- Solutions

- Banking

-

- ACI ConneticUnified cloud payments platform

- AcquiringDigital acceptance, merchant management

- IssuingDigital payments and accounts issuing

- Fraud managementReal-time enterprise fraud management

- RTGS / Wires and cross-borderMulti-bank, multi-currency processing

- Real-time, instant paymentsComplete real-time payments processing

- ATMsSelf-service, omnichannel digital experience

- Central infrastructureInnovative real-time payment infrastructure

- NEW Redefining the payments hub: Solving today’s banking payment challenges

-

- Merchant payments

- ACI Payments Orchestration PlatformEnable customer journeys across commerce channels, accept payments, prevent fraud and optimize your payments journey

- In-storeDynamic, modern in-store payments

- eCommerceOnline and mobile payments

- Alternative payment methodsGive more ways to pay

- Value-added servicesEngagement, optimization and reporting

- Fraud managementEnd-to-end fraud orchestration

- Risk, security, and complianceAchieve and maintain compliance

- NEW Datos names ACI Worldwide best-in-class in payments orchestration

- Industries we serve

- Billing and bill payments

- ACI SpeedpayDrive customer satisfaction with the widest range of bill pay options in the industry.

- Bill payment APIs and SDKsOutsource bill payment processing

- Fraud managementAI-based fraud orchestration technology

- Alternative payment methodsGive more ways to pay

- Loan servicingPreferred loan payment options

- Treasury managementStreamline and integrate your back office

- Automated debt collectionImprove your collections process

- Digital walletsManage digital cards and payments

- PCI compliance and securityAchieve and maintain PCI compliance

- Industries We Serve

- Fraud management and payments intelligence

- Fraud managementFraud solutions to minimize risk and prevent fraud

- Fraud management for bankingEnterprise-wide fraud prevention

- Anti-money launderingStay ahead of money-laundering schemes

- Robotic process automationAutomate payment processing operations

- Fraud management in the cloudProtecting your business in the cloud

- Fraud management for merchantsProtect payments from end to end

- ChargebacksPrevent chargebacks before they happen

- SCA complianceAchieve and maintain SCA compliance

- Digital identity solutionsConfirm identities with behavioral analytics

- NEW Scamscope fraud report: APP scam trends from around the globe

CompanyCustomersPartners

Home

Leslie Choo is Senior Vice President, Managing Director - Asia Pacific for ACI Worldwide . Based in Singapore, Leslie is responsible for ACI’s Asia Pacific (APAC) strategy, go to market execution, and core and new business opportunities. A long-term industry veteran, he has over 25 years’ experience in financial services, having led several transformation projects in the multi-channel and payments space across APAC including real-time payment and card modernization, national central infrastructure implementation, enterprise technology, corporate cash management, trade finance, retail and digital banking, and e-Commerce. Prior to ACI, Leslie held several senior roles with industry software leaders and has extensive experience in the financial software industry and banking transformation.

Articles by Leslie Choo

Driving Asia’s Real-Time Payments Boom

Southeast Asia: Primed for Real-Time Payments to Enter the Mainstream

Making Waves in Indonesia’s Payments Space [ALTO Q&A]

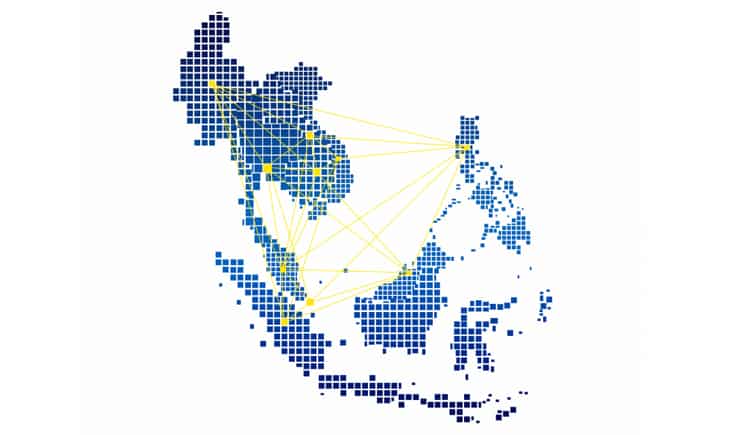

The Role of Southeast Asia’s Central Payments Infrastructure in the Emerging Pan-Regional Network

The Two Sides of Payments Modernization in Asia: Real-Time and Financial Inclusion

How Southeast Asia’s Banks Can Remain Competitive and Profitable in a Real-Time World

Southeast Asia’s Domestic Payments Infrastructure Has Laid the Foundation for a Cross-Border Real-Time Network

Putting Malaysia on the Path to Payments Innovation

Turning Impetus into Action: Real-Time Payments in ASEAN

Pairing Payments Innovation with Security Needs in Southeast Asia

Big (regional) growth opportunities in ASEAN banking