streams are costly and, at times, too narrowly focused. The right AI, however, is an efficient multiplier, a compliance accelerator, and a competitive differentiator.

How can AI help acquirers adapt and thrive?

AI can detect fraud in real-time, catching it faster and reducing chargebacks while boosting revenue. It can continuously adapt to new fraud typologies, streamline compliance with rules like VAMP, and protect entire merchant portfolios on a scale. This, in turn, leads to lighter operational workloads for existing teams, allowing them to focus on revenue-generating opportunities.

WHAT YOU NEED TO KNOW ABOUT VISA’S VAMP

Visa’s newly launched Acquirer Monitoring Program (VAMP) is a significant shift in how fraud and dispute risks are measured and managed across the payments ecosystem.

Serving every merchant, defending every channel

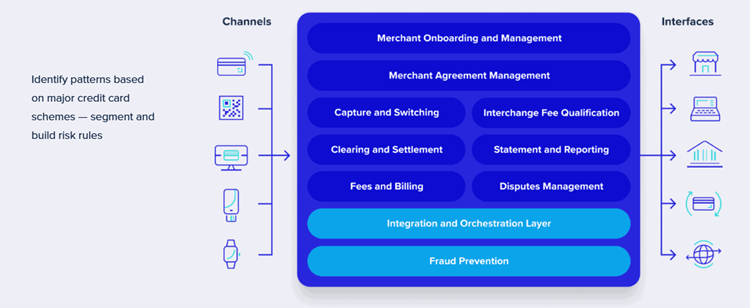

Merchant acquirers serve a diverse array of merchants, ranging from micro-merchants to enterprise retailers across both low-risk and high-risk categories, which increases the requirements for technologies that supplement their payments infrastructure and ensure their merchants achieve the full potential of payments.

Figure 1.0: ACI fraud monitoring capabilities

The mission is clear: secure every payment interaction, on every channel, every time.

AI as a revenue generator

Modern AI isn’t just a risk mitigation tool; it is a growth driver. By embedding AI fraud prevention as a value-added service, acquirers can build merchant trust, enhance customer experiences, and reduce reputation risk, leading to market share gains. New payment types launch faster and with confidence, without inviting risk with AI. AI-powered compliance for 3DS/SCA minimizes friction by identifying low-risk behavior patterns, leading to higher approval rates and more satisfied customers.

Additionally, AI slashes manual rule maintenance with citizen data science tools, in certain cases cutting upkeep by 22.5%1, freeing experts to focus on high-value investigations and innovations.

The key lies in getting commercial merchants-acquiring sales teams to work closely with fraud leaders within the organization to embrace this value-added product: fraud protection.

With AI, merchant acquirers can also offer alternative payments more quickly and aggressively, capturing market share with less risk, as AI can help reduce fraud risks associated with new or unknown channels. This presents an opportunity to compete with newer fintechs and increase market competition.

STAYING AHEAD OF FRAUD USING AI

High-volume transaction periods are critical revenue windows. But they’re also prime targets for fraudsters who exploit overwhelmed systems and understaffed teams.

What to demand from your AI

Addressing these AI challenges is important, and key elements that you need to focus on are:

- Multi-channel, multi-typology, real-time fraud prevention that scales with your business

- Low-cost, high-return deployment – no more over-engineering AI projects. Simplified AI that delivers data-science quality results

- Automated merchant onboarding without risk ratings, including AML/KYC operations to speed revenue without inviting fraud

- Predictive merchant insights for retention and cross-sell, extending value beyond fraud

The competitive differentiator

AI is no longer optional—it is the standard for leaders who will own the next decade of merchant acquiring. The outcome: higher merchant satisfaction, lower fraud costs, greater efficiency, and stronger revenue resilience.

Connect with our specialists today to discover how our democratized AI workbench transforms fraud insights into a competitive advantage.

Sources:

1ACI internal data