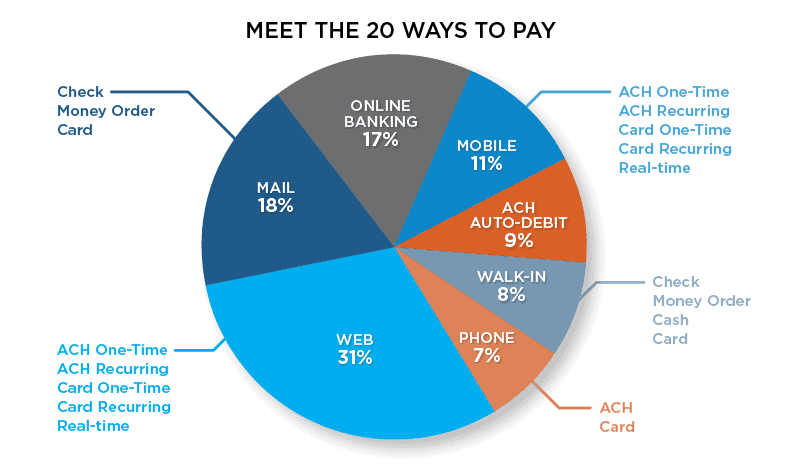

20 easy ways to pay bills – most are electronic

David: “What was once a simple transaction of writing a check has evolved into a complex interaction with an increasing number of options. Among all these options, electronic payments are the most popular, with ACH representing 46 percent, and credit/debit cards representing 30 percent. Credit and debit card payments far exceed checks in popularity for consumers.”

David notes that consumers differ among the timing of their payments, with most payments made one at a time. Only 32 percent of payments are made on a recurring basis.

“We see an opportunity for organizations to further convert more consumers to set up recurring payments. Tools like online auto pay and marketing auto pay can make a big difference,” David added.

Consumers have three different models for paying bills online today. Biller websites have grown in popularity from 62 percent in 2010 to 73 percent in 2016 at the expense of banking websites.

This growth in biller websites has been driven by younger generations looking for immediate payment posting. 78 percent of online payments made by Millennials are at biller websites, compared to 60 percent for seniors.

“When you see how consumers use a combination of channels, payment methods and timing, you see the complexity of how consumers pay today,” David advised.

Engaging electronic billing options

There has been enormous growth in consumers turning off paper bills and electing to receive bills only electronically. Organizations with a comprehensive eBill solution will benefit in terms of higher consumer engagement and lower costs.

Bill payment methods for every generation

David: “Seniors pay a larger percent of bills with check; 31 percent vs. 8 percent for Millennials. Millennials and Gen Xers pay more bills with debit cards at 22 percent and 16 percent, respectively.”

How should organizations upgrade their bill pay solution?

Based on this data, David has three recommendations for organizations:

- Meet consumer demand for a wide variety of payment options to best represent an organizations’ brand.

- Many organizations are outsourcing payment management. This allows organizations to reduce compliance and infrastructure costs.

- If you decide to outsource, APIs allow organizations to remain in total control of the user experience. Organizations are leveraging APIs to accept payments from the increasing number of places consumers want to pay you.

*Source: Aite Group’s How Americans Pay Bills Report sponsored by ACI Worldwide