Case Study

Enabling 3X cross-border conversion rate increase

The challenges facing PSPs, and by extension, their merchant customers, are easy enough to describe. But uncovering the root causes and implementing an action plan is easier said than done. One of ACI’s payment service provider (PSP) clients launched a new cross-border eCommerce solution for merchants looking to sell in Asia, Australia, Africa, Europe, North America and South America. As an ACI client, the PSP’s merchants had access to the full range of ACI’s tools, including ACI Fraud Management for Merchants, for increasing conversion rates.

The challenge

The PSP faced multiple issues impacting conversion rates across its merchants. Improper implementation of 3D Secure caused widespread cart abandonment among Brazilian shoppers unfamiliar with the tool, while merchants’ misuse of automated data fields triggered fraud alerts and unnecessary transaction blocks. Additionally, requiring card security codes in regions where shoppers were unaccustomed to entering them led to payment rejections and abandoned carts. Finally, invalid payment data submitted by shoppers resulted in acquirer rejections, discouraging repeat attempts.

The solution

After assessing the situation, ACI’s experts uncovered four major issues negatively affecting the conversion rate: an overly stringent 3-D Secure setup, merchants incorrectly using payment data fields for internal purchase reference information, an inadequate CSC setup and failing to validate data before it was sent to the acquirer. By taking action to correct each of these issues, ACI’s guidance helped the PSP’s merchants vastly improve conversion rates.

The results

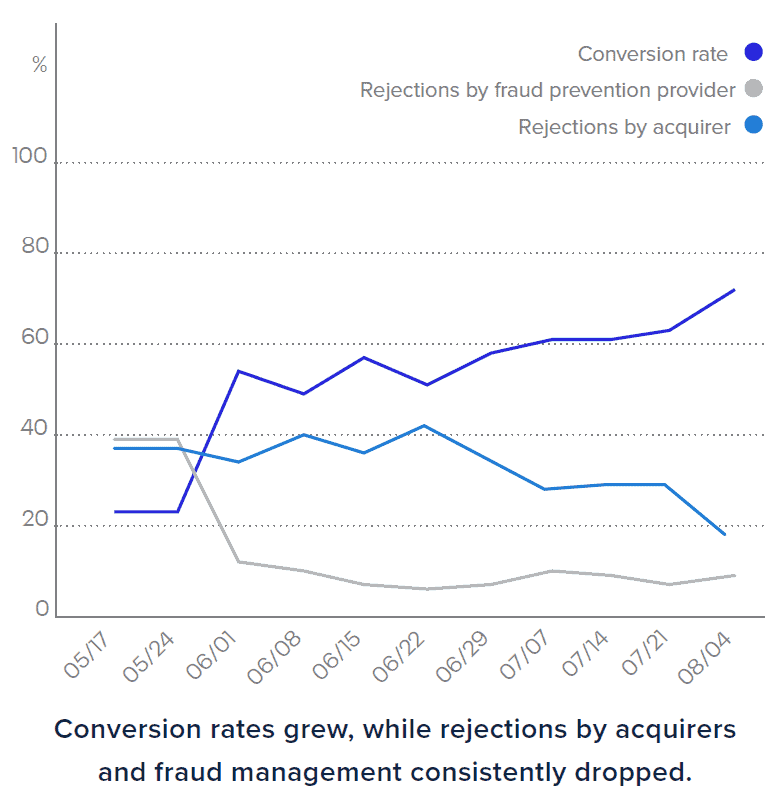

The problems the PSP and its merchants faced in their cross-border endeavors are common when expanding into relatively unfamiliar new markets. Every merchant had the tools needed to achieve a high conversion rate in every country, they only lacked a coherent and specific strategy to deal with the various situations. ACI’s expert guidance helped the PSP identify the problems and direct the merchants to take precise action using ACI tools, ultimately raising the overall conversion rate from 23% to nearly 72%.

Customer:

Anonymous Payment Service Provider

Industry:

Payment Service Providers

Location:

Asia Pacific

Africa

Europe

North America

South America

Solution: