It’s a constant struggle – as consumer behavior evolves, so do fraud tactics, as fraudsters seek vulnerabilities exposed by rapid change.

And there’s no disputing that the pandemic has changed consumer behavior and accelerated the adoption of digital payment methods. During the first six months of 2020, consumers spent 30 percent more on online purchases in U.S. retail stores than over the same period in 2019. Online commerce nearly doubled in the second half of 2020, according to Amazon.

In turn, we’ve also seen a rise in fraud related to payments. Juniper Research found that the value of losses due to eCommerce fraud will rise 18 percent to over $20 billion by the end of 2021, up from $17.5 billion in 2020.

However, with consumers having more choice than ever, identifying good customers and providing them with a seamless experience is just as important as preventing fraud. In fact, Aite Group estimates that false positives – the inadvertent cancelling of good transactions – will grow to US$443 billion this year. This is unnecessary, and ultimately affects profitability (the bottom line), as well as customer loyalty.

These growing fraud statistics are leading merchants to ask prescient questions;

So, how can a merchant know if their fraud solutions are as comprehensive as possible?

Let’s look at the data

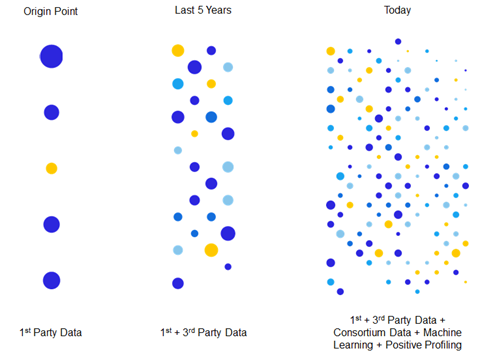

A logical place to start is the data available and the evolution of its use from a fraud perspective.

Historically, the industry has often used a limited set of data points in fraud detection. But over the last five years, by combining first- and third-party data, merchants have been able to significantly expand the number of data points available to them as part of the decisioning process. Merchants are increasingly leveraging the power of consortium data, machine learning and positive profiling. The exponential growth of data points generated in our 24/7/365 world creates new opportunities for the automated validation and verification of genuine customers and prevention of fraud. Data now spans the multi-layered approach to fraud management, giving merchants the power of validating across solutions, data types and action points.

The multilayered approach taken by ACI has been shown in the past to yield a 20 percent improvement in acceptance rates, compared to the industry average.* Real-time, automated opportunities to validate critical information – such as identity – have evolved.

Real-time identity verification solutions can be seamlessly added to existing fraud management platforms to improve accuracy, without disrupting the customer experience. Additional data sources such as name, phone number (and type), physical address, email address and IP cross-validate information in an automated and orchestrated, real-time manner. This enables higher confidence in customer verification and scoring. Taking this orchestrated approach allows merchants to target higher-risk transactions only, for example, helping to reduce costs.

What are the key benefits of this approach to merchants and their customers?

- Increased fraud identification and fewer fraud losses

- Reduced false positives resulting in higher conversion rates, profitability and loyalty

- Lower operating costs from reduced manual review

- Faster order decisioning, positively impacting the customer experience

- Cross-border transaction verification and validation with reliable international data

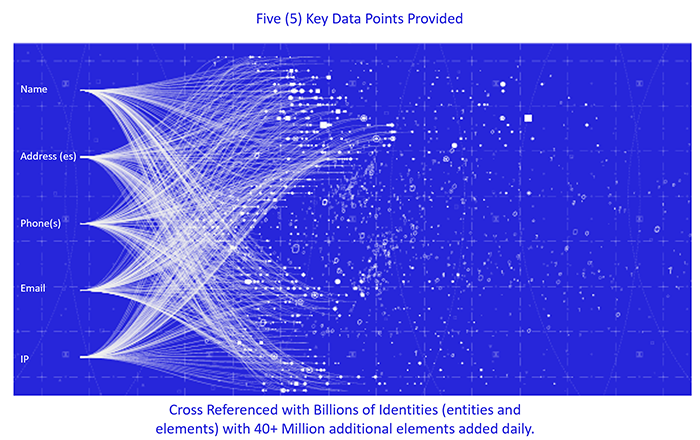

How do you know if you have enough data, and more importantly, the right data for real-time identity verification? There are five data points that sit at the heart of a good identity engine. These are rigorously assessed globally, against hundreds of additional data sources as well as almost 50 million data elements that are added daily:

- Name

- Phone

- IP

- Address

While providing all five data points to validate against yields the greatest opportunity for validation, only three of the five (with name being most important) are required to benefit from the results. In under 100ms, the Ekata Transaction Risk API (identity verification) scores the overall risk of the identity behind a transaction and delivers a concise response for integration into your existing fraud management platform and machine learning models.

The speed and accuracy of this validated information helps merchants, marketplaces, and processors to increase approvals and manage payments fraud at scale.

Adding real-time identity verification into an existing solution suite

The data shows that by adding email verification alone, for example, merchants can achieve a 15–20 percent reduction in friction by reducing false positives and chargebacks.

With information you’re likely already gathering during the purchasing process, why not add real-time, automated, identity verification through the Transaction Risk API to your fraud-fighting arsenal?

Interested in learning more about the ACI /Ekata Transaction Risk API and the other value-added services available?

*Based on MRC industry fraud statistics