Guide

What Is Buy Now, Pay Later?

Helping merchants make sense of this popular consumer financing option

On This Page

What is buy now, pay later?

Buy now, pay later — often abbreviated to BNPL — is a form of short-term financing that enables customers to purchase items without making payments upfront. Most BNPL offerings are structured as installment loans, meaning customers pay for their purchases in a series of equal installments — starting with the initial purchase — over a predetermined period of time. These loans are generally interest-free, provided customers make payments on time and in full.

Is buy now, pay later only for B2C purchases?

No. Both B2C and B2B purchases can be made using BNPL.

How does buy now, pay later work?

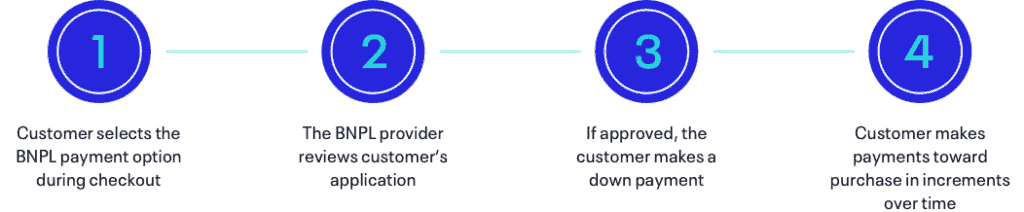

From a customer-facing perspective, the general process for BNPL is fairly simple:

- The customer selects the BNPL payment option during checkout and fills out a brief application form

- The BNPL provider reviews the customer’s application and either approves or rejects it based on predefined criteria; this step of the process may or may not include a credit check

- If approved, the customer makes a down payment — typically a small percentage of the overall purchase amount — at checkout

- The customer makes additional payments toward their purchase in predetermined increments over a specified period of time; some of the most popular repayment schedules include the “Pay in 3” model, the “Pay in 4” model and true loans, in which repayment schedules span six months or a full year

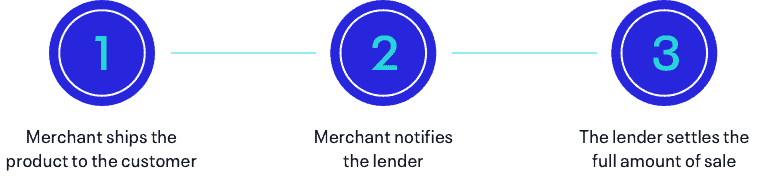

From a merchant-facing perspective, once a customer has made a purchase using BNPL, the process is as follows:

- The merchant ships the product to the customer

- The merchant notifies the lender that they have shipped the merchandise

- The lender settles the full amount of sale — minus the lender’s merchant discount rate — in the merchant’s account

And that’s it — from there on out, the lender is responsible for collecting all payments from the customer according to the agreed-upon repayment schedule.

When can merchants expect settlements for products purchased using buy now, pay later?

For services purchased using BNPL, merchants can expect a settlement the next day. For physical goods purchased using BNPL, merchants can expect settlement upon shipping (which is often the next day with same-day or next-day shipping).

What is a buy now, pay later solution?

A BNPL solution is exactly what it sounds like: a software program that enables merchants to offer BNPL as a payment method to customers at checkout. There are two main categories of BNPL solutions: consumer financing and card-based installments.

With true consumer financing, customers are prompted to fill out a credit application for a transaction and enter personal details such as their phone number, their monthly income, and the last four digits of their Social Security number or national identification number. This application undergoes a credit check with the lender, and the customer is either approved or denied financing.

With card-based installments and “Pay in 3” or “Pay in 4” models, customers are asked to enter an existing credit card number, rather than fill out a credit application. Lenders then use this information to perform a soft check and determine the open-to-buy — the difference between the credit limit assigned to a cardholder account and the present balance on the account — on the customers’ cards.

Can using buy now, pay later affect a customer’s credit?

BNPL does have the potential to affect a customer’s credit, either negatively or positively.

With solutions that use consumer financing, customers are actually applying for a new line of credit, which means lenders will perform hard checks (also known as a hard inquiries or hard pulls) on customers’ credit. Since a hard check is considered an indicator of uncertainty, it can negatively impact a customer’s credit, dropping their credit score by as many as five to 10 points.

Additionally, if a lender chooses to report a customer’s BNPL credit account to credit bureaus, and the customer then fails to make payments on time, it can hurt that customer’s credit. The inverse is also true: If a customer consistently makes on-time payments, BNPL can actually boost their credit.

