a guide to fednow

The FedNow® Service, Explained: Here’s What You Need To Know

Insights into the new Federal Reserve Bank’s instant payments service

On This Page

What is the FedNow Service?

The FedNow Service is an instant payments service being developed by the United States Federal Reserve Bank (Fed). The FedNow Service, or FedNow, is designed to offer uninterrupted 24/7/365 processing and will feature integrated clearing functionality, enabling financial institutions to deliver end-to-end instant payment services to their customers.

What are instant payments?

Instant payments refer to any account-to-account funds transfer that allows for the immediate availability of funds to the beneficiary of the transaction. Though timings may differ from one scheme to the next, payments are often completed in a matter of seconds. For these reasons, instant payments are also commonly referred to as immediate payments or real-time payments. Some of the benefits of instant payments are their irrevocability, their ability to generate rich data and their 24/7/365 availability.

How does the FedNow Service differ from Fedwire?

The Fedwire Funds Service is a real-time gross settlement system designed to support electronic funds transfer between banks, businesses and government agencies. Fedwire is capable of instantaneously posting and settling payments; however, Fedwire has limited availability and can only process payments on designated business days and during business hours. By comparison, the FedNow Service is not subject to nightly, weekend or holiday restrictions; it is available all hours of the day, every day of the year.

It is important to note, though, that FedNow transactions are limited to a maximum value; FedWire does not impose a limit, though one may be set by your bank.

Who will be eligible to participate in the FedNow Service?

According to official Fed documentation:1

“As with current Federal Reserve Bank services, the FedNow Service will be available to depository institutions eligible to hold accounts at the Reserve Banks under applicable federal statutes and Federal Reserve rules, policies and procedures. Participants will be able to designate a service provider or agent to submit or receive payment instructions on their behalf. Participants will also be able to settle payments in the account of a correspondent, if they choose to do so. Merchants, consumers or non-bank payment service providers can access the service through depository institutions as they do today with other payment systems.”

What features are included in the FedNow Service?

In addition to round-the-clock availability and integrated clearing functionality, the FedNow Service includes optional features based on a financial institutions’ desired participation type:

Send and Receive

Institutions that choose to send and receive will have the ability to send, receive and return customer payments; to send and receive credit transfers from other financial institutions to support instant payment liquidity needs; to send customer-initiated Requests for Payment (RfPs) and to opt to receive RfPs on behalf of customers.

Receive Only

Institutions that choose to receive only will be able to receive payments from other financial institutions to meet liquidity needs, return payments received and send — but not receive — RfPs.

Liquidity Management Transfers

Institutions that opt into liquidity management transfers will have the ability to complete high-dollar-limit credit transfers with other financial institutions at scheduled times, even when the Fedwire Funds Service is unavailable.

Settlement Services

Institutions that choose to participate in settlement services will gain support for correspondent/respondent relationships; more specifically, FedNow transactions for financial institutions that use correspondents will settle in the correspondent’s master account.

The first release of FedNow will also include fraud prevention tools, payments inquiry support and a liquidity management tool. The liquidity management tool, in particular, will be available to FedNow participants and their traditional liquidity providers, as well as participants in private-sector instant payment services that use a joint account at a Reserve Bank.

Why is the Federal Reserve Bank developing FedNow?

Instant payments are one of the fastest-growing forms of digital payments, with a projected compound annual growth rate of 23.6 percent from 2020 to 2025.2 Central banks in more than 50 countries have already implemented instant payment networks that support the immediate posting and settlement of funds.

U.S. consumers and corporations can already access instant payments via Zelle and the RTP® Network; these are both privately held systems, owned and operated by Early Warning Services, LLC and The Clearing House, respectively. The Fed first began to explore the possibility of introducing a centrally owned and operated instant payments network in 2013 and formed the Faster Payments Task Force (FPTF) in 2015 to identify opportunities to implement instant payments.

In its final report, published in 2017, the FPTF overwhelmingly ruled in favor of establishing a network and issued recommendations to support successful implementation. In 2018, the U.S. Treasury offered its official support for an instant payments network,3 and in 2019, the Federal Reserve Board announced that it would begin developing the FedNow Service.4

Ultimately, the Fed is developing FedNow in the interest of enabling financial institutions of all sizes across the U.S. to provide safe and efficient instant payment services to customers.

Will FedNow replace the ACH Network?

No, the FedNow Service will not replace the Automated Clearing House Network (ACH); instead, it is expected to complement ACH services.

A bit of background: ACH is a U.S.-based electronic funds transfer network for consumers, businesses, and federal, state and local governments. It is commonly used to complete direct deposit and direct payment transactions. ACH transfers typically take anywhere from one to three business days to complete.

The National Automated Clearing House Associations, or NACHA — the organization responsible for ACH governance — introduced Same Day ACH in 2016. As its name implies, Same Day ACH posts and settles payments the same day that they’re initiated — a significant improvement, but not exactly immediate. For this reason, Same Day ACH is considered a faster payments system rather than an instant payments system.

Rather than replace ACH or Same Day ACH, the FedNow Service is expected to provide greater redundancy for payment operations, thereby preventing any potential payment network bottlenecks. In the longer term, the Fed intends to establish payments interoperability between the FedNow Service and ACH.

