Understanding Real-Time Payments: The Complete Guide

The technology that’s transforming the payment processing industry

On This Page

What are real-time payments?

The term “real-time payment” (RTP) is used to describe any account-to-account fund transfer that allows for the immediate availability of funds to the beneficiary of the transaction. Real-time payments offer a confirmation of funds via a real-time balance; once a payment is authorized, the payer’s account reflects the deduction of funds instantaneously. Though settlement timing may differ from one scheme to the next, it is often completed in a matter of seconds. For these reasons, real-time payments are also commonly referred to as immediate payments or instant payments.

All real-time payments are irrevocable, meaning once a payment is made, the payer cannot deauthorize the transfer. Though early RTP systems were subject to nightly, weekend and holiday restrictions, modern iterations make payments available 24 hours a day, 365 days a year.

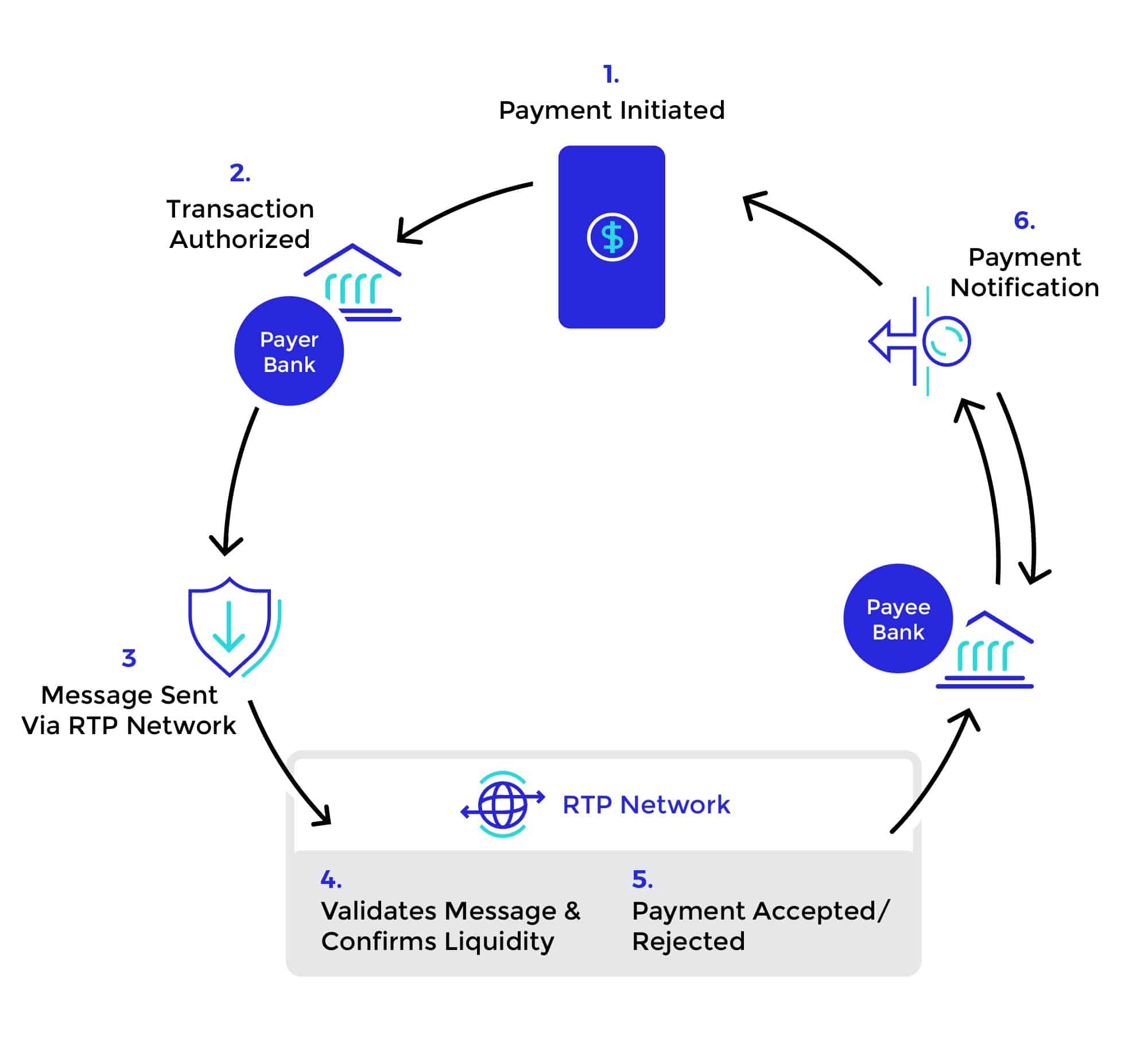

How do real-time payments work?

All real-time payment transactions involve five parties:

- The payer

- The payer’s financial institution

- The payee

- The payee’s financial institution

- The underlying RTP network

The real-time payment process itself is fairly simple:

Where are real-time payments used?

Real-time payments are used in all major regions of the world; you can view RTP adoption by country in the chart below.

| Nation | RTP Network(s) | Owner(s) / Operator(s) | Year(s) Launched |

| Australia | New Payments Platform (NPP) | Reserve Bank of Australia | 2018 |

| Belgium | SCT Inst | STET | 2019 |

| Brazil | – Sistema de Transferência de Fundos (SITRAF) – PIX3 | Banco Central do Brasil (BCB) | – 2002 – 2021 |

| Canada | – Interac e-Transfer – Real-Time Rail (RTR) | Payments Canada | – 2002 – Project launch in 2021 |

| Chile | Transferencias en Líea (TEF) | Centro de Compensación Automatizado (CCA) | 2008 |

