ACI and Auriga SpA

Auriga SpA provides the WWS solution that integrates with ACI's Enterprise Payments Platform to provide a market leading next generation (NextGen) ATM and Self Service Banking omni-channel solution.

ACI and Auriga have joined forces to bring NextGen ATM technology and self-service infrastructure to banks by integrating Auriga WWS with ACI’s ATM acquiring solution. The solution is an enabler for banks to pursue greater automation and modernization. Through a strategic alliance, the combined Auriga and ACI solution gives clients a path to transform their branch environments by introducing more self-service capabilities, such as video-assisted terminals, as well as providing greater ATM functions, such as QR-codes, mobile apps and more.

To compete more effectively with digitally native fintech technologies and respond to reducing footfall, banks need to embark upon a modernization journey to smarten their branches and make their ATMs more versatile. Integrating technologies that augment the banking experience to satisfy customers and strengthen loyalty is a key banking strategy.

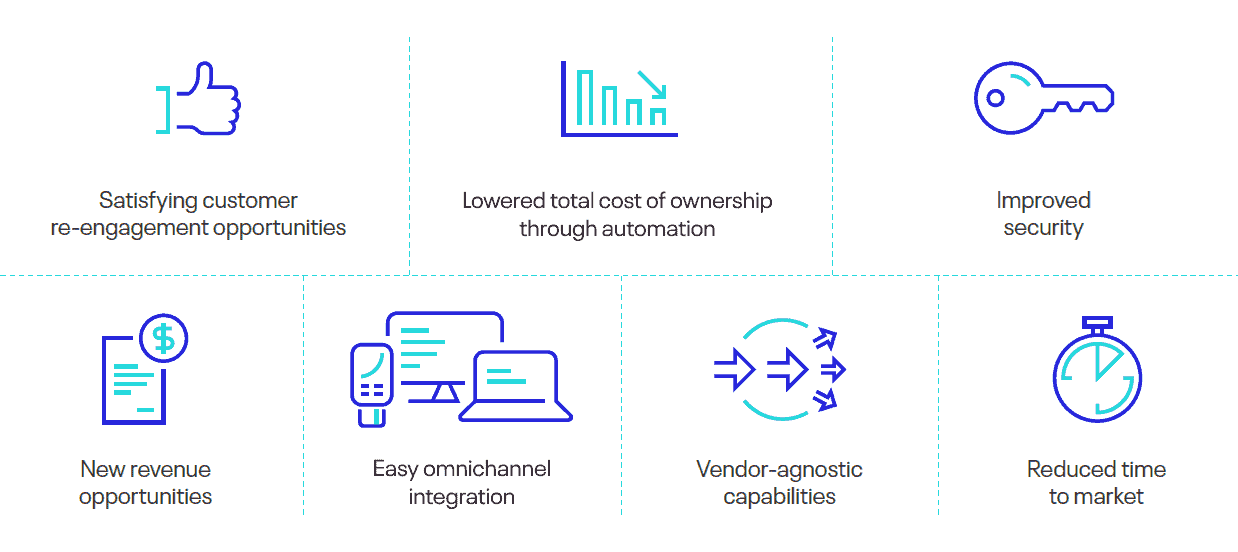

Clients deploying the ATM and self-service infrastructure solution benefit from:

- Cost Optimization – A truly vendor-agnostic, highly secure, end-to-end ATM software solution designed to lower the cost of ownership and reduce complexity

- Customer Satisfaction – Modernize the ATM to introduce new customer-facing features faster for an omnichannel experience (web, mobile, app)

- Availability – Avoid technical constraints and downtime. Future-proof the ATM to let it evolve over time and securely release new services and experiences more efficiently

- Revenue Opportunity – Increase customer interaction by offering personalized advertising

The Italian leader in omnichannel banking software

For over 30 years, Auriga has been creating innovative software and has become a benchmark for high-quality banking software. As the leading developers of integrated proprietary solutions with an international scope, Auriga has helped define standards for the new omnichannel banking model.

Their web-based architecture guarantees optimal synergy between self- service banking, branch banking, internet banking, and mobile banking for a seamless world-class banking experience.

Website

Partner Type

ACI Solution

Region

Asia Pacific

Europe

North America

Related Segment

Our Products