NEW PAYMENTS ARCHITECTURE GUIDE

What Is the New Payments Architecture?

A comprehensive look at this new initiative and the future for U.K. interbank payments

On This Page

What is the New Payments Architecture?

The New Payments Architecture (NPA) is an initiative in the U.K. that will transform the interbank payments landscape. It involves the development of a new infrastructure that will enable faster, more secure and more efficient payments, while also supporting innovation and competition in the payments industry. The New Payments Architecture represents the future development of the U.K.’s retail payments infrastructure. The original ambition and scope for NPA was the consolidation of all current payment types, including Faster Payments, Banker’s Automated Clearing Systems (BACS) and Clearing House Automated Payments System (CHAPS), and Cheque and Credit Clearing (C&CCC) into a single, central, modern ISO 20022-compliant architecture.

However, following regulatory review, the scope of NPA has been narrowed back to focus on replacement of Faster Payments, with the option (subject to regulatory agreement) to also include BACS at a later stage.

The main drivers and catalysts for this modernization include simplification and making access to the scheme for new participants (challenger banks, fintechs and regtechs) easier, accelerated innovation, increased competition and delivering new payment services at lower costs.

Who is responsible for developing the NPA?

Pay.UK, the operator of Faster Payments and BACS, is responsible for facilitating the delivery of the NPA, which includes procuring a provider to build and operate its central infrastructure services. An announcement on the third-party operator for NPA is expected to be made before H2 2022.

The design and delivery of NPA will be framed by six guiding principles:

- Robust, resilient and scalable platform to accommodate U.K. payments growth

- Adoption of the ISO 20022 messaging standard

- Real-time payments capability

- Lowering barriers for entry to open up access to NPA services

- Safe and secure processing to combat fraud and financial crime

- Ensuring users of NPA benefit from efficiencies, for example, using data to support innovative new services.

Pay.UK, the operator of Faster Payments and BACS, is responsible for facilitating the delivery of the NPA, which includes procuring a provider to build and operate its central infrastructure services. An announcement on the third-party operator for NPA is expected to be made before H2 2022.

What are the six payment types included in NPA?

The NPA has defined a set of products that will be made available for the participants, who will select which ones to implement depending on their individual business needs. These payment types have similar attributes to FPS and BACS payments today but will be built on a richer ISO 20022 format, replacing the legacy FPS ISO 8583 and proprietary BACS Standard 18 formats.

All payment types are aligned with Pay.UK strategy of unlocking account-to-account payments. These interbank systems are owned by Pay.UK and include all real-time transactions between consumers and/or businesses, as shown below.

| Payment Products | |

| Immediate Payment | The standard payment product for single customer payments, usually attended by the payer end user. |

| Standing Order Payment | The payment type for overnight runs of recurring scheduled payments, usually submitted in volume and unattended by the end user payer. Requires most payments to be submitted between midnight and 6 am so that funds are usually available to the payee by 7 am that day. |

| Forward Dated Payment | The payment type that may be submitted at any time, usually unattended by the payer end user. |

| Submission Options | |

| Bulk Submission | The payment type for overnight runs of recurring scheduled payments, usually submitted in volume and unattended by the end user payer. Requires most payments to be submitted between midnight and 6 am so that funds are usually available to the payee by 7am that day. |

| Multi-Payment Message | A single payment message with multiple individual credits, one debit, which should allow us to improve processing efficiency for our customers and may enable early Bacs Credit migration. |

Why change to the New Payments Architecture?

Four main catalysts have been identified as key to the need to modernize with the NPA:

Simplification and Ease of Access

One of the key issues identified with the current Faster Payments scheme is the number of roadblocks and complexity for access and integration. For this reason, the first driver has been simplification and ease of access to new participants. This will open the payments ecosystem to a greater players outreach.

Accelerating Innovation

Boundaries to innovation were another pain point identified. U.K. financial institutions have a clear need to provide and support new payment types and enable better customer experiences through digital form factors, hence having a second-to-none platform is a must.

Increasing Competition

With a need to open up to new players, increasing competition has been identified as another driver for modernization. Today’s payments ecosystem is now removing barriers with the rise of fintech and bigtech, who are willing and able to add value to end customers.

Lowering Costs of New Payments Services

To cope with users’ fast-changing demands, financial institutions need to have a flexible and demand-driven payments platform. Delivering new payments services at lower costs has been identified as another driver for the move to NPA.

What are the expected benefits of NPA modernization?

- Opportunities for users and businesses to choose within all payment types while ensuring protection. Customers are placed at the center, giving them the opportunity to choose their payments journey depending on their preferences and needs, and always in a safe and secure environment. Protection has been identified as a key to encourage confidence in the payers.

- Development of new digital overlay services (also known as value-added services) connected to a single payments infrastructure, instead of having multiple connectors and different integrations. Some examples include Request to Pay, Confirmation of Payee and QR code payments. The vision of opening the new infrastructure is designed to allow fintech and regtech suppliers to add new services.

- Richer data sets allowing more information to be included with the payments message to support and enrich downstream payment processes, such as reconciliations.

- Enablement of new revenue streams. With this consolidation, financial institutions have better tools to track and obtain information from consumer payments.

- Agility from new technology. The NPA brings new technology that is no longer limiting innovation, is more scalable and flexible, and improves go to market.

How can banks move to the new architecture?

Participants are expected to start testing the new infrastructure from Q2 2023, meaning that 2022 is a critical year for planning how to implement NPA, whether through a new single point NPA gateway or broader transition to a payments hub as part of a modernization program.

