The latest ACI Speedpay research reveals a significant gap between consumer expectations and the disbursements experiences offered by many billers.

Speed has become a defining factor in the success (or failure) of consumer payment experiences in recent years.

Beyond convenience, which is a primary driver for many consumer decisions, being able to pay bills faster or even instantly allows consumers to quickly tick off important life admin

Now turn this on its head and think of those instances when a consumer is waiting on a payment owed to them by a company. In this situation, instant gratification and choice over how they receive that payment is an even bigger contributor to their satisfaction.

And when that payout is based on a major life event (such as a car accident or devastating property loss), faster resolution — or at least the perception that there will be a faster resolution — can be hugely reassuring at a stressful time.

Consumers are currently underserved by disbursements

Consumers seem to be chronically underserved when it comes to faster disbursements, as revealed by a recent ACI Worldwide survey of U.S. consumers who have received payments from companies, including refunds or rebates.

Of those due a refund or rebate, 21 percent reported issues receiving those payments, including taking too long to receive the payment (29%), no way to track payment status (23%) and checks being lost in the mail (36%).

Worse, half of the 62 percent of U.S. adults who made an insurance claim as a result of a natural disaster and needed their funds immediately had to wait for a check to arrive in the mail. And 53 percent of respondents overall experienced a check getting lost in the mail after making an insurance claim.

Disbursement experiences are suffering a choice deficit

There’s a disconnect between the way companies are handling disbursements and consumer expectations. In fact, it might more accurately be called a choice deficit. Almost half (48%) of those who have received a payment said that a choice of payment method for their disbursement was very important or important. And yet 54 percent of that group report not being offered one.

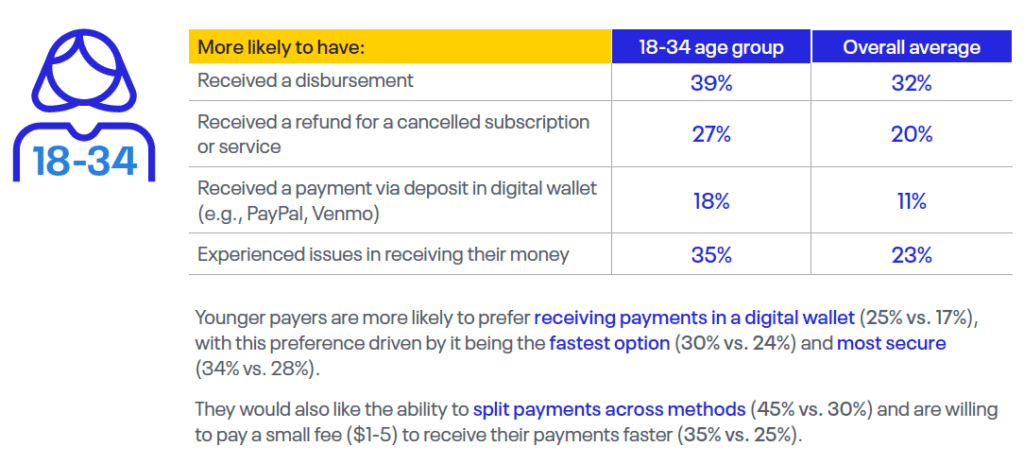

These unmet needs are ideal spaces into which to launch new and differentiated services. Indeed, our survey shows that by not innovating around disbursement options, the nation’s billers are missing opportunities to position themselves ahead of changes in consumer behavior. In our data, 17 percent would prefer to receive their payment deposit in a digital wallet, rising to 25 percent for 18-34 year-olds. Overall, regardless of age, 35 percent would prefer to be paid by direct deposit to their bank account.

Companies could even be leaving cash on the table in the form of hidden costs and foregone revenue opportunities. Labor, supplies and processing fees mean there is much more to the cost of a check than the $0.58 postage — end-to-end processing potentially costs up to $20 (not to mention the costs involved with lost checks and mail that is never opened). Furthermore, 25 percent of respondents said they would be willing to pay a fee of between $1 and $5 to receive their payment faster than they normally would, rising to 35 percent and 33 percent for 18-34 and 35-54 year-olds, respectively.

Digitize disbursements to better meet consumers’ needs

Clearly there is a large space to grow into when it comes to increasing the speed of disbursement, and there is real-time payment technology available today that can quickly and securely achieve this.

And this technology can be adopted with confidence, as elevated consumer focus on convenience and choice (plus generational and demographic factors) sees real-time payment services such as PayPal, Venmo and Zelle becoming more widely used. As well as better serving customers, digitizing disbursements and making them real time will lower costs by reducing manual processes. It will improve security too; digital payments can’t be lost or stolen in the mail, and they come with a stronger audit trail for faster resolution in the rare event of payments reaching the wrong person.

Ultimately, faster disbursements are expected by consumers, and real-time payments are the next frontier for which billers must prepare. In fact, the impact of a relatively small tweak to the disbursement experience in favor of speed could be business-defining in an era when the competition is only ever just a click, tap or swipe away.

For more on consumer bill payment preferences, checkout our new Infographic: Disbursement Preferences from Boomers to Gen Z