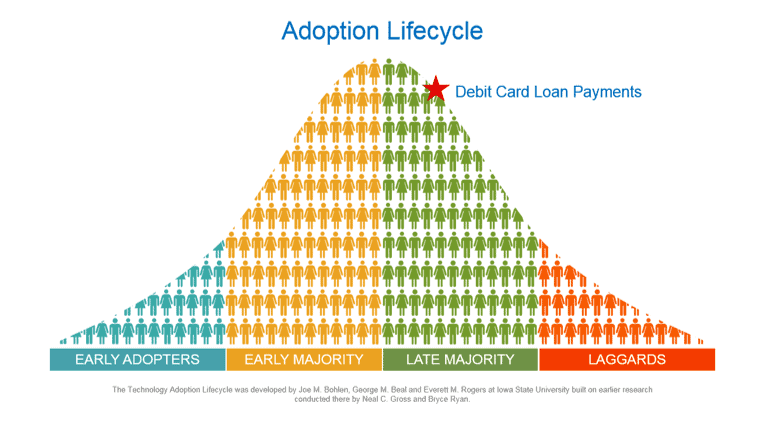

“Unless it is seen as the task of the organization to lead change, the organization will not survive,” wrote Peter Drucker. Will 2016 be the year for your organization to keep trailing the pack as a technology adoption “Laggard” as shown in the image below? Or will you join the “Late Majority” and start reaping the benefits of accepting debit card payments?

To meet customer demand for convenience, 60 percent of the top US lenders have added debit card processing for accepting loan payments. Meeting this need does not mean you have to absorb the cost. 50 percent of large lenders accept electronic payments at no cost to themselves, by allowing their customers to pay a service fee or convenience fee for making electronic payments.

Lenders offering debit card payment processing are now improving portfolio performance—not only through increases in revenue from satisfied customers, but also in increasing customers paying on time. Accepting debit card payments online also reduces customer service calls and staff time spent on payment exceptions.

While the lending industry has been slower than others in accepting debit card payments, the practice is now mainstream among the nation’s leading lenders. In a recent survey of the top 20 US lenders by ACI, 60 percent accept debit cards for loan payments. 20 percent accept debit cards only for those loans in collections, while 40 percent accept debit cards for on-time loan payments.

Debit card payment processing for loans reaches the “late majority” stage

The trend toward accepting debit cards for loan payments began in the collections arena—as lenders reached the point where they needed to at least get something from customers who fell behind on payments. Taking debit card payments at that point-and-time is certainly a logical way to resolve collections issues.

But customers who enjoyed this capability then began to ask, “If you’ll take my debit card when I’m behind on payments, why not do so when I pay on time?” That’s when many lenders—including the 40 percent among the industry giants—realized that accepting debit card payments and keeping customers paying on time was a good idea.

Lenders then started accepting debit card payments for auto, credit card, mortgage, student and other personal loans. If your lending institution does not accept debit card payments, now is the time to get on board—before your customers take their business elsewhere.

The business case of loan servicing that accepts debit cards

Many lenders that have held back on accepting debit card payments have done so due to confusion around the cost. They likely think the costs are higher than they actually are. But recent industry changes have lowered the cost of debit card transactions.

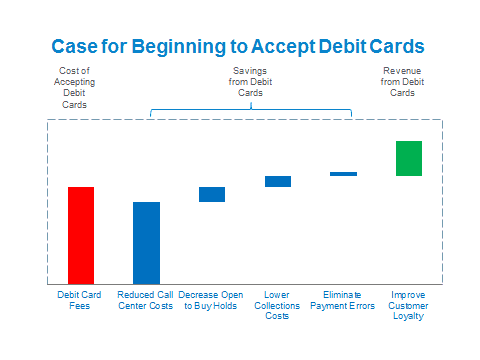

In assessing the business case of debit card transactions, it’s important to look beyond the interchange costs. Your organization should also consider the on-going long-term cost savings and revenue gains:

As shown in the image above, the cost of accepting debit cards can be recouped and even turned into a revenue-generator by the off-setting cost reductions. In comparison to ACH transaction fees, debit card costs end up providing a lower total cost of ownership over their entire lifecycle. This proves true whether the lender absorbs the interchange fees or passes the fees along to the customer. Though not included in the image above, lenders that pass along the transaction fee costs to consumers can generate an even higher ROI.

The benefits of loan servicing experiences that accept debit cards

Lenders that accept debit card payments on loans discover that the benefits fall into two general categories: revenue growth and cost reduction.

