Your one solution for every billing and payment need

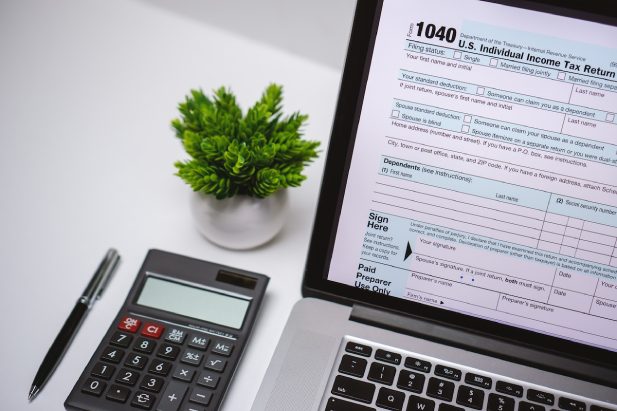

ACI Speedpay is a modern bill payment solution designed to deliver a better, integrated billing and payment experience for every generation and situation. Consumers can choose simple mobile and web payment methods, without giving up the option of walk-in or call center payments.

With the ACI Speedpay solution, viewing and paying bills seamlessly integrates with your overall customer experience. No matter how they decide to make their payment, the experience will be easy.

ACI’s highly configurable solution is pre-built for integration with 100+ systems. Plus, ACI’s strategic partnerships mean that you get a holistic, comprehensive electronic bill presentment and payment service. ACI’s free consumer marketing consultation and creative resources produce superior adoption rates, giving clients faster ROI.

ACI Speedpay includes services for one-time payments, recurring payments, integrated payment plans, service-fee payments, integrated treasury management and real-time digital disbursements.

CUSTOMER COMMUNICATION

Increase consumer engagement by 30%

Engage your customers using a single platform to send all communications from alerts, to bills, to documents, to regulatory notices and marketing communications.

Reduce customer service calls by up to 10%

Cut document delivery costs by up to 50%

Boost engagement with targeted messages and notifications

Manage print, email, text, mobile, and website messaging with a single system

Develop, change, manage content and govern all communications to educe expenses, resources, and timelines

DISBURSEMENT SERVICES

Send money quickly and securely at a lower cost

ACI’s Digital Disbursement Services provide you with a low-cost way to send money to your customers in real-time. Customers simply provide their debit card number and the money goes directly into the account associated with that card. Or, if consumers prefer, we can send the money via ACH, Alternative Payment Method, gift card (physical or virtual), or paper check. No matter how they choose to get paid, you get rich reporting and industry-leading security.

We can disburse multi-party insurance claims, student refunds, loan distributions, loyalty rewards, rebates, payouts, government benefits and many other payments.

REMITTANCE SERVICES

Let customers quickly pay their bills

Offer a fast, cost-effective, accurate way for consumers to pay all their bills—from the mortgage to the babysitter—from a single website or mobile app.

Leverage 9,000+ endpoint relationships to deliver electronic payments quickly and accurately.

EBPP frequently asked questions

What is electronic bill presentment and payment?

Electronic bill presentment and payment — often abbreviated to EBPP — is a form of electronic billing service that enables businesses to present electronic billing statements and invoices to customers, typically using an online platform. In most cases, customers also have the option to pay their bill electronically using the same platform. EBPP is an integral component of online banking and other electronic billing systems across all industries.

Are there different approaches to electronic bill presentment and payment?

Yes. Businesses have the option of billing customers directly, through a third party —often a bank — or both.

With direct billing, customers can make direct payments using a company’s website over a secure connection. With a third-party service, customers can make payments to multiple companies through a single online portal, and the service provider — sometimes called a consolidator or aggregator — distributes payments to the appropriate recipients.

Does implementing electronic bill presentment and payment increase customer satisfaction?

Investing in EBPP is one of the best ways to improve customer engagement and overall satisfaction because it consolidates all communications — print, email, text, mobile and more — to a single platform, helping customers stay up-to-date and on top of payments. Electronic billing services such as ACI Speedpay also give customers the flexibility to choose their preferred payment method and channel. In fact, according to research from ACI, EBPP has the power to reduce customer service calls by up to 20% and increase engagement by 30%.

Can electronic bill presentment and payment help businesses save money?

Yes. By moving customer communications, billing and payments online, EBPP reduces document delivery costs by 50%. Since everything is online and electronic, EBPP also makes it easier than ever before for customers to complete payments, increasing the likelihood for consistent on-time payments. Businesses can expedite the payments process even further by investing in a disbursements solution such as ACI’s Digital Disbursement Service, which enables businesses to send funds — from refunds to insurance claim payments — in real time.

How can businesses implement electronic bill presentment and payment?

In order to implement EBPP — or any other electronic billing service, for that matter — businesses need to invest in the appropriate technology and build a comprehensive online platform or partner with a provider focused on EBPP innovation. ACI Speedpay is a modern bill payment solution that supports EBPP by making it easy for businesses to electronically generate and present billing statements and invoices to customers, and for customers to view and pay bills through the channel of their choosing, whether that’s online, on a mobile device or in-person.

ACI speedpay pulse report: billing and payment trends and behaviors

Our annual survey reveals that new consumer habits and attitudes are still emerging to shape expectations of billing and payment experiences

Related Solutions

Explore more solutions

Learn about our additional solution capabilities.

ACI Speedpay

Powerful suite of digital billing, payment, disbursement, and communication services that lowers the cost of presenting and accepting bill payments while delivering industry-leading security

Bill payment API: Payments authorization, processing, and remittance

ACI’s bill payment engine API enables outsourced bill payment processing, while you maintain control of the user interface

Real-time disbursements

Send money in real time to one or multiple parties through the latest payment options, including consumers’ debit cards

Electronic bill presentment and payment services (EBPP)

Deliver a better, integrated billing and payments experience for every generation and situation

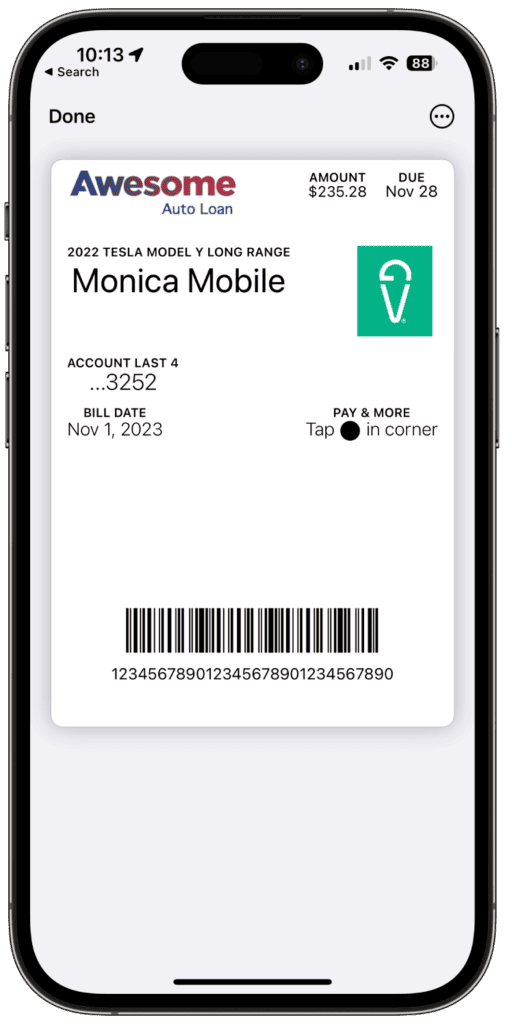

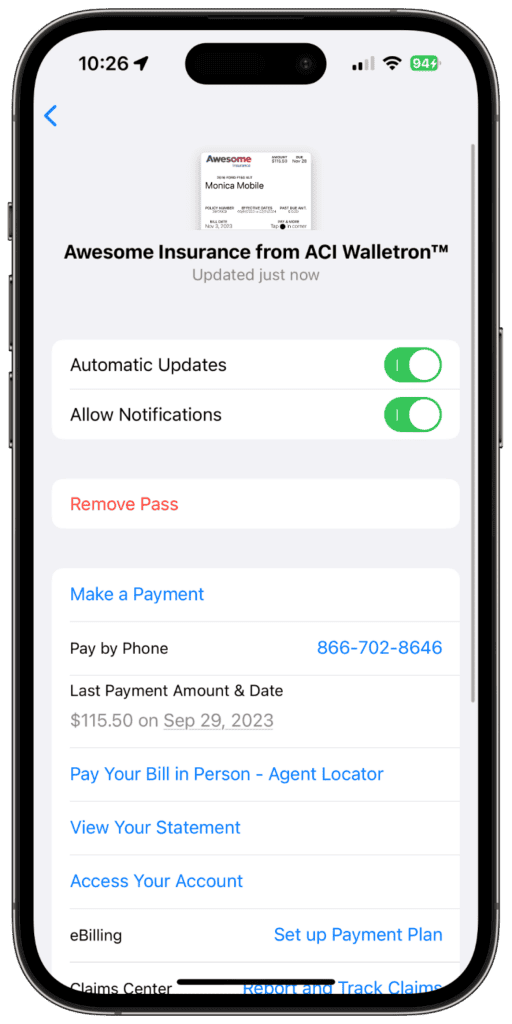

Mobile wallet bill presentment and payments platform

Award-winning bill presentment capabilities for your customers’ native digital wallets