Industry Guide

Payments Industry Trends and Innovations To Watch

Digital identities, biometric authentication, digital currencies and more — discover the top payments industry trends for billers here

On This Page

In the ever-evolving landscape of digital finance, staying ahead of emerging payment trends is imperative for billers. As we step into 2024, payments are poised for another transformative year, with new challenges and opportunities that will redefine how billers interact with payers to facilitate seamless transactions.

In this guide page, we’ll explore the leading trends that will help billers improve operational efficiency, enhance the billing experience and ensure continued growth in the dynamic payments market.

What are the leading payment trends for 2024?

Rising costs

There’s no two ways about it — it’s getting increasingly expensive for billers to accept debit and credit card payments. We can largely attribute this issue to interchange fees, which are on the rise due to a variety of factors, including the growing use of rewards and commercial cards, continued inflation and increasingly sophisticated fraud.

In August 2023, the Wall Street Journal reported that Visa and Mastercard were set to increase both their network and interchange fees in October 2023 and again in April 2024, a move that would cost billers and merchants an estimated $502 million annually in fees.

Though Mastercard and Visa have disputed these claims, those in the payments industry are still on high alert for higher costs, and both industry groups and lawmakers have called for regulation. In the United States, lawmakers have introduced bipartisan legislation — the Credit Card Competition Act — in an effort to enhance competition in the credit card network market and control costs for merchants and consumers.

Whether the Credit Card Competition Act and other similar legislation will be signed into law remains to be seen, but this payments industry trend is certainly one to keep an eye on as we head into 2024.

Digital identities

Continuing on the theme of one-to-one digital representations of individuals or organizations, digital identities are slated to be a major payments trend for 2024. For reference, a digital identity is an electronic copy of a payer’s personally identifiable information (PII) used to verify and authenticate their identity during CNP transactions.

A payer’s digital identity may consist of a variety of data points, including:

- Basic personal information, such as their name, date of birth and address

- Contact information, such as their email address or mobile phone number

- Biometric data, such as their fingerprint, facial features or voice pattern

- Government-issued identification, such as a driver’s license or passport

- A unique token, access code or password

- Cryptographic signatures

- A behavioral history of their digital interactions and payment preferences

Although fraud prevention is the primary use case for digital identities, they have a wide variety of possible applications that can streamline the billing experience.

For example, by allowing billers to create and store their digital identities, payers can easily log into their accounts and make payments without having to remember complex usernames and passwords. They can even store their payment credentials within their digital identities and then use them to automate recurring payments, reducing the risk of late or missed payments. From billers’ perspective, digital identities can be a valuable source of data that they can then use to personalize payment offerings to their customers, such as recommending certain payment methods or setting due date reminders.

For evidence that digital identities will be one of the top payments trends for the coming year, look no further than Juniper Research, which estimates that the number of digital identity verification checks will surpass 70 billion in 2024 — a 16 percent increase over 2023.

Fraud and identity theft

Though rapid advancements in technology have accelerated payments innovation, they’ve also created vulnerabilities that fraudsters can easily exploit, which has led to a dramatic increase in payments fraud over the past two years.

According to Experian’s 2023 U.S. Identity and Fraud Report, consumers and billers lost a collective $43 billion to identity theft and fraud in the U.S. in 2022. Experian also cites a recent PwC survey, which found that over half of companies with global annual revenues of over $10 billion experienced fraud within the past year — and that one in five of those incidents had a financial impact of over $50 million.

$43 billion

lost collectively by consumers and billers to identity theft in the U.S. in 2022

Social engineering attacks, CNP fraud, identity theft (digital or otherwise) and account takeovers are just a few examples of the types of payments fraud against which billers will need to increase their defenses. The good news is that from strong customer authentication (SCA) and point-to-point encryption (P2PE) to tokenization and predictive analytics, technology is providing billers with the tools they need to effectively fight fraud both now and in the near future.

Biometrics

Speaking of strong customer authentication methods, biometric authentication has emerged as one of the strongest. This payments industry trend streamlines the authentication process by enabling payers to verify their identity using unique physical or behavioral characteristics, such as fingerprints or facial recognition. Not only is this approach more convenient for payers than having to remember and manually input passwords, it’s also much harder for fraudsters to replicate. When used in conjunction with other security measures, biometric authentication can strengthen billers’ security posture and even help them comply with various payment regulations, such as the Revised Payment Services Directive’s SCA requirements.

Innovation vs. regulation

The speed of digital payments innovation continues to accelerate, putting regulators in the difficult position of having to take aim at a moving target. This is especially true in regard to credit and debit card interchange fees and the Payment Card Industry Data Security Standard (PCI DSS) 4.0. Although there isn’t any immediate action for billers to take regarding this payments trend, the general guidance is that businesses remain flexible and that compliance teams stay on top of emerging and evolving legislation pertaining to payments innovation.

Real-time payments

Real-time payments (RTPs) aren’t exactly “new for 2024” — most major markets already have RTP schemes either in place or in development — but the sustained consumer demand for RTPs and their anticipated growth make them a trend to watch for the coming year.

Based on market research conducted in partnership with GlobalData, ACI anticipates the total number of global real-time transactions will reach 511.7 billion by 2027, at a compound annual growth rate of 21.3 percent from 2022 to 2027.

By 2027, we expect RTPs to account for 27.8 percent of all electronic payments globally.