Revenue growth comes from customers who are satisfied with their billing and payment experiences as well as the overall level of customer service they receive. This drives them to open new accounts with their lender. Operational cost reductions come from the less time that lenders need to spend with debit card customers, since this payment method functions more efficiently.

Revenue growth: Customer satisfaction with billing and payment experiences are the primary factors in determining whether or not customers originate new loans with their lenders, according to J.D. Power & Associates. Making it easy to pay loans by offering the debit card option can lead to increased business with each customer.

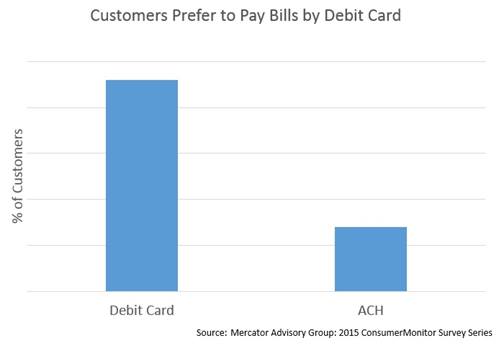

As shown in the image below, consumers also prefer 3:1 to pay with debit cards rather than the ACH method, which requires more information to submit and thus more time to pay. Offering debit card payments makes it easier for customers to pay since 80 percent of customers do not carry their checkbooks for making ACH payments.1

J.D. Power & Associates also found that 90 percent of highly-satisfied customers say they will purchase additional loans from that lender. If lenders keep customers happy, they are more likely to increase their business with the lender. That means the loan payment process must be hassle-free, and accepting debit cards is one of the best ways to achieve this objective.

The VP of Operations at a lender told me their strategy is to impress customers with their billing & payment experience so they can earn more business from them. To seize the opportunity, the lender launched debit card and ACH payment options.

Cost reduction: The fewer phone calls that customers place to confirm payments have been received on time, the lower the cost of operating the call center. Such calls occur frequently when customers mail a check or make an ACH payment. With each call costing $4 and up to 80 percent of incoming calls related to billing & payment, ACH payments contribute to higher call center costs.2 But with debit card payments, calls are never necessary: the customers receive immediate confirmation.

Compared to ACH payments, debit cards also shorten call times by 80 percent when customers call in to make payments.3 The debit card process does not require “disclosures and recordings” as mandated by ACH regulations. As the lending industry knows all too well—the longer calls last, the greater the staff time and the higher the costs of the call center.

When lenders accept ACH payments, they also cannot immediately confirm if customer accounts have sufficient funds. If the funds are not there, the lender incurs payment errors that require time and money to resolve. Even if it’s the customer’s fault, the situation still causes undue friction between the lender and its customers.

But with debit cards, both parties know right away if sufficient account funds exist. If necessary, another form of payment may be necessary, but at least the customer knows the score right away and does not get hit with an NSF fee.

With debit cards, there’s also a reduction in the time for open to buy holds on credit card usage. By allowing customers to pay off credit cards that have reached their limit with a debit card payment, the customers can immediately start using their credit cards, which generates new interchange revenue. If you force customers to mail a check to pay off credit cards, they then have to wait several days until the payment goes through, during which time the credit card cannot be used.

Case study in raising loan portfolio performance

A top-25 lender in the US boosted its loan portfolio performance with debit card payment processing. The lender raised the number of performing loans due to a double-digit increase in customers paying on delinquent accounts and helped collect a greater number of payments on-time. The lender also lowered the cost of collecting payments through affordable interchange rates for debit cards. This virtually eliminated staff time spent on payment exceptions since customers use debit cards more often now instead of ACH payments.

Other key objectives achieved by the lender included reducing customer service payment calls by one-third and saving treasury staff time spent on reconciliation. All of these cost reductions freed up additional cash flow. The lender was then able to leverage the cash to further expand its loan portfolio.

Offering debit card payment processing can introduce complexity. This lender eliminated the complex treasury operations by outsourcing the integrated treasury management service, which generated several additional benefits:

- Saved staff time spent on back-dating payments.

- Freed up cash by receiving all funds the next business day.

- Delayed processing fees until month-end.

- Simplified operations by combining payments from all debit card networks and ACH into a single deposit and posting file.

2016: The year to add debit card payment processing

With 60 percent of the top US lenders now accepting debit card payments, the time has arrived for all lenders to follow suit. Customers demand the convenience and ease of using their debit cards for all their transactions—including payments on loans.

If your organization does not already cater to customers trending toward using their debit cards, you will need to do so soon or else risk losing your customers to a lender that does accept debit card payments. As I learned, technology changes quickly and this is not the year to bring your flip phone to the party!