INDUSTRY GUIDE

What Are Digital Payment Overlay Services?

Everything you need to know about Request for Payment, instant payments, mobile payments and more

On This Page

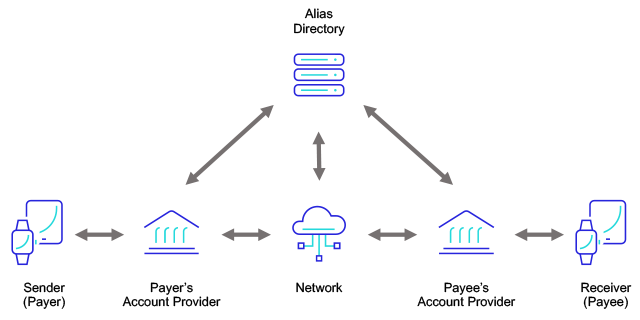

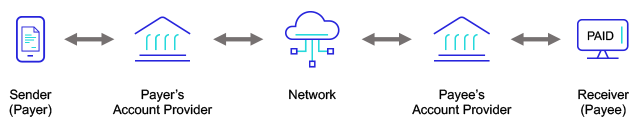

How do Digital Payment Overlay Services work?

Digital overlay services have appeared in global markets, particularly where we see high levels of real-time payments adoption. These ancillary services often ride the real-time payment rails, and are flexible, nimble drivers of innovation. They enable many kinds of alternative payment methods.

Digital overlays use real-time payments to settle a payment or transaction, or to provide an ancillary service for a real-time payments method; these are services over and above the core payment processing that adds value to the standard payments.

Where do you find digital payment overlay services?

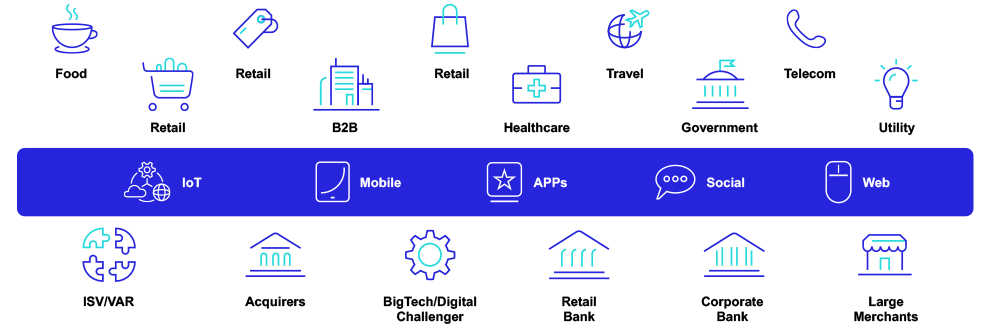

Overlay services can be provided to consumers, banks, corporates and merchants and are used on internet-based front-end devices like mobile phones, tablets, laptops and watches. They are most prevalent in advanced digital economies such as India, Singapore and Malaysia. The U.K. and Europe have some examples live, and are currently designing new services at national and pan-European levels. The U.S. has also enabled Request for Payment in its real-time payment systems from The Clearing House, with Mastercard’s Bill Pay Exchange service live now in pilot.

What are the use cases for digital payment overlay services?

Overlays can be used to improve the workflows and customer experience in a range of payment scenarios, including bill payments, at point of sale, social payments, in-app payments, QR-code-enabled payments and invoice payments.

What are some examples of digital payment overlay services?

Google Pay, WhatsApp Pay, Amazon Pay, Paytm and Walmart PhonePe are all examples of real-life overlay services that are helping people to have a smoother, frictionless payments experience in their day-to-day life. These are integrated directly into everyday actions such as online shopping, booking cinema tickets or social media interactions.

Is request to pay/request for payment a digital service?

Request to Pay (R2P) can be both a digital overlay service used by an end user to request or make a payment, as well as be core functionality of a central infrastructure (usually real-time payments) that provides the R2P transaction flows and rules to play in the R2P network. The front-end touchpoint for consumers, merchants or corporate customers is a digital overlay service, as it’s about connecting real-time payments to a purchasing experience, billing scenario or accounts payable process. In comparison, from a central infrastructure point of view, the provision of the flows and rules framework for an R2P service is either a capability within the faster payments scheme or system itself, a closely related offering by the same central infrastructure provider.

How can banks enable for alternative payment methods (APMs)?

Alternative payment methods is a catch-all term used to identify both brand new payment types (such as real-time payments) and new payment initiation methods (such as QR codes) that can run on either real-time rails or the traditional card networks. However, in markets where APMs have flourished, we see they are most often linked to real-time, account-to-account payments, as the faster clearing and settlement of the payment is a key benefit that drives adoption of these APMs.

Therefore, enabling for APMs, both those already in market and emerging methods yet to appear, requires robust payment engines for both real-time and cards, the ability to orchestrate between those engines and API-enabled solutions that can quickly adapt to accept new initiation methods on those payment types. ACI’s consumer payment processing solution with real-time payments is already being used in this way by banks, processors, acquirers and central infrastructure providers in advanced APM markets, such as India, Malaysia and Singapore.

Which markets have high adoption of alternative payment methods and digital overlay services?

India has seen explosive growth in digital payments, partly fueled by the enablement of digital overlay services. India’s implementation of the Unified Payments Interface (UPI) provided API access to real-time rails for bank-fintech collaboration. Combined with the regulator’s push for a cashless society, this has created the most advanced real-time and digital payments ecosystem in the world. There are more than one hundred banking and fintech applications for consumers available via the national Bharat Interface for Money (BHIM), more than one hundred million active users and almost ninety percent of UPI transactions are initiated on fintech apps. There are also great examples in the Netherlands and U.S. iDEAL allows Dutch banking customers to pay at the POS or online via their internet or mobile banking apps, instead of with a debit card. Zelle enables P2P payments in the U.S., both as a standalone app and integrated into banking applications, and rides the existing ACH rails.

What is India Unified Payments Interface (UPI)?

Unified Payments Interface (UPI) in India is an API-enabled, real-time payments system. Developed by National Payments Corporation of India, it allows for any-to-any, account-to-account, real-time payments, including for P2P (Peer-to-Peer), C2B or P2M (consumer to business or person to merchant), P2PM (Person to person/merchant, e.g., paying a small merchant or unorganized retail sector) and B2C (business to consumer, e.g., refunding customers, salaries and more). UPI itself is regulated by the Reserve Bank of India.

Who can offer digital payment overlay services?

Banks, payment processors, payment service providers (PSPs), fintechs and the central infrastructure itself can use digital payment overlay services to enable customer propositions that generate value for their customers and merchants, as well as the business itself.

How can I enable for digital payment overlay services?

Banks, payment processors, payment service providers (PSPs) and fintechs should prepare to capitalize on digital overlay services with an end-to-end real-time payments solution that underpins the services to the end customer. ACI’s Real-Time Payments solution provides processing and orchestration for digital payment overlay services, alongside complete instant payment gateways and other value-added services.

As ACI’s partner for digital overlay services, Mindgate’s front-end offerings can be seamlessly integrated into your ACI engine by APIs to support you in rapidly bringing innovative payments offerings to market.

Make Real-Time Payments a Reality

Get an in-depth look at how financial institutions can leverage important learnings from around the world to launch future-proofed solutions.