On this page

As “Cyber Week” is rapidly approaching, retailers around the world are preparing for this critical period. Indeed, the risk of outages and cyber attacks has grown over recent years, putting strain on payment systems. Most retailers are now seeking ways to gain greater control over their payments through multi-acquiring strategies. In addition to delivering failover capabilities, this approach provides benefits such as higher approval rates and load balancing. Let’s look at what the 2025 season may have in store.

2025 holiday sale season predictions

A recent article by McKinsey & Company1 suggested that the 2025 holiday shopping season will be a tepid one. Although this analysis was based on consumer sentiment, it highlighted a disconnect between sentiment and spending. Merchants couldn’t solely rely on sentiment indicators to forecast demand. It also highlighted that consumers are starting earlier. This aligns with Rakuten’s 2024 research2, which found that shoppers began in July, with many ramping up in October, and more than half starting in November, as shown in Figure 1. This means merchants need to be ready earlier than ever.

Figure 1.0

What can merchants do to prepare for the 2025 golden quarter?

How do you get ready? Don’t worry about trends; start by assuming peak demand, based on a percentage increase from last year, paired with devious fraudsters utilizing artificial intelligence (AI). This means you should focus on the 3 Ss: stability, scalability, and security, especially for the most critical step in the checkout process, the payment.

Achieving payments system stability during peak sales season

Ensure your systems are reliable and have high availability processes in place to address any issues that may arise. If you have a multiple-acquiring strategy, you can also set a failover acquirer should your leading acquirer fail or even deny the transaction.

If not, it is still not too late to set up a second source, a backup processor, or an acquirer to improve your resilience.

How important is resilience to merchants? In a recent ACI-sponsored multi-acquiring survey3, “increasing resilience” was listed by 40% of tier-one merchants as one of the top three benefits of their multi-acquiring strategy.

Can your current payment systems scale to meet higher transaction volumes?

As transaction volumes increase each year during the holiday sales season, you need to be confident that your payment systems will perform virtually uninterrupted and without processing impacts.

