U.S. REAL-TIME GUIDE

Real-Time Payments for the United States

Expert overview to accelerate your transformation

On This Page

What are real-time payments for the U.S.?

In short, real-time payments deliver 24x7x365 access, instant funds availability and irrevocable payments.

Already a way to send money in over 50 countries around the world, the U.S. started its adoption of real-time account-to-account payments over the past few years with Zelle and The Clearing House (TCH) Real-Time Payments (RTP). Real-time payments enable American financial institutions to support their customers’ needs for sending money instantly, and them instantly being able to use that money for something else. Real-time payments are increasing innovation in the payments market and generating new revenue opportunities for financial institutions.

Do ACI Worldwide’s solutions support real-time payments for the U.S.?

ACI has already supported financial institutions with their processing of real-time payments. The Real-Time Payments solution provides connectivity and payment processing for global real-time payment schemes, and the primary U.S. ones, including Zelle and TCH RTP, and in the future, FedNow. Additionally, Domestic RTGS and Cross-Border supports Real-Time Gross Settlement (RTGS) payments, Fedwire, SWIFT messaging, ACH, and domestic and regional real-time payments.

How is ACI working to drive the adoption of real-time payments in the U.S.?

ACI Worldwide is a member of the U.S. Faster Payments council, contributing global experience in advancing the adoption of real-time payments. “ACI’s commitment to the advancement of faster payments in the U.S. goes beyond our business goals,” says Craig Ramsey, head of real-time payments, Banking, ACI Worldwide. “As consumer demand for speed, convenience and simplicity with payments increases, the push for real-time payments will continue to accelerate. The launch of multiple real-time payment systems in the U.S. is clear evidence of that. ACI’s goals are aligned with the Faster Payments Council’s as we look to drive the successful implementation, adoption and monetization of real-time payments in the U.S.”

What is TCH RTP?

The RTP network from The Clearing House is a real-time payments platform that allows financial institutions and processors to clear and settle payments in real time. TCH is working with providers of core processing and payment services, bankers’ banks and corporate credit unions to ensure that every financial institution in the U.S. has a way to access the RTP network. TCH RTP works to deliver efficient real-time payments for bill payment, cash management, P2P transactions and more.

Is Zelle RTP?

Zelle offers real-time payment services to customers. The experience for the end user feels like real-time. Previously, the clearing and settlement of these transactions has not operated on real-time payment rails, but Early Warning Services (the owner and operator of the Zelle network) and TCH (the operator of the RTP network) have announced that financial institutions can now settle Zelle transactions over the RTP network.

Zelle is a closed network that allows transferred funds to be made available immediately to the end recipient, without interbank real-time settlement. Zelle payments can be integrated into a real-time payments hub with ACI Enterprise Payments Platform, allowing for use cases such as real-time disbursements, batch-to-RTP and more.

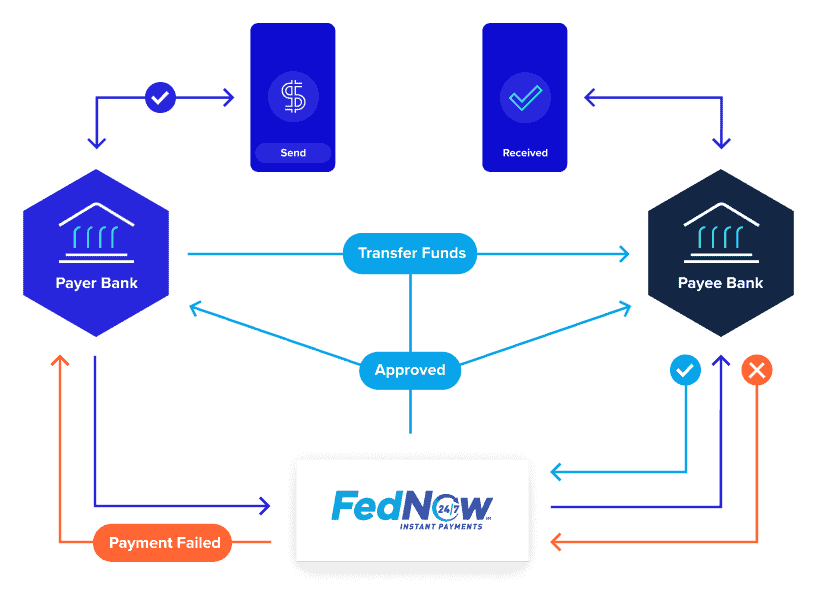

What is FedNow?