| China | Internet Banking Payment System (IBPS | People’s Bank of China | 2010 |

| Colombia | Transferencias YA | ACH Colombia | 2019 |

| Denmark | Straksclearing (also known as Express Transfers or RealTime 24/7) | Danish Bankers Association / Nets | 2014 |

| Finland | Siirto | Automatia | 2017 |

| France | SCT Inst | STET | 2018 |

| Germany | SCT Inst | EBA Clearing ECB | 2017 |

| India | – Immediate Payment Service (IPS) – Unified Payments Interface (UPI) | National Payments Corporation of India | – 2010 – 2016 |

| Kenya | PesaLink | Kenya Bankers Association (KBA) | 2017 |

| Japan | Zengin System | Japanese Bankers Association | 1973 |

| Malaysia | DuitNow | Payments Network Malaysia | 2018 |

| Mexico | Sistema de Pagos Electrónicos Interbancarios (SPEIS) | Banco de México | 2004 |

| Netherlands | SCT Inst | ECB | 2019 |

| Nigeria | NIBSS Instant Payments (NIP) | Central Bank of Nigeria | 2018 |

| Norway | Straksbetalinger. | BITS AS | 2013 |

| Republic of Korea | – CD/ATM – Electronic Banking System (EBS) | Korea Financial Telecommunications & Clearings Institute | – 1988 – 2019 |

| Singapore | – Fast and Secure Transfers – PayNow | The Association of Banks in Singapore | – 2014 – 2017 |

| South Africa | Real-Time Clearing (STC) | Absa / Capitec / Bankserv Africa | 2006 |

| Spain | SCT Inst | ECB / Iberpay | 2017 |

| Sweden | BiR | Bankgirot | 2012 |

| Thailand | PromptPay | National ITMX | 2016 |

| United Kingdom | Faster Payment Service (FPS) | Pay.UK | 2008 |

| United States | – Zelle – Real-Time Payments Network – FedNow | – Early Warning Services – The Clearing House – The Federal Reserve | – 2017 – 2017 – Project launch date in 2023 |

For more details about each of the RTP networks, as well as additional global payment insights, trends and predictions, we recommend reading Prime Time for Real-Time: The Global Real-Time Payments Report.1

What are the benefits of using real-time payments?