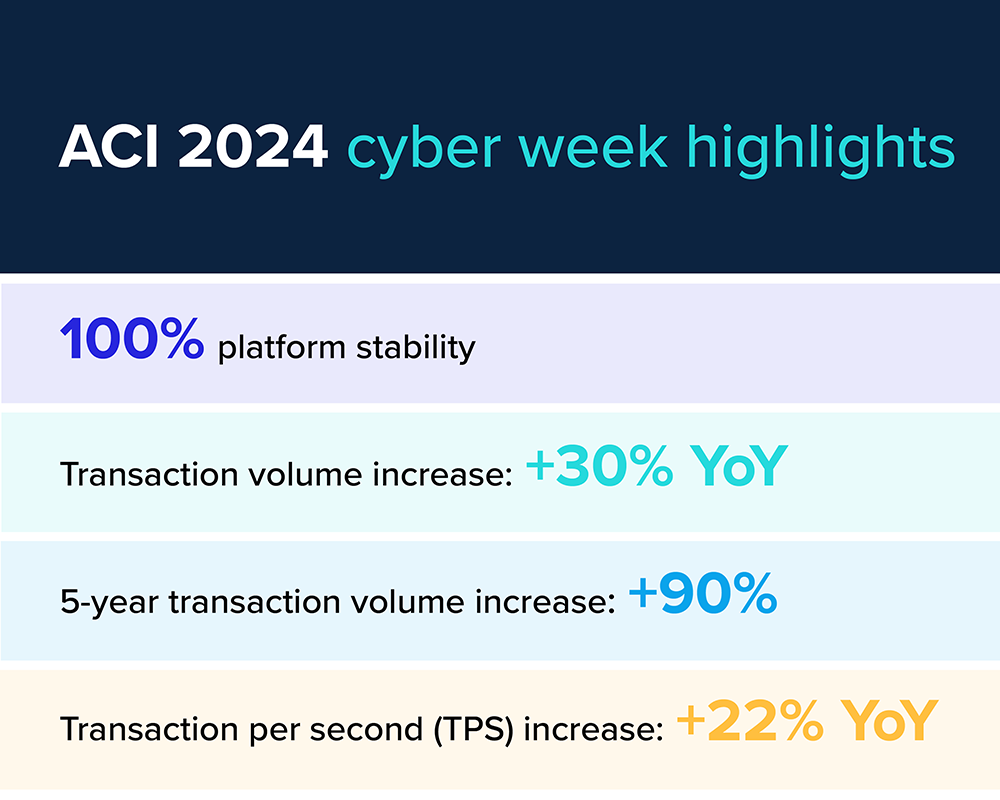

Utilizing a web-based platform hosted by a reliable provider provides payment systems with the flexibility to scale operations up or down, which is crucial in meeting today’s demands, as shown in Figure 2.0.

Figure 2.0

What types of security do you need during the 2025 golden quarter?

Security has two components: one is PCI compliance and protecting sensitive information, and the other is protection against malicious attacks (such as denial-of-service attacks) and fraudsters who continually modify their tactics and utilize AI.

Ensuring no sensitive customer information is stored in the merchant’s environment is key to PCI compliance and mitigating risk. However, not having the information hinders deeper analysis that could lead to improvements and revelations. Having a payments processor that utilizes tokenization enables the secure flow of information to all payment-related systems, such as delivery, customer service, and loyalty.

Fraudsters are attempting to increase their volume, assuming merchants will loosen their acceptance thresholds, to capitalize on converting every sale. Their use of AI has also been a significant factor in recent years. Merchants need to have a fraud management strategy that doesn’t favor increasing acceptance rates at the cost of increased fraud and costly chargebacks. Fraud protection is a key area for the use of AI, and every solution provider has implemented AI to varying degrees. Another key here is to utilize signals to ensure that you are not denying legitimate sales due to a single change or an error. According to Adobe’s holiday shopping report4, mobile devices now account for 54.5% online sales, so there will be some mistyping. The use of as many indicators as possible would allow for slight variations and location information to be downplayed when identifying potential fraud.

In the same ACI survey3 mentioned above, we asked about the current role AI plays in their payment processing and where it has had the most impact. The #1 use case was “enhancing fraud detection and risk management,” with 65% reporting it as one of the top three roles of AI. When asked about the use of AI that had the most impact, it was #2 with 47% listing “enhancing fraud detection and risk management” as one of the top three areas for AI’s impact on processing transactions.

STAYING AHEAD OF FRAUD USING AI

High-volume transaction periods are critical revenue windows. But they’re also prime targets for fraudsters who exploit overwhelmed systems and understaffed teams.

Summary

There are numerous factors to consider when ensuring you are ready for peak seasons, but the 3Ss—stability, scalability, and security—are the foundation for success. Failing to address them could lead to costly losses.

ACI Payments Orchestration Platform is built to handle the 3Ss, including consistent year-over-year increases in transaction volumes. In fact, the 2024 holiday season saw our most significant growth. Our platform’s reliability, scalability, and our teams’ readiness allow our customers to focus on their core business.

Consistently, a payments orchestration platform paired with a multi-acquirer strategy allows merchants to go beyond the 3Ss and deliver greater profit through increased acceptance and savings. Understand how and how much, then compare your results to your peers by exploring the 2025 ACI and Payments Dive Multi-Acquiring survey.

Sources

1 McKinsey & Company insights

2 Rakuten’s 2024 research

3 2025 ACI and Payments Dive Multi-Acquiring survey

4 Adobe’s holiday shopping report

The New Payments Era

Embracing change at full speed and future–proofing payments for tomorrow’s needs

✔ Urgent case for modernization

✔ Strategies to combat fraud

✔ Faster, cheaper, more inclusive cross-border payments

✔Navigating complex regulations