Manual order review (MOR) has often been referred to as the last line of defense to securing good revenue, but how does it fit into a merchant’s business? Striking the proper balance between automated fraud prevention tool(s) to allow legitimate orders to flow through, while identifying questionable ones, is a continuously evolving proposition. Getting it wrong has potentially ruinous consequences.

Today’s digitally-connected consumers have high expectations when it comes to the purchase experience and each order interaction is an opportunity to either strengthen the customer relationship — or lose it. False declines, slow order processing or delivery delays can break trust and discourage a customer from returning. Meanwhile, customers also expect retailers to protect them from fraud.

The more sophisticated fraud becomes, the more important it can be to have a person review certain suspicious transactions, alongside your automated fraud prevention tools. Enter manual order review — which combines the expertise and power of professional analysts and real-time data trends to lower approval friction and provide protection through accuracy that benefits both merchants and their customers.

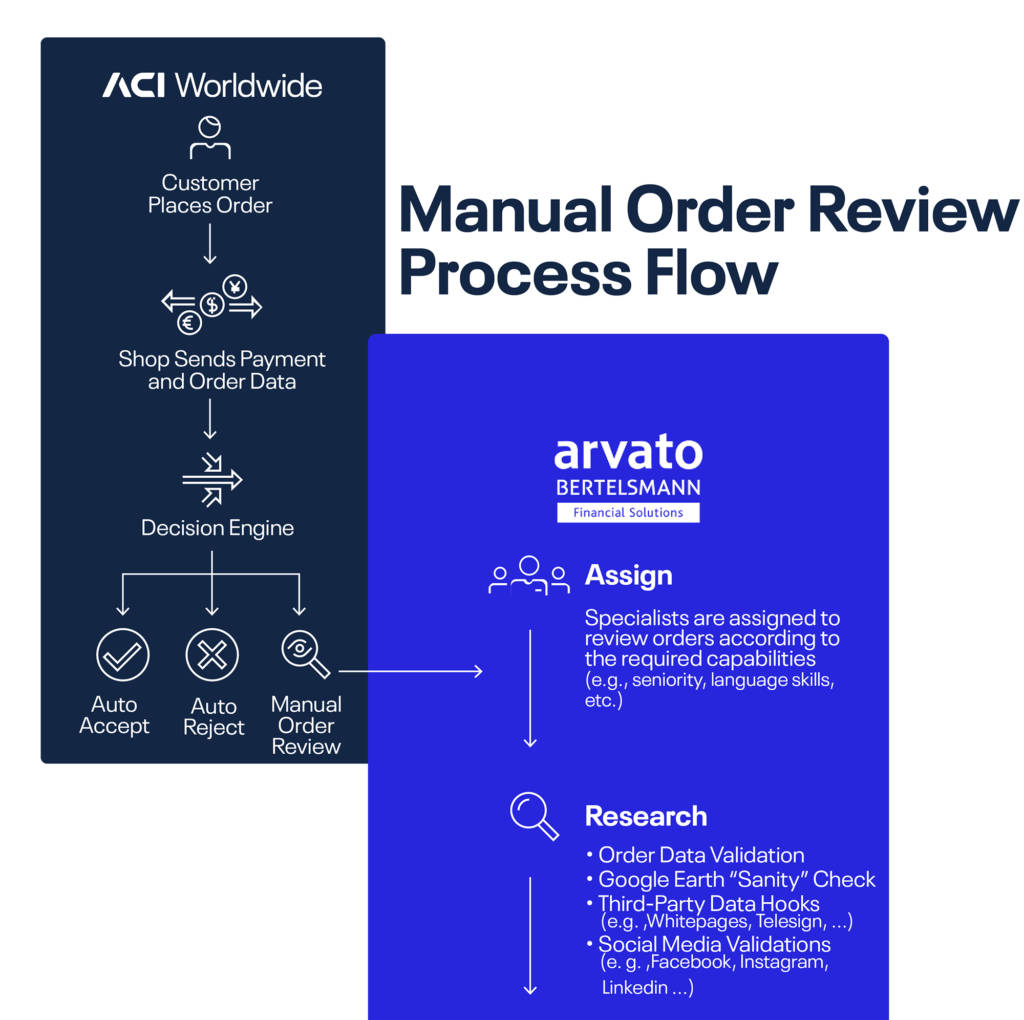

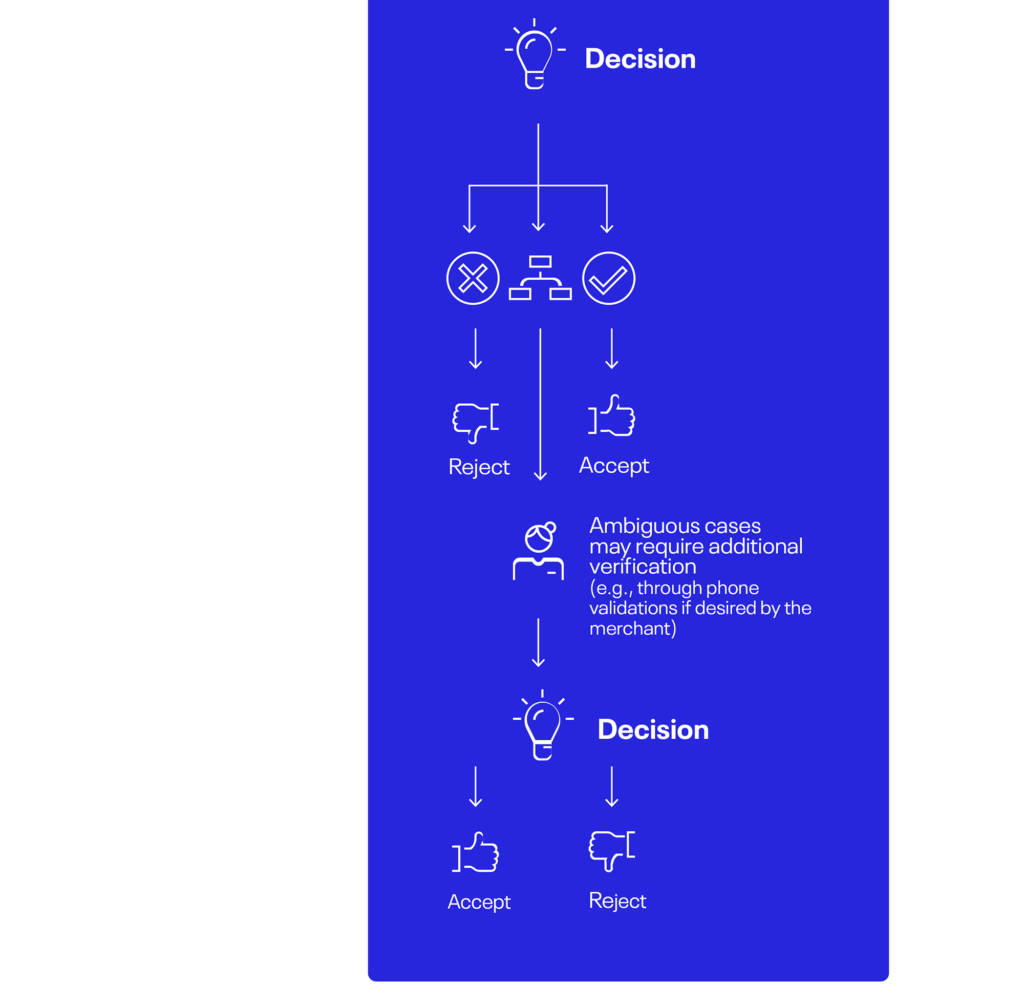

Not all merchants have the resources for in-house MOR; however, considering whether to outsource is a big decision for any company. How do you know if outsourcing is a better fit than in-house MOR? Let’s look at the process flow as used by ACI and our partner arvato, and then dive into some of the circumstances that warrant outsourcing.

As you can see from the diagram, MOR provides an additional checkpoint beyond the automated decision engine, extending a merchant’s capabilities to have human (professional analyst) review of suspicious transactions.

