According to Anthem CEO’s Joe Swedish as quoted in the Indianapolis Business Journal, “Frustration is pre-eminent and growing by virtue of the intolerance of health care’s inability to match the experiences in other aspects of our lives…We intend to change this dynamic, and our strategy is to create an improved customer experience as a distinguishing characteristic of Anthem.”

Insurance leaders envision monumental changes.

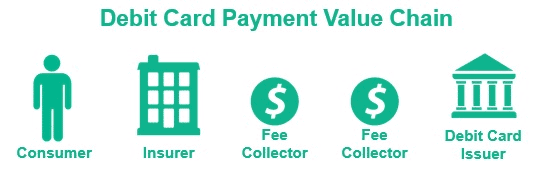

- Reducing the number of fee collectors in the insurance payments value chain (46%), ranked higher than targeted offers (41%) and mobile payments (32%).

- 72 percent are evaluating direct connections with banks—illustrating how insurers may reduce fee collectors.

- 85 percent of banks report wanting to work closer with insurers to reduce costs.

Insurance Payment Systems Went Awry

The multiple fee collectors (card networks and merchant acquirers) in today’s payments value chain can inflate costs, introduce possible debit card number theft and slow down money movement.

Think of it this way: Imagine walking into an insurance office to make a payment. Steve, your insurance agent, tells you to hand your cash to Jim, who will hand it to Joan and Joan will then pay Steve. These two extra people complicate the process. Steve has to pay his employees Jim and Joan for their service. Two additional people introduce added risk of fraud and slow down the payment.

Insurance leaders now plan to remove the middlemen.

Business Outcomes of a New Insurance Payments System

- Lower cost card payments by reducing the fee collectors.

- Stronger security by decreasing the parties transmitting sensitive payment information.

- Higher revenue by engaging consumers with real-time money movement and cross-sell offers.

3 Take-aways for Your Next Staff Meeting

- Post payments in real-time to your billing system.

- Cross-sell consumers with targeted messages in your eBill.

- Prepare to connect to debit card issuers and reduce the fee collectors.

Like pioneers heading west for the gold rush, the finance, education and utility industries plan to simplify their payments value chain. This will raise consumer expectations for insurers. But you have the opportunity to move faster. Grab your shovel, jump on your horse and be the first one to the gold fields.