Real-time payments offer numerous advantages to organizations across all sectors, including:

- Satisfying growing consumer demand for instant access to funds and more convenient electronic payment options, thereby enhancing the customer

- Expediting the refund and disbursement processes

- Providing individuals with greater visibility into their financial situation, reducing the risk of overdraft fees and similar penalties

- Offering businesses greater liquidity, visibility into accounting and better overall cash flow management, thereby enabling them to better manage operational expenses and maintain positive vendor relations

- Creating opportunities which bring new value-added services — such as QR payments social payments and Request-to-Pay — to market

- Empowering organizations to optimize existing service offerings, service new markets and open up new revenue streams

- Reducing operational costs by either paying lower credit card interchange fees or bypassing interchange fees entirely

- Increasing payment security by enabling bidirectional communication within a secure system; introducing two-factor/multi-factor authorization, device binding and confirmation mechanisms; and offering more secure payment options, such as Request to Pay, which processes payments through verified channels

- Improving business performance, enhancing operational efficiencies and reducing the risk of fraud by conforming to ISO 20022, which enables financial institutions to send rich data sets with each transaction

What is driving real-time payments’ growth?

According to research from ACI Worldwide and GlobalData, “More than 70.3 billion real-time payment transactions2 were processed globally in 2020, a surge of 41 percent compared to the previous year.” Though real-time payment systems have existed in some form since the 1970s, global adoption of RTP has dramatically increased within the past decade — in fact, the RTP market has a projected Compound Annual Growth Rate of 23.6 percent from 2020 to 2025.

There are numerous drivers behind this rapid expansion, including:

- Increased reliance on digital payments amidst COVID-19 pandemic

- Centrally-driven payments modernization initiatives

- Growing consumer demand for convenient payment initiation and authorization methods

- Financial ecosystem inclusivity permitting new entrants with access to RTP capabilities

- Advances in digital overlay services allowing for frictionless payments, immediate settlement and seamless user experiences

- Easy access and connectivity to new payment rails due to APIs and open banking

- Government-backed initiatives to reduce cash reliance

- Widespread government recognition of RTP’s benefits to GDP and local business economies

- Consumer interest in and openness to alternative payment methods

What are some potential use cases for real-time payments?

Real-time payment platforms support a variety of payment dynamics and use cases, including those shown in the chart below:

| Payment Dynamic | Potential Use Cases |

| Person to Person (P2P) | Repayments / remittances to family or friends |

| Government to Consumer (G2C) | Subsidies, tax refunds / rebates, government wages, pensions, social benefits, unemployment benefits, loans |

| Business to Consumer (B2C) | Bill payments (using Request to Pay), rebates, refunds, vouchers, legal settlements, insurance claims, employee wages, employee reimbursements |

| Consumer to Business (C2B) | Point of sale transactions, bill payments, medical co-pays |

| Consumer to Government (C2G) | Taxes, loan repayments, donations, registration fees |

| Business to Business (B2B) | Supplier payments, refunds, adjustments |

| Business to Government (B2G) | Taxes, registration fees, campaign donations |

| Government to Business (G2B) | Privatized services, tax rebates, government contracts |

What is the difference between real-time payments and faster payments?

Though similar in nature — and often mistakenly used interchangeably — real-time payments and faster payments are not one in the same. Faster payments certainly post and settle more quickly than traditional payment methods, but they aren’t instantaneous, or even near instantaneous.

In fact, faster payments can take anywhere from a few minutes to a few hours to complete. As a general rule of thumb, faster payments are always credited by the end of the following business day.

RTP are truly instantaneous in that there is no interval between when funds are deducted from the payer’s account and made available to the payee.

Is there such a thing as real-time ACH?

