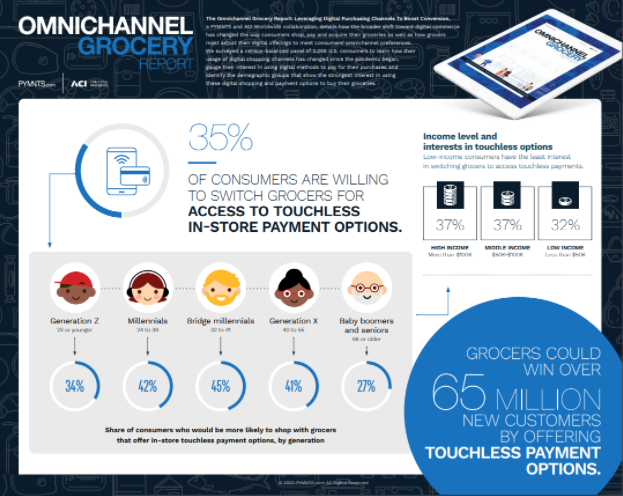

Consumers have increasingly turned to online shopping over the past year, including for groceries and essentials, accelerating the pace of digital adoption as consumer behavior rapidly evolves. For Millennials and Gen Z, this wasn’t much of an adjustment. For older generations, this represented a marked shift from pre-pandemic behaviors.

The Omni-Channel Grocery Report demonstrates a clear split between digital shoppers and those who are more wary of new payment methods and channels. That said, the report shows that wary does not mean completely against, and grocers must find ways to drive adoption of contactless payment technologies – such as digital wallets, QR codes, cards on file and credit payments – for demographics that may be slower to change their payments behavior. These digital payment methods offer interesting pathways towards incentive and loyalty packages, amongst other benefits for merchants.

Tapping the untapped potential

64 percent of consumers are purchasing at least some of their groceries online, while one in five consumers is doing their grocery shopping exclusively online since the start of the COVID-19 pandemic. This shift from in-store to online for grocery shopping showcases the snowballing desire for consumers to have simpler, more convenient ways to shop.

But while nearly two-thirds (63.9%) of grocery shoppers do use digital channels to pay, this means that 1 in 3 (36.1%) do not. These digital holdouts still prefer conventional payment methods — but many claim they are interested in trying digital payment options. What’s holding them back? According to the data, most either cannot understand the functionality of digital payments, or don’t trust them as reliable payment methods.

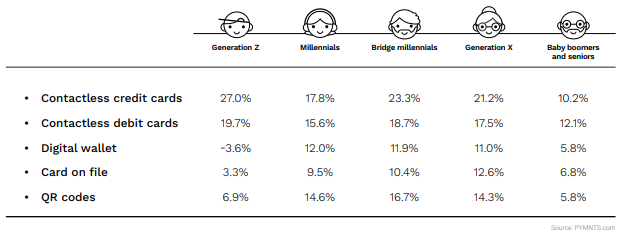

Table

How demand for select payment methods compare to their usage: Share of consumers who are either “very” or “extremely” interested in using or currently using select payment methods, by generation.

As seen in this table, there is demand across the board for new digital payment types, which means untapped potential for grocers. However, to cash in, grocers must fine tune and optimize their digital payments strategies to attract these holdouts.

Understanding the demographics

The digital holdouts — including some Bridge Millennials, Gen X and Baby Boomers — are often loyal customers to grocery retailers. Grocers trying to drive digital adoption without turning off these loyal consumers must first understand and address the reasons holdouts are slow to change. A comprehensive understanding of consumer behavior is required, such as understanding the influence of products, prices, deals, shopping times, etc. This thorough understanding will help grocers to provide a customized experience that will aid in shifting behaviors toward digital for good.

Streamlining the omni-channel experience

Convenience is the magic potion that encourages consumers to change more quickly. This is particularly important for getting digital holdouts onboard. Even a slight, random change or discomfort in using alternative channels can be very off-putting. Some Boomers indicated that engaging with technology is a chore.

Getting this right is crucial. Being able to provide a simple, secure and more satisfying omni-channel shopping experience for all generations will create a major differentiator for grocers.

Promotion of digital payment methods

The first step in advancing towards a completely digital payments system is creating trust from the customer to the technology. A lack of understanding of the “how” and “why” leads to slow adoption of any method. Educating digital holdouts and highlighting the benefits of digital payments will be an effective way to guide the customers to using them.

Grocers should take advantage of in-store staff and signage, customer service executives, marketing campaigns and other customer touchpoints to communicate what is available and why it will ultimately deliver a better shopping experience.

Digital payment methods also offer interesting pathways towards incentive and loyalty packages. Attractive offers such as points per usage and digital coupons will ease new shoppers into the benefits of digital payments, giving them more reasons to shift.

Put payment analytics into action

To gain greater contextual awareness of shoppers and their payment behaviors, grocers must capitalize on the data across channels to dynamically optimize the payments experience. Through integrated omni-channel payment analytics, grocers can maximize the value of every transaction — and make the digital payments journey truly personalized and incredibly simple.

The research is clear — consumers are willing to switch to digital payment methods. While consumer behavior tends to naturally evolve, speeding up this evolution is possible by communicating the right offers and benefits, and then ensuring consumers are met with the simple, convenient and secure payments process they were promised.

Read the full Omni-Channel Grocery Report for detailed insights on how to accelerate digital payments adoption.