The demand for instant payments across all global regions is unprecedented, and it isn’t limited to merchant or banking transactions. Our research also shows that alternative payment methods are gaining traction in the billing space, and that payers’ interest in RTP functionality is growing.

According to one survey, we found that 41.2 percent of payers said that they would be “extremely” or “somewhat” interested in real-time bill payment, citing avoiding late payments (32 percent), immediate confirmation of payments receipt (24.9 percent) and immediate payment/transfer of funds (20.8 percent) as the primary motivations for their interest.

Digital currencies

Cryptocurrencies, central bank digital currencies (CBDCs) and other blockchain-based forms of payment are slowly but steadily gaining traction within the billing space, though generational divides remain.

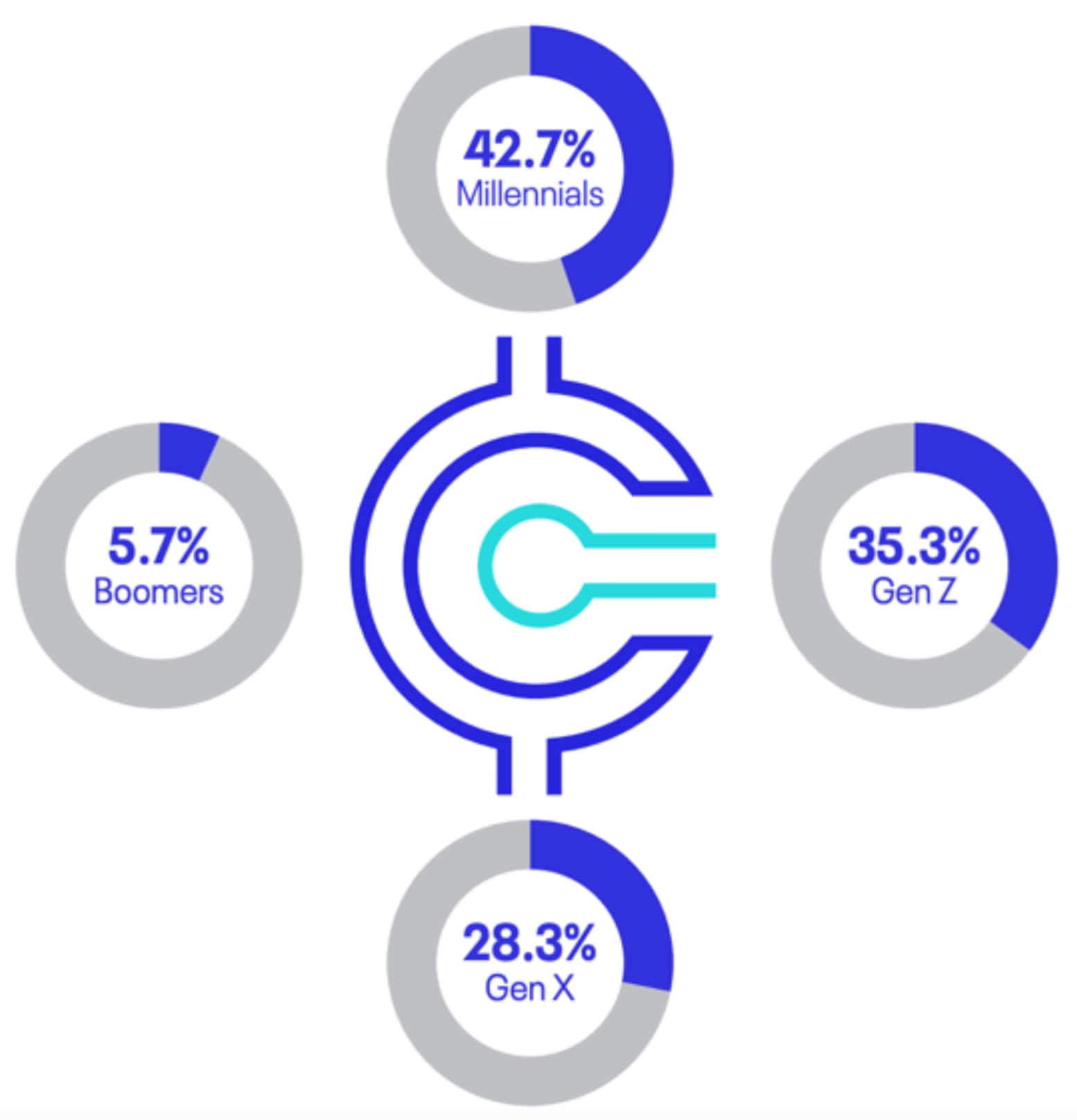

Millennials and Gen Z are far more comfortable with the idea of using digital currencies to make bill payments than Gen X or Boomers. When polled, 42.7 percent of Millennials and 35.3 percent of Gen Z said that they were confident in the security of cryptocurrency payments — a considerable show of confidence compared to 28.3 of Gen X and a mere 5.7 percent of Boomers.

We can attribute Gen X and Boomers’ reluctance to the volatility and decentralized nature of cryptocurrency, with recent crashes hardening skepticism amongst older generations.

Confidence in the security of cryptocurrency payments:

However, we could see that attitude soften in the years to come as a growing number of banks debut their own regulated digital currencies. Should this come to bear, billers that choose to accept digital currencies for bill payments will be able to better differentiate themselves from their competitors, especially in highly crowded markets.