Simply put, no, there is not. Automated Clearing House (ACH) payments are a form of faster payment, which means they post and settle payments in batches rather than in real time. Though faster than traditional payment methods, even same-day ACH transactions take a full business day to complete. While this is a significant improvement over traditional ACH transactions, which took three days to complete, it pales in comparison to the immediacy of real-time payments.

What is FedNow, and why does it matter?

The United States has two existing RTP systems — Early Warning System, LLC’s Zelle and The Clearing House’s Real-Time Payments Network — and one currently in development. This third real-time payments system, FedNow, is an interbank round-the-clock real-time gross settlement service with integrated clearing functionality and is intended to enable financial institutions to deliver end-to-end faster payment services to customers.

Thanks to its enhanced gateway, which supports system connectivity; value-added services, such as Request for Payment; convenient payment settlement options; and liquidity services, FedNow is a highly anticipated RTP system and will be a must for entities in the U.S.

The Federal Reserve is expected to launch FedNow in 2023; the official pilot program, of which ACI is a member,3 began in 2021.

How can I implement real-time payments?

In order to implement real-time payments, banks must first modernize their existing payments architecture. This includes investing in a platform capable of:

- Supporting real-time payments processing and back-office operations;

- Enabling existing digital touchpoints;

- Delivering value-added services; and

- Providing a gateway or endpoint to the central scheme

As the real-time payments partner of choice for countless organizations around, ACI Worldwide specializes in delivering software that enables banks, merchants and billers to bring new payment types to market at speed, adapt to shifting and regulatory mandates and rapidly launch new value-added services according to consumer demand.

Our ACI Enterprise Payments Platform processes 50% of the U.K.’s Faster Payments, 75% of Hungary’s AFR transactions, and is the core processing infrastructure for Malaysia’s Real-time Retail Payments Platform and STET’s real-time payments platform.4 ACI also serves on the U.S. Faster Payments Council, is a member of the ISO 20022 Real-Time Payments Group and the European Payments Council’s Instant Payments Technology Group, and was named as a participant in the FedNow pilot program.5

50%

of the U.K.’s Faster Payments are processed by ACI’s Enterprise Payments Platform

75%

of Hungary’s AFR Transactions are processed by ACI’s Enterprise Payments Platform

To learn more about how ACI Worldwide can help your organization realize the benefits of real-time payments, contact us today.

Article Sources

- ACI Worldwide, “Prime time for real-time global payments report, https://aciwwstage.wpengine.com/real-time-payments-report.” ↩︎

- ACI Worldwide, “Global Real-Time Payments Transactions Surge by 41 Percent in 2020 as COVID-19 Pandemic Accelerates Shift to Digital Payments – New ACI Worldwide Research Reveals, https://investor.aciworldwide.com/news-releases/news-release-details/global-real-time-payments-transactions-surge-41-percent-2020.” ↩︎

- PaymentsJournal, “The FedNow Leaps Forward with a Large Pilot Group of Processors and Financial Institutions for Real Time Payments, https://www.paymentsjournal.com/the-fednow-leaps-forward-with-a-large-pilot-group-of-processors-and-financial-institutions-for-real-time-payments/.” ↩︎

- ACI Worldwide, “ACI Worldwide and STET Team to Drive European Immediate Payments Adoption, https://investor.aciworldwide.com/news-releases/news-release-details/aci-worldwide-and-stet-team-drive-european-immediate-payments.” ↩︎

- ACI Worldwide, “ACI Worldwide Selected to Participate in Federal Reserve’s Pilot Program for its Upcoming Real-Time Payments Offering—the FedNow Service, https://investor.aciworldwide.com/news-releases/news-release-details/aci-worldwide-selected-participate-federal-reserves-pilot.” ↩︎

Make Real-Time Payments a Reality

Get an in-depth look at how financial institutions can leverage important learnings from around the world to launch future-proofed solutions.