Merchants need all the help they can get to optimize their income, liquidity and reach. Rising inflation, the cost-of-living crisis, and supply and cashflow issues are slowing down retail growth and shrinking margins, and as competition intensifies, they have to work even harder and invest more to win each sale. They need new solutions that help them differentiate, maximize profit potential and act as a catalyst for economic growth.

At the same time, the cost of payments continues to increase for merchants. The interchange fee for card payments in the U.S. varies approximately between 2 percent and 4 percent – and it becomes even costlier when fraud and chargebacks come into the equation. According to a recent Merchant Fraud Journals report, retailers can expect to pay more than 100 billion USD in chargebacks in 2023; meanwhile, the compounded annual growth rate of fraud is 1.5 percent.

Real-time payments (RTP) could be the salvation

At ACI, we believe RTP will help tackle many of the biggest challenges facing retailers today, including the mounting costs of doing business at home and abroad, as well as the growing revenue risk from chargebacks and friendly fraud.

RTP can bring widescale benefits to the entire retail business, from providing purchasing with faster access to capital to giving marketing the opportunity to offset discounts and attract new customers. RTP is also a way to optimize business sustainability, fast-track expansion and cut out much of the complexity of accepting payments internationally.

The real-time modernization of national payments infrastructures has already demonstrated global success, creating a win-win situation for businesses, financial institutions and governments. RTP is expected to see 64.5 percent YoY growth from 2021-2026 and is forecasted to help generate an additional 173 billion USD GDP by 2026.

It’s easy and safe for customers, too

Customers looking for alternative payments that match their lifestyles will be the first to embrace RTP. New solutions are bringing one-touch retail RTP payments in-store and online, allowing them to pay instantly via a QR code, virtual ID or phone number. This paves the way for more inclusive payments, especially for credit-cautious and card-shy Gen Z and Millennials who may want to manage their budgets in real-time. According to Pew Research, only half (55 percent) of Gen Zers have credit cards, compared to 85 percent of Baby Boomers.

And there’s no compromise on security; RTP complies with PCI DSS, PSD2 SCA and 3DS and is subject to KYC, AML and other fraud checks, so there’s no extra risk for merchants or their customers.

So, what’s in it for merchants?

In these hard times, merchants are becoming increasingly frustrated by payments complexity and rising costs. It’s costing too much and taking too long to access funds – and in some cases, it’s impacting their growth.

RTP smashes these pain points and delivers major advantages to those retailers ready to innovate. Here are our top seven benefits:

Seven reasons why RTP works for merchants

- Instant access to capital

Unlike card transactions, RTP payments are cleared instantly, which means that merchants don’t have to wait to put funds to work. Being able to access money faster means merchants can run their businesses in real-time and dramatically improve the return-on-investment capital. They can stock up sooner, ship faster, negotiate better discounts with suppliers and manage cashflow more efficiently. - Lower cost, higher revenue

RTP does not involve a card intermediary, so there is no interchange fee for the merchant. With fees currently between 2 percent and 4 percent of each credit card sale in the U.S., this is a significant savings and a welcome uplift, especially for large retailers, where every percent represents a sizeable sum. The more they encourage consumers to use RTP, the more their business will benefit. - Wider inclusivity

Not every consumer has a credit card, through choice or circumstances, especially Gen Z, who are denied access to credit cards because of age or credit score restrictions. With RTP, consumers can pay directly from their bank or prepaid account at no additional cost. In addition to opening a new doorway into merchants’ digital stores, RTP can also be used in store through QR codes to deliver a seamless experience for omnichannel customers. A great example is India, where even the smallest roadside merchants now accept RTP via QR codes. Going real-time has saved Indian businesses and consumers 12.6 billion USD and helped unlock 16.4 billion USD of economic output (0.56 percent of the country’s GDP) - Tackles card fraud declines and chargebacks

RTP is a cardless transaction, so there’s no associated card fraud, and with no issuer involved, there are also far fewer declines and minimal risk of chargebacks. Merchants currently view chargebacks as they would a tax or a churn rate, writing off disputes and filing them under cost of goods sold. Now estimated to be a 125 billion USD problem, it’s costing them dearly – for every 100 USD lost as a chargeback, the price tag for merchants is 240 USD. - International expansion

Looking further ahead, RTP has the potential to simplify and reduce the cost and processing delays often associated with cross-border sales. No interchange fees and easy fiat-to-fiat conversion can help remove viability barriers to expansion in certain countries. ACI is already working on solutions for RTP cross-border payments and hybrid/RTP blockchain payments that could create completely seamless, no-cost international payment rails within the next year or so. - Loyalty and sales incentives

Consumers trying to cope with the rising costs of living are seeking bigger rewards and incentives. With RTP, merchants can use interchange fee savings (up to 4 percent) to fund new loyalty and discount programs that give all or part of this cost-savings back to the user. The more they use RTP, the more retailers and customers can save, making it a win-win situation. Even in the EU, where interchange savings are lower (0.3-0.4 percent), there is still scope to offset discounts or to use the other benefits of RTP to deliver instant rewards that differentiate and boost loyalty. - B2B payments and savings

Once merchants are RTP-enabled, they can use the same platform to facilitate RTP B2B payments to their suppliers and vendors, which helps reduce reconciliation cost. By paying their suppliers faster, they can negotiate better rates, operate just-in-time supply lines and benefit from supplier discounts and cashback.

