Deliver end-to-end

instant payments with the FedNow service

Get started quickly and grow revenues through custom and pre-built integrated solutions that work within your existing payment systems. Gain access to experts who have worked closely and collaboratively with the Federal Reserve FedNow team throughout every step of development, enabling you to connect payees with payers in real time.

Experience you can trust

Get started early

As we move closer to the FedNow instant payments launch date in July, it’s important that financial institutions begin their onboarding journey as soon as possible. ACI is here to help and guide you.

One scalable connection

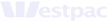

Connect to our SaaS-managed service platform ISO 20022/API interface and gain access to the U.S. low-value payments market. Your credit transfer will look the same to you — regardless of network.

Full FedNow service support

Receive support for all FedNow participation types and all FedNow messages. Whether taking a phased approach to send/receive or launching at scale, our team of experts is here to meet your needs.

FAQs

What is the FedNow Service?

The FedNow Service is an instant payments service being developed by the United States Federal Reserve Bank (Fed). The FedNow Service is designed to offer uninterrupted 24/7/365 processing and will feature integrated clearing functionality, enabling financial institutions to deliver end-to-end instant payment services to their customers.

Will FedNow replace the ACH Network?

Rather than replace ACH or Same Day ACH, the FedNow Service is expected to provide greater redundancy for payment operations, thereby preventing any potential payment network bottlenecks. In the longer term, the Fed intends to establish payments interoperability between the FedNow Service and ACH.

How is FedNow being rolled out?

Starting this July, the FedNow Service will roll out in stages; the initial launch will include core clearing and settlement functionality, Request for Pay capability and tools to support reconciliation.

How will financial institutions benefit from FedNow?

The FedNow Service is expected to: Make instant payments technology accessible to a wider audience, including smaller community banks, thereby increasing equitable access for all businesses and individuals; Reduce overall payment processing costs for banks and other non-bank financial institutions; Provide individuals with instant access to paychecks and other electronic fund transfers for improved cash flow management; Optimize liquidity management and cash flow forecasting for businesses, enabling them to better manage operational expenses and maintain positive vendor relationships; Conform to the new ISO 20022 standard, enabling participants to send and receive rich data, including non-value message types and Request for Payment messages; Promote instant payments security through the development of industry-wide standards for disputing fraudulent transfers, ISO 20022 conformity and the use of payments authentication

How will ACI support FedNow?

In preparation for its target release date, the Fed has asked more than 110 organizations — including ACI Worldwide — to participate in its FedNow Pilot Program. As a program participant, ACI has helped shape the FedNow Service’s features and functions, provided input into the overall user experience and ensured readiness for testing, all of which help define the FedNow Service and adoption roadmap, industry readiness approaches and overall instant payments strategy. As a result, ACI has a team of FedNow experts and FedNow-ready solutions to provide support for all FedNow participation types and messages.