How poor reconciliation impacts financial operations

In the battle to win sales in a market that’s increasingly shaped by intense competition, rapid change and economic disruptors, the customer experience is now king. With much of a merchant’s focus on front end functionality, back-end processes like payments and account reconciliation are often inadvertently relegated to the back seat.

Making sure transaction figures and payments data add up may not be as ‘sexy’ as innovating the UX, but its role is nonetheless essential for every business.

If you’re serious about improving commerce performance, then getting the figures to balance in a timely manner and with minimal effort should be a priority. Not only will optimizing reconciliation deliver the operational efficiency your business demands, but it also creates a better foundation to support the nimble, ultra-convenient experiences that customers desire.

Like payments, reconciliation is increasingly complex

Getting reconciliation right in today’s multifaceted retail environment is becoming more challenging. Many merchants now rely on multiple-acquirers and a growing number of alternative payment methods including BNPL, installments and subscriptions to do business.

Pushing high volumes of transactions through many diverse payment rails and physical, digital and mobile channels complicates matters further. Omnichannel merchants must load many different files in different formats with different security mechanisms from different locations.

As a result, matching sales transactions and bank payments is becoming increasingly complex, time-consuming and costly.

Failure to optimize reconciliation can hold your business back

Without optimized reconciliation, businesses simply can’t ensure the timely detection and resolution of transaction leaks. In addition, they may find it difficult to scale operations in line with growing transaction volumes. Failure to connect systems and processes can also lead to data silos that hinder traceability and prevent data comparison and sharing between teams.

Non-standardized and time-consuming reconciliation processes are not only prone to errors, but some also involve a degree of manual checking, which eats up resources and accelerates costs even further.

Poor tracking can also erode customer trust

All of this can lead to suboptimal performance and poor financial control with an adverse impact on cashflow and liquidity. It can also spill out into the customer experience.

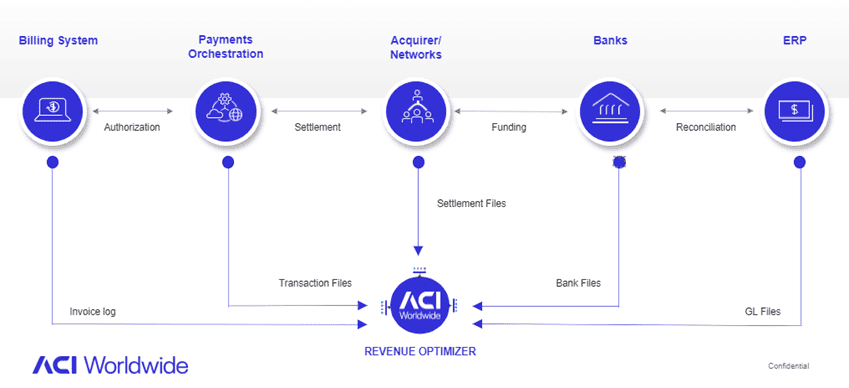

Lack of transactional-level order-to-cash traceability across billing systems, financing systems, payment gateways, acquirers, networks and bank accounts may result in auditing and customer dispute challenges. Regular payment incidents that impact customers can lead to poor reviews, amplifying the issue and resulting in reputational damage.

How to know if reconciliation inefficiencies are impacting your business

It’s clear that outdated reconciliation processes can cost businesses. How can you tell if your business is impacted? Here are six signs to look out for:

- Regular monthly write-offs due to high revenue leakage

- High operational costs and frequent manual work, leaving room for error

- Increased customer churn due to payment incidents

- Audit friction attributed to poor financial oversight and accountability

- High business risk caused by inadequate controls, data integrity and security issues

- Increased cost-to-serve from customer support and FinOps involvement

How can merchants improve their financial operations?

With the right reconciliation management tools, such as ACI’s Revenue Optimizer, you can consolidate and automate back-office functions and perform multi-way reconciliation across all your payment channels, harmonizing and orchestrating financial data in a faster, secure and convenient way.

Payment orchestration platforms that include omnichannel reconciliation enable you to:

- Consolidate back-office functions end-to-end to better track, manage and account for money

- Optimize the financial health of your business by detecting and fixing revenue leakage, mitigating payment incidents and ensuring audit readiness

- Automate complex processes for greater financial accuracy, speed, performance and control

Shifting mindsets toward financial optimization

For those looking to innovate or enhance their commerce applications, it pays to remember that just because reconciliation is invisible to the customer, doesn’t mean it’s not important.

Merchants must look at where they can optimize and drive better value. For instance, ensuring that their payments orchestration solution also includes a comprehensive reconciliation tool.

A fully integrated and automated reconciliation option that is designed to work seamlessly in tandem with your payment platform is sure to benefit your business in the long run – and that is exciting.