On This Page

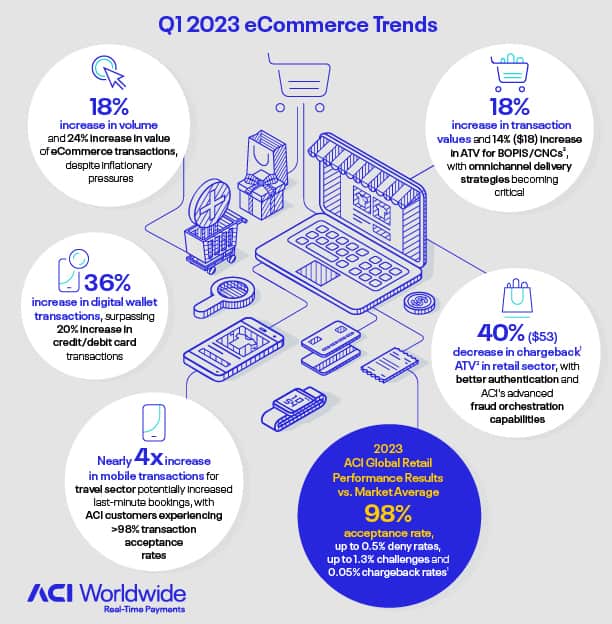

The first quarter of the year has been exciting for merchants, globally. While ACI’s recap for the 2022 holiday season indicated strong consumer optimism, despite economic headwinds, consumers remained headstrong through the first quarter of 2023. Higher consumer confidence could be seen in the 18 percent increase in transaction volumes, compounded by a 24 percent growth in transaction values.

In this blog, let’s delve into some of the key trends for the first quarter, as indicated from our internal data.

Mastering a seamless, omnichannel delivery experience

The retail industry’s response to the pandemic, commonly known as “Buy Online Pickup In-Store” or “Click and Collect,” played an important role during the first quarter. Retailers offering these delivery channels to consumers showed an 18 percent increase in transaction values, with another 14 percent, or $18, increase in their average ticket values (ATV).

This hybrid shopping experience has been well received by consumers and is anticipated to remain a favored method for delivery, as shoppers no longer need to endure long waiting times or standing in queues.

Digital wallets overtake credit and debit card growth

The quarter also saw digital wallets surpassing credit and debit card growth by a full 16 points over last year. Digital wallets have expanded their domains to let shoppers make purchases safer, often with built-in loyalty programs, experiencing a 36 percent year-over-year increase. Credit and debit cards, being an indispensable component of the payments journey, also experienced a 20 percent increase.This could potentially be owed to some of the compulsory 3D secure upgrade, which uses more than 100 data points to make genuine shoppers’ transactions frictionless and adds an extra authentication layer for only the transactions that require it.

Mobile surges within the travel sector

This quarter experienced a notable surge for mobile transactions within the travel sector, with a four-fold increase compared to last year. Mobile devices have become prevalent to a shopper’s journey to complete their transaction. Similar research by PYMNTS shows 42 percent of consumers opting for leisure travel compared to spending for other luxuries. Despite the travel sector reaching pre-pandemic levels, smart travelers also realized they could get last-minute booking deals, with their smartphones making their whole experience seamless and frictionless. So, while transactions and mobile usage were up, these deal grabs caused a significant decrease of 48 percent in ATV.

ACI beats market averages, yet again

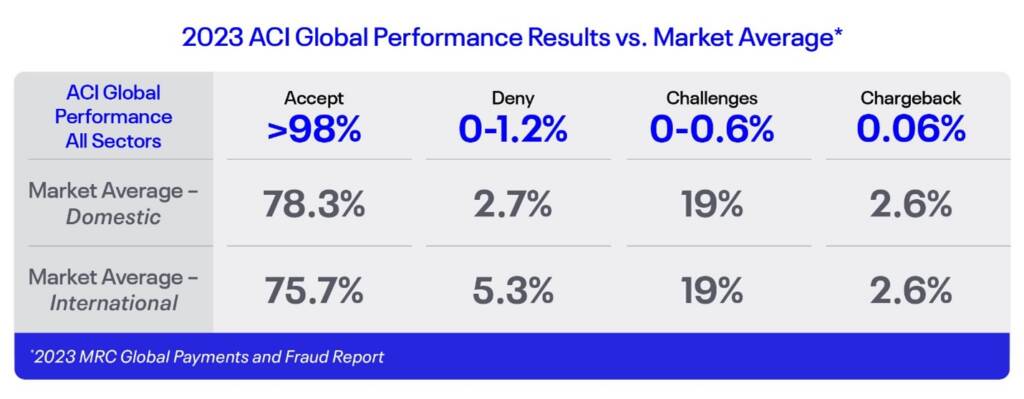

As we continue into the year with uncertainty, merchants may want to evaluate their current, present or existing fraud strategies. One must always think of their fraud prevention solution provider as a revenue generator, as ultimately, the aim is to sell more, lose less and maximize margins. Gradually, as governments and financial institutions work on creating a safer environment for consumers, this will create additional heavy lifting for merchants and businesses in adhering to these mandates. In addition, with the increasing presence of alternate payment methods, payments strategies are more complicated than ever, and this opens a door for fraudsters and fraud.

At ACI, we believe our AI-augmented fraud orchestration strategies not only help prevent fraud but also take over the heavy lifting, so merchants can concentrate on their core business strategies. Compared to global benchmarks, our results speak for themselves:

Our mantra is three-fold: sell more, lose less and maximize margins.

Sell more by recognizing, not challenging or denying, customers and offering the payment methods they prefer. Lose less by recognizing fraudsters and reducing chargebacks. Maximize margins by reducing manual efforts brought on by underperforming fraud management strategies for challenges and chargebacks.

To sum it all up, 2023 is going to be an interesting year for all merchants and businesses, globally. To ensure we are up to date with our payment and fraud strategies, we must consider payments and fraud orchestration. Deploying a multilayered fraud prevention solution empowers merchants to detect fraud, make data-driven decisions, and deliver on fraud prevention strategies and KPIs as shown in the table above.

Want to know more? Use our savings calculator to see how much you can benefit from payments and fraud orchestration.

(Stay tuned for ACI’s quarterly trends.)