On This Page

ATM channel update

As digital banking sweeps the industry, automated teller machines (ATMs) are adapting to the changing tides of consumer demands and fewer physical branch locations. ATMs are no longer just cash dispensers – they serve as multifunctional banking kiosks where routine and low-value branch transactions can be performed (cash or check deposits, bill payments, or money transfers).

ATM transaction increases

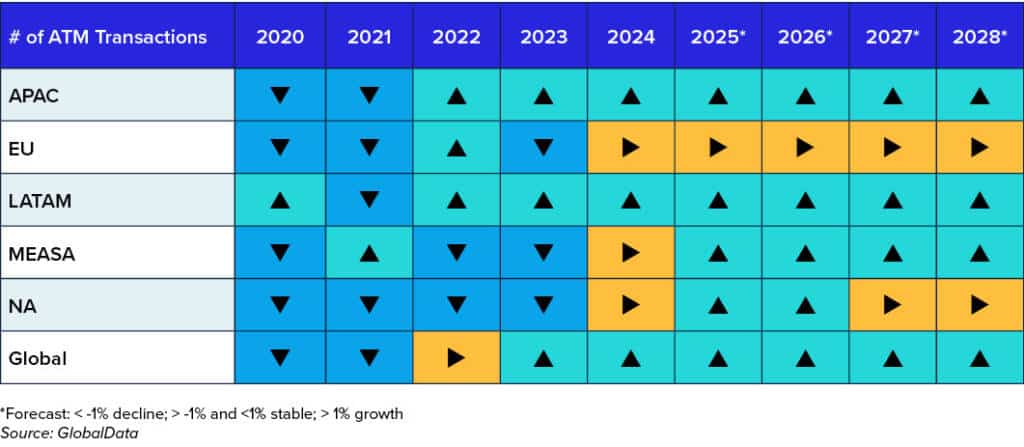

Let’s look at the different ATM behaviors per region:

- Asia-Pacific or APAC: This region leads the way in ATM usage thanks to digital wallet integrations and a push for financial inclusion.

- Latin America or LATAM, the Middle East, and Africa: These regions show a slight growth forecast due to the need for accessible banking services to underserved populations.

- North America and Europe: The number of physical ATMs and transactions has declined since the pandemic, showing them remaining stable but still slightly declining.

Overall, the channel suffered around 3% sustainable decline in ATM numbers, showing a projected decrease of another 1% per annum. Global transactions remain stable, seeing growth between 2-3%.

Financial institutions looking for a reliable partner can depend on ACI Worldwide, with nearly 50 years of expertise, serving more than 100 ATM customers in 45 countries.

Contactless and tap transactions

Whether ATMs remain resilient, fade away, or morph into something new depends on the industry’s ability to adapt to meet consumers’ diverse needs. Globally, the most significant demand has been for supporting contactless authentication methods at ATMs, which are currently mandated in the LATAM region. The channel must embrace the massive growth of wallets, QR codes, or contactless cards by supporting them in their ATM fleets.

ACI’s ATM acquiring solution supports EMV contactless in BASE24-eps, Postilion device handlers, and Auriga’s WinWebServer (WWS).

Cash automation

Cash management is a pillar of ATM network maintenance, comprising one-third of the total operating costs. Ignoring the significance of robust cash management automation is no longer an option. ATM deployers can proactively identify improvement points and obtain cost efficiencies by streamlining cash logistics, enabling cash recyclers across the ATM estate, anticipating cash needs with an artificial intelligence (AI)-enabled forecasting tool, and monitoring the end-to-end process.

ACI’s ATM acquiring solution supports cash recycling in our most-used BASE24-eps and Postilion device handlers. ACI also partners with Auriga’s cash forecasting tool for customers willing to benefit from an AI-first and cost-efficient cash automation solution.

AI

Cash management, monitoring, and fraud prevention solutions benefit significantly from AI, enabling better predictability and error reduction. Beyond transactions, AI extends its reach to code maintenance to ensure streamlined operations. The path forward is clear: embrace AI to unlock a resilient, secure, customer-centric ATM program.

Compliance

As we approach 2025, two critical mandates demand attention: Encrypted PIN pads (EPP) and adherence to TR-31 Phase 3 key blocks. EPPs shield and protect PINs during transactions and need to be upgraded to be encrypted. TR-31 ensures robust key management and needs to be supported across all ATMs.

ACI is working to be PCI PIN v3.1-compliant by supporting TR-31 key blocks in our BASE24, BASE24‑eps, and Postilion products and our partner solutions during 2024.

Self-service banking

The convergence of ATM technology and self-service banking continues to reshape the market. The rise of interactive teller machines (ITM) bridges the gap between traditional ATMs and in-person teller services. As branch closures increase, ITMs step into the spotlight. These video-assisted terminals connect customers with remote tellers, extending branch hours to 24/7. These terminals offer real-time teller support, account services, and other digital branch transactions. However, their adoption introduces complexity in terms of security and monitoring, entailing careful consideration in self-service banking strategies. While consumer adoption remains a challenge, education holds the key.

ACI has partnered with Auriga to complement our offering to support multi-vendor ATM SW needs and self-service banking capabilities, closing the gap between digital banking, ATMs, and branches.

Conclusion

ATMs have moved away from mere cash dispensers. They are now hubs of innovation and can potentially be replacements for counters. The expected transaction surges, driven by convenience and digital adoption, underscore their enduring relevance. Contactless and tap transactions redefine the user experience, while cash automation solutions streamline operations. AI tools enhance security and efficiency, but compliance remains non-negotiable. Amid branch closures, self-service banking emerges as the bridge between tradition and transformation.

Read more about ACI’s ATM Driving, Acquiring and Processing solution