What happens if a customer who used buy now, pay later wants to return an item?

The process for returning an item purchased using BNPL is much the same as it would be for any other item: The merchant processes the return as usual, notifies the lender and the lender cancels the debt.

Who is liable if a customer misses a payment — the merchant or lender?

Merchants are not liable if a customer who used BNPL to make a purchase misses a scheduled payment. Instead, it’s the lender’s responsibility to collect from the customer and to follow up with that customer should they miss a payment.

Who bears the cost of a fraudulent chargeback with buy now, pay later?

Merchants do not bear the cost for fraudulent chargebacks with BNPL. Since all collections take place between the lender and the customer, it’s the lender’s responsibility to verify that the customer is legitimate.

What are some of the biggest players in the buy now, pay later market today?

The most popular BNPL lenders vary by region and include:

- Australia: Zip, Afterpay

- Canada: Flexiti, Zip, Visa Installments

- EU: Klarna, PayPal, Divido, Twisto, Payu, Santander

- Asia: Zip, LazyPay, Hoolah, Twisto

- Mexico: Zip

- Saudi Arabia: Zip, Tabby

- South America: Addi

- Spain: Twisto

- United Arab Emirates: Tabby, Payflex

- United Kingdom: Clearpay, Duologi, DivideBuy, Zopa

- United States: Affirm, Afterpay, PayPal PayLater, Klarna

How are lenders within the buy now, pay later market classified?

The most popular BNPL lenders vary by region and include:

- Prime: Individuals who are considered the least likely to default on a loan; prime borrowers have a credit score of 660 or higher

- Near-prime: Individuals who just fall short of — but, with consistent habits, could cross over into — the prime risk profile; near-prime borrowers have a credit score of 620–659

- Subprime: Individuals who are considered most likely to default on a loan; subprime borrowers have a credit score of 619 or lower

These risk profiles filter down into BNPL lenders because some lenders will only offer financing to customers who meet a certain risk profile. For example, lenders that only offer financing to customers who are considered prime borrowers are known as prime lenders. Lenders that are willing to lend to near-prime borrowers are considered secondary lenders, and those willing to lend to subprime borrowers are considered tertiary lenders. Many BNPL lenders fall into two or more of these categories.

How can merchants benefit from implementing buy now, pay later?

BNPL has quickly become one of the popular alternative payment methods, with an estimated 360 million users worldwide — a number that’s projected to reach 900 million globally by 2027. BNPL is also in high demand with younger generations. According to one consumer survey, 47% of Gen Zers and 40% of Millennials are more likely to purchase items from a merchant if that merchant offers BNPL as a payment option.

BNPL has the power to help merchants increase conversion rates by up to 20%–30% and to lift their average order value by as much as 30%–50%. A consumer survey from Cardify also shows that nearly 50% of shoppers will spend 10% to 20% more when making purchases with BNPL than they would using their credit card.

It’s clear that implementing a BNPL solution gives merchants the opportunity to get in on a rapidly growing and in-demand market and to provide their customers with convenient checkout experiences that increase conversion rates, transaction volumes and average order values.

Last, but certainly not least, buy now, pay later can help merchants acquire new customers by making their products accessible to a wider audience. Take, for example, luxury retailers whose high-ticket item might be out of the average consumer’s price range. With BNPL, the purchase prices for such items are broken into smaller, more manageable installments, enabling a wider range of consumers to shop with that brand.

What should merchants be aware of before implementing buy now, pay later?

Although buy now, pay later offers numerous benefits, it isn’t without its challenges, which merchants would do well to consider before investing in a BNPL solution.

These challenges include:

High Transaction Fees

Similar to credit card interchange fees, merchants must pay transaction fees to BNPL lenders — as much as 4% to 8% of the total transaction value. Merchants can reduce these rates by implementing the right buy now, pay later solution — for example, ACI PayAfter offers rates that range from 1% – 6.5%.

Impulsive Purchases

One of BNPL’s biggest selling points is that it makes it easier for customers to pay for purchases. But on the flip side, BNPL can also encourage customers to make more impulsive purchasing decisions — decisions they may regret at a later date. To that end, buy now, pay later has the potential to increase merchants’ rate of return.

