Hollywood gives us an example. What’s your favorite movie quote? “What would you say you do here?” from Office Space has to be one of mine. Tom explains to the consultants that he’s the middleman who takes the specifications from customers to the engineers. It is obvious Tom does not add any value being in the middle.

Trader Joe’s grocery store removes the middlemen to deliver tasty food at an affordable cost*. When we moved to another town, the first thing we researched was the location of the closest Trader Joe’s. It’s that remarkable!

Middlemen crowd today’s government payment processing

Multiple fee collectors or middlemen stand in between your government and your citizens’ bank accounts. Like toll booths on a toll road, the card networks and merchant acquirers increase the cost of payments and slow down the movement of money.

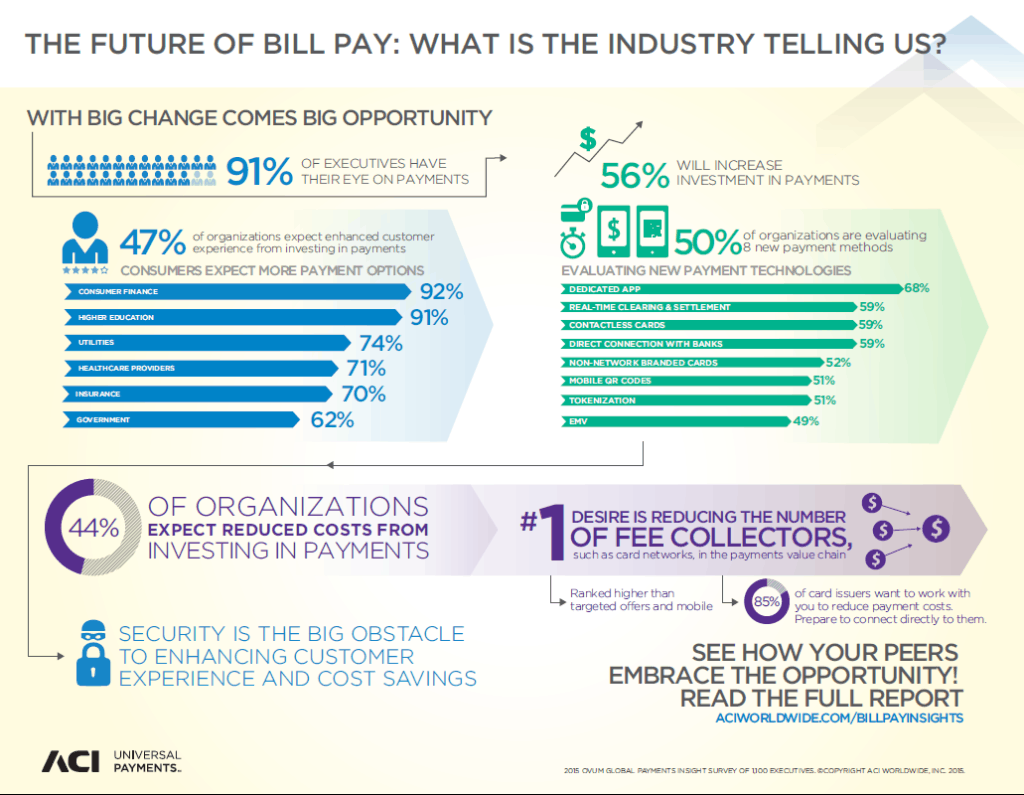

Reducing fee collectors is industry’s #1 desire

Governments are evaluating connecting directly to banks to eliminate the fee collectors in the middle according to our new survey exploring government payment services. In fact, reducing fee collectors ranks higher than mobile payments in priority!

Benefits of removing middlemen from government payment processing

- Make citizens smile. 62% of consumers demand faster payments than today’s payment networks deliver, according to Mercator Advisory Group. Removing the middlemen will enable faster money movement.

- Save money on payment processing. Invest more in the community. Reducing multiple fee collectors from the payments process will lower the cost of accepting card payments.

- Tighten security. Citizens’ sensitive banking information will travel through fewer parties. Criminals will have less chances to steal it!

Your peers’ plan to simplify payments. As governments begin updating their strategic plans for 2016, will you embrace simplicity?

*Source: CBS News