On This Page

How automated reconciliation helps lower costs and drive profit

Every merchant must reconcile transactions, but not every reconciliation tool is the same. Outdated back-end platforms can result in merchants missing out on multiple performance gains, while an automated, orchestrated approach can put their business out in front.

Like many behind-the-scenes functions, there’s a tendency to think, “if reconciliation isn’t broken, why fix it?”. Consequently, many merchants are blindly using the same outdated tools and manual-reliant processes many years after they were implemented.

Bolt-on reconciliation platforms are often slow and outdated and struggle to keep pace with businesses as they evolve, grow and expand. This can result in mistimed and inaccurate financial reporting and resource inefficiency, which erodes revenue and reduces profit.

Keeping pace with change

In today’s fast-moving B2C and B2B environments, your platforms must keep pace with accelerated change in terms of customer behavior, regulation, digitalization and new and disruptive ecosystems.

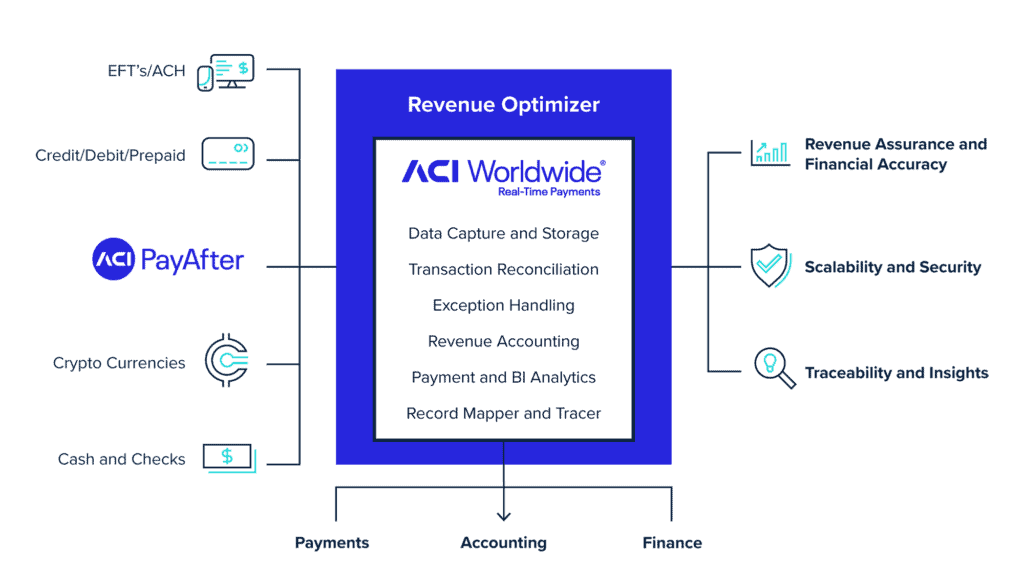

Using payment orchestration platforms that include fully integrated reconciliation management tools, such as ACI’s revenue optimizer, lets you consolidate and automate, as well as perform multiway reconciliation across all payment channels, harmonizing and orchestrating financial data, making the process more accurate, scalable, insightful and efficient.

Why automated processes help merchants win

Streamlining finance operations with automated workflows to track, manage and account for money end-to-end can significantly reduce the burden of reconciliation for merchant business. This frees up valuable team resources to focus on improving customer-facing areas of the business, including UX and conversion.

It also makes sound economic sense. Many of the advantages, such as finding lost revenue and cutting costs, translate directly to the bottom line. And, for omnichannel merchants and commercial businesses with large customer/subscriber bases, the impact on financial health can be game-changing.