Currency Exchange Rates

Cross-border services are still an emerging concept within the buy now, pay later space, but a growing number of lenders — including Visa, Klarna and Afterpay — are looking to expand their offerings into this market in order to capture new growth opportunities. As interest in cross-border BNPL services grows, we may see regulations and even credit bureaus specific to BNPL put in place.

Consumer Concerns

Multiple consumer protection groups have raised concerns around buy now, pay later, citing a lack of regulation, poor consumer education and growing sums of consumer debt. This has prompted organizations such as the Consumer Financial Protection Bureau to open inquiries into leading BNPL lenders in order to assess the risk BNPL may pose to consumers.

Given this information, some merchants may be reluctant to offer BNPL as a payment option. Until the industry becomes more regulated, merchants can mitigate risk to their customers by sharing educational materials about BNPL and clearly disclosing terms and conditions, such as credit application information and repayment schedules. In doing so, merchants can empower shoppers to confidently make informed purchasing decisions.

How can merchants implement buy now, pay later?

Any merchant interested in entering the world of buy now, pay later should begin their journey by developing a complete understanding of BNPL — including how it works and how it might impact their company and customers — to determine whether it’s a good fit for their business. From there, a merchant can evaluate various BNPL programs and determine which one(s) make the most sense for their customers and their business; some merchants may even consider offering multiple BNPL programs.

Merchants have two options for implementation: Either work directly with a lender to implement a BNPL solution, or partner with a provider such as ACI Worldwide. No matter which of these options a merchant chooses, it’s important that they integrate BNPL with all off their payment channels, including in-store point-of-sale, online checkout and product pages to make customers aware of their new payment option.

How does ACI Worldwide support buy now, pay later?

ACI PayAfter is a software solution that enables merchants to connect to a network of more than 70 of the leading BNPL lenders globally — and counting. Merchants can use ACI PayAfter to configure connections to multiple lenders based on their business needs and who they’re trying to serve. When a customer submits a credit application, ACI PayAfter uses a waterfall-style flow to identify the path of least resistance for consumer financing approval.

Best of all, ACI PayAfter enables merchants to connect to a wide range of lenders using only a single contract and integration, thereby eliminating complexity and enabling merchants to experience lower technology and operational costs, higher acceptance rates, access to more financing options and increased conversion rates. We also use that same integration for all of our solutions — including our credit authorization and cryptowallet solutions — so merchants can grow their investment over time.

ACI even handles BNPL disclosures on merchants’ behalf, building consumer financing disclosure notifications directly into our transaction flow, so customers are always informed of their options.

Consumers benefit, too: With ACI PayAfter, customers are able to easily apply for credit with multiple lenders using only a single application (and a single credit check), thereby increasing their likelihood of approval without having to take multiple hits to their credit. And because ACI PayAfter works with a large network of prime, secondary and tertiary lenders, shoppers with low credit scores or who are unbanked won’t have to worry about whether they’ll be approved.

What does the future hold for buy now, pay later?

Here are some trends the ACI team has observed in the buy now, pay later space:

- As noted earlier, there’s been increased scrutiny around BNPL from consumer protection groups, with concerns that borrowers have been extended too much credit. Some of the larger credit bureaus are considering developing secondary bureaus to perform BNPL checks, and we anticipate that the industry will become more regulated over time.

- The market is consolidating, with larger players buying out smaller companies, such as Zip’s recent acquisition of Sezzle, and partnerships forming between leading providers, such as Stripe’s team-up with Klarna.

- As cryptocurrency continues to gain traction as a form of payment, we expect to see more BNPL solutions integrate blockchain technology; in fact, ACI Worldwide is already hard at work adding crypto payments as a feature to ACI PayAfter, with a projected launch in 2023.

- The number of use cases for BNPL continue to grow and diversify, moving beyond traditional retail applications and into other purchases such as groceries, gas and even rent. Part of this growth stems from rising inflation motivating consumers to find more affordable ways to disperse costs. We’re also seeing consumer demand for BNPL on big-ticket items, such as automobiles. As new use cases emerge, merchants will need to consider expanding their available network of BNPL lenders, as many lenders only operate within certain market segments.

- Travel is quickly becoming a popular use case for BNPL, with many hotel properties looking to offer BNPL their customers. In this arrangement, consumers would open up a line of credit for the duration of their stay, using BNPL to pay for meals, activities and so on, and then close that line of credit at checkout.

Let’s Talk Payments

Our payment experts are ready to help you tackle your payment challenges. Set some time to speak today!