As we head into 2023, the big question for merchants is not “why RTP?” but “why not?”

Up until now, much of the industry focus for RTP has been building out the banking infrastructure to support it. Now that it is in place, the next stage is to empower merchants.

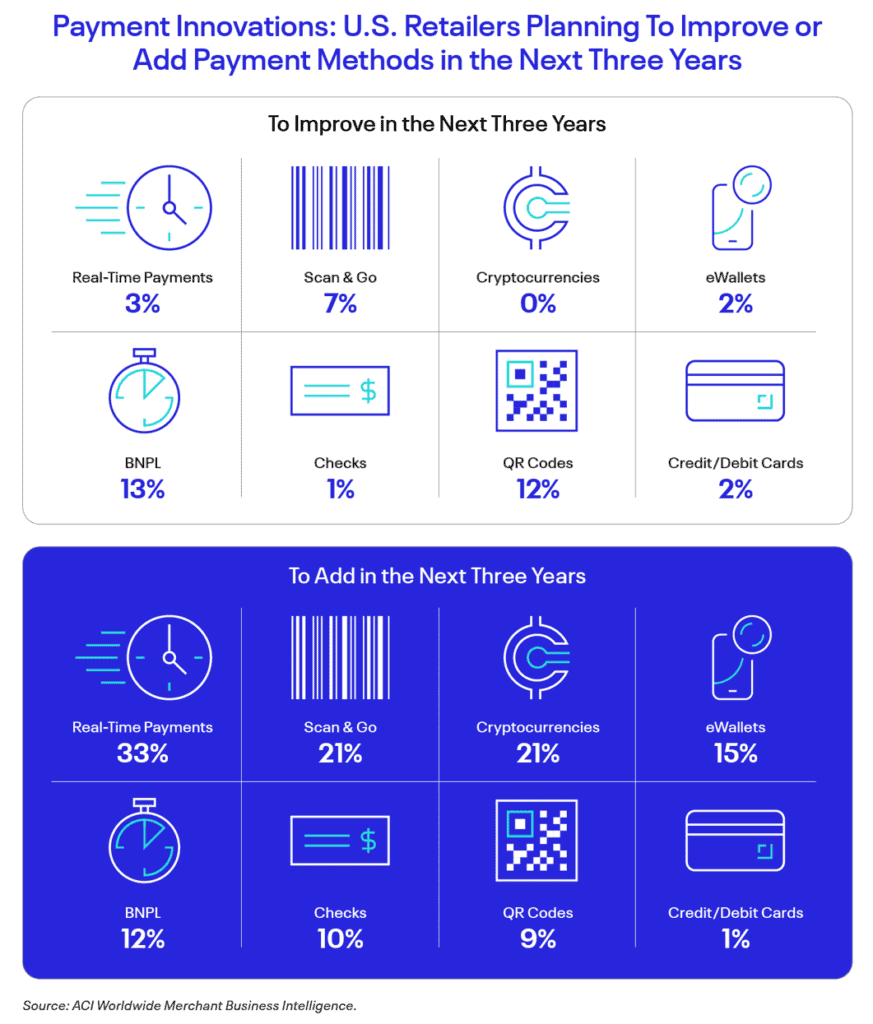

Our research shows that RTP is now on U.S. merchants’ improvement radar, ahead of eWallets, cryptocurrencies and card payments. In addition, a third (33 percent) of U.S. retailers are planning to add RTP in the next three years (see infographic below).

At ACI, we have been focusing on solutions that will make it easy for merchants to add RTP rails to their checkouts, irrespective of the shopping channels. With simple API integrations and without any additional infrastructure, we can fast-track implementation and have merchants RTP-enabled and up and running in no time.

There’s no doubt that the real-time retail revolution is here

It’s up to retailers to start embracing RTP innovation now – to take the lead and shape their own real-time destiny.

When merchants make a sale, it’s their money – why should they wait or pay to access it? With RTP, merchants can get the returns they deserve instantly, helping them stay ahead of the curve and steal a lead on new markets in the digital age.

Check out ACI Instant Pay – the real-time payments solution for merchants – and contact our payment experts today!