A sizable proportion of payments activity in the United Arab Emirates (UAE) is cash-based, but the market continues to shift toward modern, digital payment methods. Aiming to further accelerate this trend, in 2021 the Central Bank of the UAE (CB UAE) began implementing its NPSS (National Payment Systems Strategy), designed to make payment systems universally interoperable and foster the transition to a cashless society built around real-time – also known as instant – payments. It consists of four pillars:

- Encourage a real-time culture and seamless access to any type of payment 24/7/365

- Enable competition to decrease costs and increase efficiencies

- Boost the economy by enabling instant payments

- Establish the foundation for open banking

Instant Payments Platform (IPP), as per the announcement and messaging from CB UAE, aims to provide best-in-class payment services, promote financial inclusion and increase financial stability in the UAE. The central bank has been actively promoting the modernization of the country’s payments infrastructure for several years and now wants to accelerate this process with the implementation of IPP.

The UAE’s payments strategy aims to enable safe, efficient, instant and customer-centric payments, all in a central infrastructure (instant payments platform). CB UAE has published the go-live dates for the real-time payments central scheme:

- Q4 2022: Pilot launch of phase 1 (including Credit Transfer and Request to Pay)

- Q2 2023: Phase 2 (planned other functionalities such as direct debit and overlays like eCheque clearing; this would apply to both phases 2 and 3)

- Q4 2023: Phase 3 (planned to enable more digital payment services like eCheque, eBills, etc.

Real-time payments are growing sharply globally year on year, led by India, the biggest real-time payments market with over 300 banks live on its UPI platform and more than 5.4 billion monthly transactions. According to ACI’s 2021 Prime Time for Real-Time report, Real-time Retail Payments Platform (RPP) in Malaysia is forecasted to grow at 84 percent CAGR in real-time transactions over five years, one of the top five countries in the world for projected real-time transaction growth.

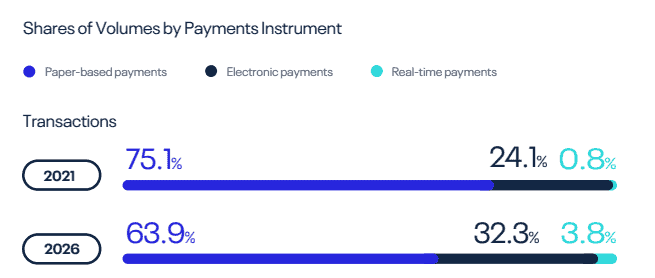

In the UAE, forecast growth is 36.5 percent CAGR over the next five years, growing to 134 million transactions annually. As a share of overall transactions, real-time payments are expected to rise from less than 1 percent to nearly 4 percent in that time, winning share from paper-based (i.e. cash) transactions.

In terms of the UAE’s neighbors in the region, Oman is starting to see the benefits of its payment infrastructure improvements, and is expected to experience 61.7 percent growth, driven by advancements in contactless and EMV payment modes, plus the government’s push for digital payments. Meanwhile, Saudi Arabia’s digital transactions scheme, which activated in 2021, is expected to contribute to the country’s economic development by enabling speed and transparency in both corporate and retail payments.

The UAE’s IPP scheme is now set to follow in the footsteps of some of the leading real-time payment markets when it comes to use cases. Real-time payments growth is expected in the UAE due to new IPP digital overlay services being clearly defined at the outset. Not only will IPP include Request to Pay (RtP) and centralized addressing services in phase 1, but plans to add new services like eDDA (Electronic Direct Debit Authorization) and e-cheque services in future phases. Being part of the IPP scheme will allow banks to leverage real-time payments to target new customer segments, offer differentiated services to end consumers and merchants, and drive revenue through new use cases. Value-added services are driving real-time payment innovation around the globe, helping banks and financial institutions (FIs) to strengthen their solution proposition and achieve competitive differentiation.

Banks and FIs should be prepared to not only support the scheme standards, but implement robust and reliable systems to ensure smooth and secure customer experience, which will play a critical role in driving real-time payments adoption and help gain customer confidence in the market. There is also a need to think beyond connectivity to the scheme; banks and FIs should go further on putting new digital capabilities into the hands of their retail banking and business customers.

ACI Worldwide is working closely with national banks to help connect to the UAE’s real-time payments scheme. ACI currently supports 17 real-time domestic schemes around the world, including Zelle and TCH in the US, and FedNow as it moves toward production. In Europe, approximately 50 percent of the UK’s Faster Payments (UKFP) and 75 percent of Hungary’s GIRO transactions are processed through ACI Enterprise Payments Platform.