5 ways optimized reconciliation boosts merchants’ financial health:

- Fixes leaky revenue

For high-volume merchants, payment incidents can result in millions of dollars of write-offs each year. Optimizing reconciliation lets you detect unmatched transactions, fix revenue leakage and mitigate payment incidents in real time to avoid costly write-offs for your business. - Improves operational efficiency

Optimizing reconciliation can help consolidate and automate your operations, prevent data silos and provide a single view for better decisions and easier auditing. ACI’s revenue optimizer has been shown to deliver a 75% reduction* in staff hours on transaction matching, data setup and exception research alone. - Reduces cost of change

Getting the checkout and channel mix right is vital for conversion and to keep merchants competitive in international markets. Updating the reconciliation process when introducing and scaling new methods can be complex and time-consuming. Using an end-to-end payments orchestration platform can dramatically cut the time involved so that you can go to market faster (e.g., 80% faster* channel implementation with ACI). - Optimizes payment rates

Improving processing speed and authorization rates can dramatically improve service levels and turn-around times, removing friction points for customers and helping to raise conversion and revenue. ACI’s revenue optimizer can process one million records in just 50 seconds* and provides real-time authorization monitoring, which works with payments orchestration to route payments and helps elevate approval rates for lower churn. - Reduces dispute costs

Including reconciliation as part of payments orchestration gives you all your finance data in one place, with in-depth filtering and reporting. Having better transactional-level order-to-cash traceability across your billing systems, financing system, payment gateways, acquirers, networks and bank accounts results in far fewer customer dispute challenges and a higher win-rate.

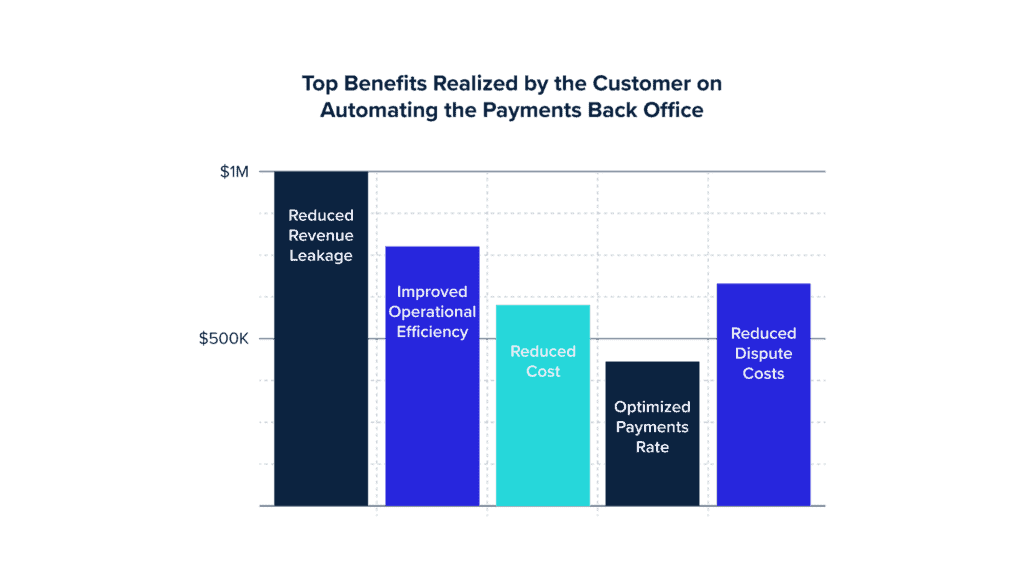

How do all these benefits impact the bottom line?

Whether you’re a small cashflow-sensitive business, a margin-tight e-tailer, large-scale omnichannel merchant or a high-volume billing company, the benefits of enhanced reconciliation through greater efficiency, fewer leaks and more accurate processes can make a positive contribution to the financial performance of your business.

Of course, the actual value of any improvement will depend on the size, nature and scale of your operations. However, to illustrate its significance, the graph below shows actual savings made by a major telecommunication business. Read the full case study here.

All-round healthier operations

By shifting reconciliation processes from ‘good-enough’ to an optimized approach, you can not only improve the financial health of your business, but, through reduced manual effort, also the health of your teams. And that’s something worth changing for.

*ACI internal data