We launched a new global survey tool in Australia at the Total Retail & Payments Expo held in Melbourne on May 11th & 12th. As ACI attends different events across the world we will continue to survey participants and will be reporting back on the results. We got off to a great start with some headline grabbing feedback from down under.

64% of those who we interviewed said that they faced disruption by new technologies and new entrants. The respondents who offer services across the entire payments value chain are starting to feel the pressure from the likes of AliPay, PayPal and in-app purchases. These types of entrants are active in the region and are starting to take market share, strain existing business models and alter how companies go to market.

To battle back against these disruptive forces, incumbents see Open APIs and New Payment Types as trends they can harness to provide them growth opportunities in the next 12 months. From a regulatory perspective Asia is behind Europe and in particular the UK. In our conversations all banks were the strongest voice in the benefits of improving services to their customers.

The conference host country, Australia, has seen banks working independently on API standards. With the release of the Australia New Payments Plan in December there was a recommendation for cross-industry collaboration. This did not explicitly advocate the use of APIs, but it should. As a believer in standardization, it will make it easier in Australia for banks and payment players to work together for the benefit of the customer if they chose to connect via open API’s.

As noted in many different forums, e-Commerce is going through explosive growth. eCommerce payment volume is expected to grow ~19% annually across the globe in the next five years. Interestingly, “alternative” payments are expected to surpass traditional card based payments in 2017. 25% of those surveyed said they would be introducing new payment types this year. This sentiment echoes what we found in a consumer study we conducted with IDC last year.

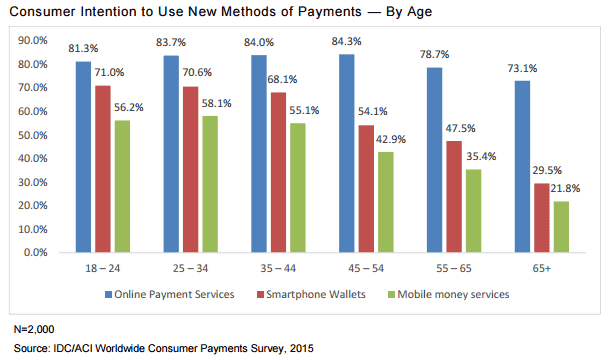

Based on a survey of 2,000 consumers and 10 financial services institutions across 9 countries in Asia Pacific we found that 82% of the consumers had used new digital payments.

The payment players we spoke to at Total Retail Expo understood this shift in consumer preferences and are working hard to provide new payment alternatives. 1/3 of them also identified eCommerce fraud and the theft of consumer payment details as their biggest security concern. So we are in a position of consumers demanding new payments types, eCommerce growing at double-digit rates, and new entrants offering digital payment alternatives – with the threat of fraud lurking over it all!

New digital methods of payments are set to fuel the growth of eCommerce in Asia Pacific, especially for lower value transactions. To react to this burgeoning threat, incumbents and particularly banks have to expose their data through Open APIs. A cycle can be described as a “complex chain of events which reinforce themselves through a feedback loop”. Whether it is a virtuous or vicious cycle will be decided by how the current incumbents work with the new entrants.

Our customers and survey respondents tell us that the world of payments is in fact changing rapidly in Asia Pacific and Australia, and we expect to see similar sentiments and growing signs of a global disruption within the payments ecosystem as we continue to collect input around the globe. We’ll keep an eye on the data and let you know what we find.