When it comes to creating infrastructure and resources to support MOR, factors like fluctuating transaction volume (due to product launches, sales, holiday season shopping, etc.), staff planning and decision delays impacting customer experience can be challenging for any size organization. In working with merchants around the globe, we’ve found some recurring themes that drive the decision to outsource MOR:

- The nature of 24x7x365 eCommerce means a constant flow of orders and order review queues

- Competition with Amazon standard shipping times creates a critical position for fast, accurate order review processing

- “Just-in-time” staffing for organizations large and small carries considerable overhead and management, not to mention high fully loaded costs that make it difficult to attract and retain order review experts

- Organizations recognize limitations for decisioning orders such as tool and technology improvements, and access to industry best practices

As fraudsters become more proficient, the number of MORs will continue to increase, creating new stress points for in-house teams.

One global retailer that ACI works with made the move to outsource MOR. After 24 months and 1,000,000 reviewed orders, they experienced:

- Over 30 percent improvements in SLAs

- An annual accuracy rate of 99.2 percent

- 17 percent acceptance rate on challenged orders

While outsourcing may not be for everyone, companies big and small can benefit from an experienced partner that is built to handle all of the uncertainties and variance that comes with successful MOR.

Learn more about outsourced MOR and other value-added fraud management services that help merchants to protect and grow revenues.