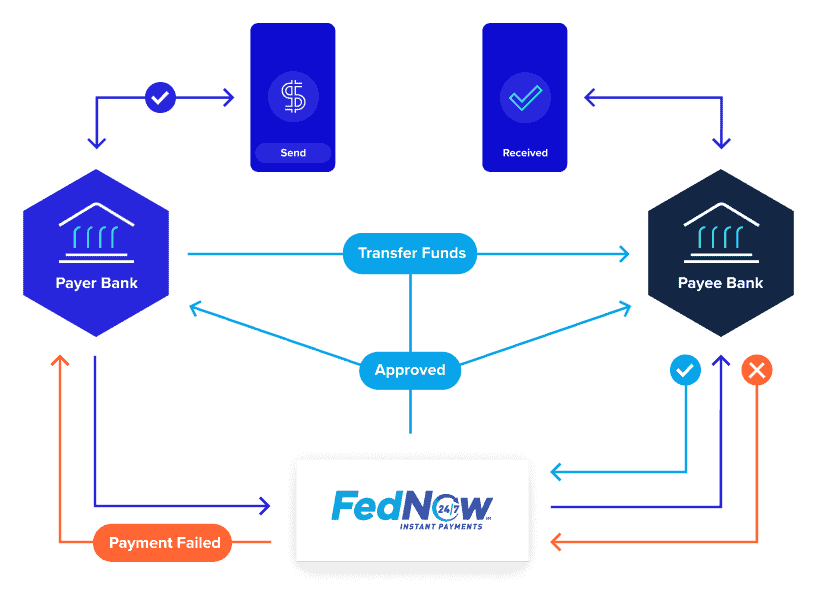

What does a FedNow payments flow look like?

A FedNow payments flow is similar to any other instant payments flow, starting with the parties involved: a payer, the payer’s financial institution, the FedNow network, a payee and the payee’s financial institution.

The general process is as follows:

- A payer initiates a payment by sending a payments message to their financial institution through an end-user interface outside of the FedNow Service.

- The payer’s financial institution receives the payments instruction and, provided the payer has sufficient funds in their account, authorizes the transaction.

- The payer’s financial institution submits a payments message to the FedNow Service.

- The FedNow Service validates the payments message and sends the contents of that message on to the payee’s financial institution for acceptance or rejection.

- The payee’s financial institution sends a response to the FedNow Service either accepting or rejecting the payments message. If the payee’s financial institution rejects the message, the FedNow Service will notify the payer’s financial institution of payments failure. If the payee’s financial institution accepts the message, the FedNow Service automatically deducts funds from the payer’s account and posts them to the payee’s account.

- The FedNow Service notifies all parties of the successful transfer of funds, and the transaction is complete.

How will financial institutions benefit from the FedNow Service?

The Fed’s announcement of its plans to launch the FedNow Service has generated positive reactions in the industry, with the general consensus that the new service will be a positive driver for faster instant payments adoption in the market.

The FedNow Service is expected to:

- Make instant payments technology accessible to a wider audience, including smaller community banks, thereby increasing equitable access for all businesses and individuals

- Reduce overall payment processing costs for banks and other non-bank financial institutions

- Provide individuals with instant access to paychecks and other electronic fund transfers for improved cash flow management

- Optimize liquidity management and cash flow forecasting for businesses, enabling them to better manage operational expenses and maintain positive vendor relationships

- Conform to the new ISO 20022 standard, enabling participants to send and receive rich data, including non-value message types and RfP messages

- Promote instant payments security through the development of industry-wide standards for disputing fraudulent transfers, ISO 20022 conformity and the use of payments authentication

How is the FedNow Service being rolled out?

As of March 15, 2023, the Fed announced the FedNow Service will start operating in July 2023. The service will roll out in stages; the initial launch will include core clearing and settlement functionality, Request for Pay capability and tools to support reconciliation.

In preparation for its target release date, the Fed has asked more than 110 organizations — including ACI Worldwide — to participate in its FedNow Pilot Program.5 As a program participant, ACI will help shape the FedNow Service’s features and functions, provide input into the overall user experience and ensure readiness for testing, all of which will help define the FedNow Service’s service and adoption roadmap, industry readiness approaches and overall instant payments strategy.

Article Sources

- Board of Governors of the Federal Reserve System, “FedNow® Service: Frequently Asked Questions, https://www.federalreserve.gov/paymentsystems/fednow_faq.htm.” ↩︎

- ACI Worldwide, “Global Real-Time Payments Transactions Surge by 41 Percent in 2020 as COVID-19 Pandemic Accelerates Shift to Digital Payments – New ACI Worldwide Research Reveals, https://investor.aciworldwide.com/news-releases/news-release-details/global-real-time-payments-transactions-surge-41-percent-2020.” ↩︎

- U.S. Department of the Treasury, “A Financial System That Creates Economic Opportunities: Nonbank Financials, Fintech, and Innovation, https://home.treasury.gov/sites/default/files/2018-08/A-Financial-System-that-Creates-Economic-Opportunities—Nonbank-Financials-Fintech-and-Innovation_0.pdf.” ↩︎

- Federal Register, “Vol. 84, No. 154, https://www.govinfo.gov/content/pkg/FR-2019-08-09/pdf/2019-17027.pdf.” ↩︎

- FedNow®, “Our Journey, https://explore.fednow.org/explore-the-city?id=9&building=community-center&card=our-journey.” ↩︎

Get Ready for FedNow Service Instant Payments

Jumpstart your real-time payments revolution by getting access to the connections you need to seamlessly integrate into the FedNow Service network