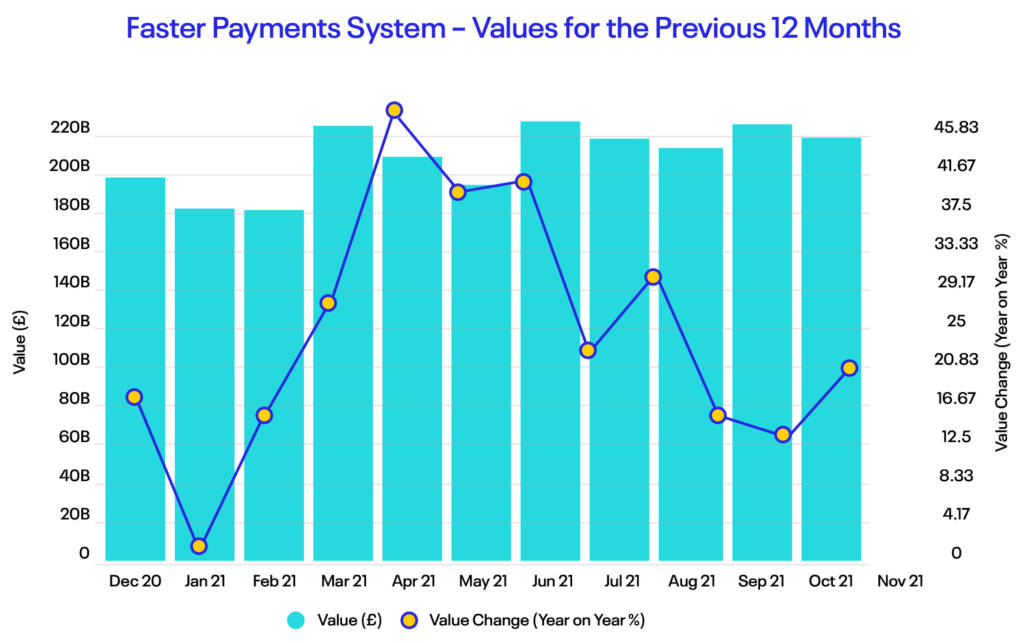

What has been the U.K.’s adoption rate for Faster Payments?

Faster Payments has seen significant growth since its launch in 2008, both in volume and the number of direct participants..

With 13 direct participants at launch, there were nearly 40 direct participants by the end of 2021, and in December 2021, 311.4 million payments were processed, a 16% increase on the amount processed in December 2020. These payments amounted to a total of £232 billion for the month, a 15% increase on November 2020’s total.

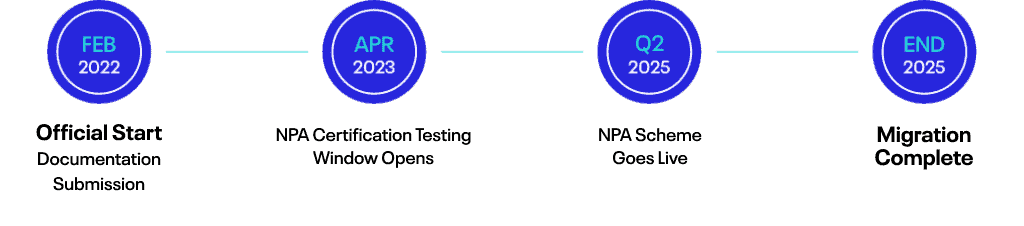

What is the implementation timeline for NPA?

February 2022: U.K. Faster Payments participants need to submit documentation to Pay.UK to demonstrate their level of preparedness for NPA, including:

- How they will comply with NPA (Design Document – attestation)

- Milestone plan

- Impact assessment including the systems’ changes needed

April 2023: NPA certification testing window opens for all interested financial institutions

Q2 2025: NPA scheme go-live

End 2025: Migration from U.K. Faster Payments to NPA complete following 18 months of co-existence

How much time is required before go-live?

The implementation timeline will be driven in part by the steps and processes of the NPA testing and certification window — details of which are expected to be released when the window opens in Q1 2023. ACI has received the draft specifications for the NPA scheme from Pay.UK and has achieved a full payments hub implementation go-live in nine months. ACI’s ambition and plan is to make available a new NPA scheme cartridge in readiness for supporting participants once the window for testing and certification opens.

How does ACI support NPA?

SWIFT has supported ISO 20022 for some time now, called SWIFT MX. In the case of NPA, financial institutions would need to manage the connectivity, integration and interoperability of two real-time payment schemes, the legacy Faster Payments and the NPA. Dealing with this complexity can be alleviated by having a single platform, i.e., a payments hub.

ACI Enterprise Payments Platform is an award-winning payments hub solution that can be installed as a signal point solution to provide gateway connectivity into NPA or as a payments hub. ACI’s solution is flexible and offered in any deployment model that satisfies the financial institution’s need: on-premise, cloud or fully managed services (SaaS), where the financial institution focuses their resources on customer needs and delivering value, while ACI manages the platform.

ACI has proven to be a trusted partner with local and global proof points. ACI’s solution currently processes 50% of U.K. Faster Payments transactions and the platform has been awarded by IBS Intelligence for its payments hub implementation in Hungary for OTP Bank.

New Payments Architecture — The Future for U.K. Interbank Payments

A comprehensive look at this new initiative and how to prepare for the biggest U.K. payments system change