FedNow is the U.S. real-time payments platform being developed by the Federal Reserve Banks. This new interbank 24x7x365 RTGS service will feature integrated clearing functionality and is intended to enable financial institutions to deliver end-to-end faster payment services to their customers. FedNow will launch fully in 2023, with pilot program activities starting in 2021.

ACI is collaborating with the industry to bring the FedNow service to full production by participating in the FedNow pilot program to develop an enhanced gateway to support connectivity to the system and value-added services, such as Request for Payment.

Why is Fed developing FedNow?

With real-time payments already up and running, the Federal Reserve Bank’s announcement of its plans to launch another real-time payments system (FedNow) in the U.S. has generated positive reactions in the industry, with general consensus that this is a positive driver for faster adoption of real-time payments in the market.

Certainly, the addition of a Fed-based real-time payments system will present opportunities and challenges. Financial institutions will be able to leverage their master account for settlement of all payments. Liquidity services will be provided and broad customer experience and industry engagement will be incorporated into the new services launched with FedNow.

Who owns real-time payment schemes?

Different real-time schemes are owned or operated in different ways. RTP in the U.S. is owned and operated by The Clearing House and open to all interested participants. TCH is owned by 26 of the world’s largest commercial banks. Zelle is owned by the Early Warning Services network, which is owned by seven of the U.S.’ largest banks. FedNow is owned by The Federal Reserve Banks.

How many countries currently have active real-time payment schemes?

There are now more than 50 real-time payment schemes and systems live around the world, up from 40 in 2018. This includes both domestic and regional networks.

International payments are also moving towards real-time with the evolution to SWIFT gpi and Universal Confirmations.

Which U.S. banks offer real-time payments?

Several U.S. banks already offer services that use real-time payments. ACI is currently working with multiple financial institutions, including Bank of Montreal and Jack Henry & Associates (JHA) to enable their real-time payment services.

Where does ACI support real-time payments?

ACI currently supports 18 real-time domestic schemes around the world, including Zelle and TCH in the U.S., and will support FedNow during pilot and into full production.

Approximately 50 percent of the U.K.’s Faster Payments (UKFP) and 75 percent of Hungary’s GIRO transactions are processed through ACI Enterprise Payments Platform. The solution is also the core processing infrastructure for Malaysia’s Real-time Retail Payments Platform (RPP) and STET’s real-time payments platform for PSPs in Europe. Additionally, ACI has customers using ACI Enterprise Payments Platform to access Singapore FAST and the Australian NPP (New Payments Platform).

ACI also serves on the U.S. Faster Payments Council, ISO 20022 Real-Time Payments Group and the EPC Instant Payments Technology Group.

Can real-time payments be done in the cloud?

ACI’s real-time payment solutions are available through a licensed or SaaS model — or a hybrid approach — based on each customers’ needs. In a licensed approach, customers can manage our software on their premises, in their private cloud or in the public cloud. Customers can also choose ACI’s SaaS model, where we manage their solution in either our data centers or the public cloud.

Cloud solutions have now reached the levels of availability and reliability necessary to support real-time payment service levels. In fact, cloud solutions are a great option for U.S. banks looking to enable real-time payments now and ensure the flexibility to grow with increasing transaction volumes as adoption rises.

Discover how ACI’s payments hub, real-time payments and domestic RTGS and cross-border capabilities can help you go live with real-time payments in the U.S.

Get Ready for FedNow Service Instant Payments

Jumpstart your real-time payments revolution by getting access to the connections you need to seamlessly integrate into the FedNow Service network